Australian investment management group Regal Partners [ASX:RPL] said it would buy a 50% stake in Taurus Funds Management, increasing the firm’s funds under management to $8 billion.

The Sydney-based firms shares rose 6.9%, trading at $1.87 per share — one of its best days in what was otherwise a difficult year.

In the past 12 months, economic headwinds buffeted the financial sector, causing the company to shed nearly 30% of its stock value.

However, Regal has continued notching wins, accelerating from around $1 billion in funds under management in 2017 to almost $8 billion now. Founder and investment head Phil King says the company aims for $15 billion next.

Source: Trading View

Take the bull by its horns

The $28 million deal (plus a 25% after-tax share of future carry — earnings minus liabilities) aims to diversify Regal Partners’ portfolio, particularly enhancing its capabilities in alternative investment strategies.

Taurus is a specialist investment provider focusing on global junior and mid-tier mining, managing $2.3 billion in predominantly US institutional investors and pension funds.

CEO Brendan O’Connor, emphasised that the integration of Taurus aligns with the firm’s objective to emerge as a leading alternative investment strategies provider within the Australian and Asia regions. He went on to say:

‘Taurus represents an exciting and accretive opportunity for Regal Partners to further expand its existing investment capabilities across the global resources sector. The founders of Taurus have built a highly experienced 23-person team, with a strong performance track record and proven fund-raising capability across blue-chip, US-based institutional investors.’

The company expects to complete the acquisition in the next few weeks, with unconditional terms and no regulatory requirements.

Regal Partners projects the deal will boost its earnings per share by 2024 but did not provide an estimate.

Before the deal, Regal’s funds under management came at approximately $5.8 billion.

Source: Regal Partners

Regal Partners is also reportedly in advanced negotiations to acquire PM Capital, a fund house helmed by veteran investor Paul Moore, with a valuation of around $140 million.

This additional deal would add $2.7 billion to Regal’s assets under management and introduce a robust global equities fund and a high-performing fixed-interest strategy to its offerings.

Speculation suggests an announcement could be imminent after ‘advanced’ weekend talks.

Outlook for Regal Partners

The music doesn’t stop for Phil King, who continues his aggressive expansion strategy.

There have been a few disappointments for the firm in executing its expansion goals. The two most recent were the failed swing at the massive Perpetual Ltd in 2022 and the dropped bid for niche fund Pacific Current in August this year.

The attempt on Perpetual was closer to an ambitious David and Goliath story, while the acquisition bid earlier this year was abandoned by Regal, citing ‘disappointment with the level of engagement.’

You’ve got to give them points for trying, as the firm refuses to sit still while its funds’ performance is the envy of many.

With the Taurus deal under its belt, the firm will continue to aggressively push for the PM Capital deal as it looks to diversify its fund assets.

Moreover, this acquisition is seen as a strategic fit for Regal, presenting an opportunity to tap into PM Capital’s global client base and establish a more substantial presence in the global equities space.

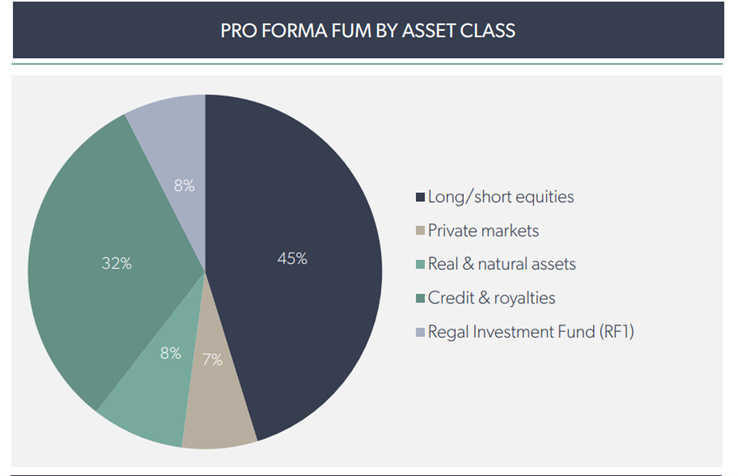

As you can see below, both funds would nicely round out Regal’s lopsided position.

Source: RPL

With the stake in Taurus, the company will rebalance its heavy long-short portfolio with exposure to natural assets and royalties.

Whatever happens next in the growth of this fund, The financial community is watching closely as Regal Partners moves ahead with its expansion endeavours, setting the stage for a reshaping of the investment management landscape in Australia.

Setting up your own strategy

Having the knowledge and skill to trade like Phil King is hard, but avoiding common pitfalls helps.

Editorial Director and value investor specialist Greg Canavan is a market realist and understands where many people find themselves right now.

He understands that dividends are the defensive position of choice for some investors right now and that income is favoured over growth.

But simply investing in dividend stocks isn’t without capital risk.

He’s seen investors make this mistake too many times by thinking they are getting on an easy ride.

Are you falling into this common investor trap?

Click here to see how to avoid this ‘dumb dividends trap’.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments