Fast-growing Telix Pharmaceuticals [ASX:TLX] has watched much of its meteoric gains evaporate in the past week as the company released its quarterly report and results in its latest medical study.

Telix is a radiopharmaceuticals company developing a new generation of diagnostic and therapeutic products. The company’s flagship product, Illuccix, is a radioactive diagnostics indicator for PET scans for prostate cancer.

The company is only seven years old but has increased its quarterly revenue almost 30-fold in the past 12 months as sales of Illuccix rocketed in the US.

However, Telix’s share price has fallen by 6.85% today after steep falls in previous days that have left the share price at $8.57 per share.

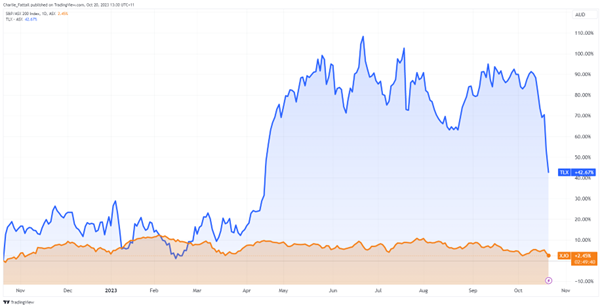

Despite the heavy losses this week, the company has seen a 43.25% share price increase in the past 12 months, outperforming the sector average by over 50%.

What has caused the sudden drop in investor confidence, and can this be shaken off in the long-term?

Source: TradingView (XJO: Orange, TLX: Blue)

Mixed results

The third-quarter results released by Telix paint a rosy picture for the company.

The star of the show was the Illuccix injection. Telix saw significant growth, with dose volumes increasing and US sales soaring by 13% from the previous quarter to a staggering AU$130.6 million.

The injection’s popularity was evident through new customer acquisitions and robust growth from existing accounts.

One of the key highlights was Telix’s successful shift in its customer base composition.

The company moved from a 19% government/81% commercial weighting to a 26% government/74% commercial mix.

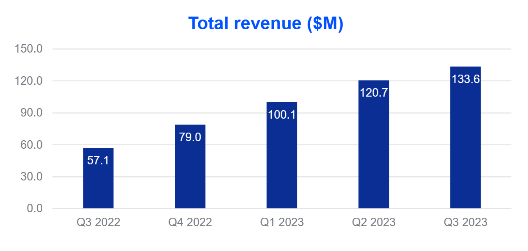

Telix’s total revenue for the quarter stood at AU$133.6 million, marking a remarkable 134% increase from the same period last year and an 11% gain on the previous quarter.

Commenting on the results, Telix’s Managing Director and CEO, Dr Christian Behrenburch, said:

‘We have posted another quarter of double-digit revenue growth for Illuccix in the U.S. with average daily demand for doses continuing to grow month-on-month.‘

‘Just as importantly we have a number of near term value drivers on the horizon, being the commencement of the ProstACT GLOBAL study and advancing the U.S. regulatory filing and commercial launch preparations for our renal (kidney) and brain cancer imaging agents.‘

This positivity around growth has been overshadowed by the elephant in the room— a single sentence in its latest study— which likely spooked investors.

The company’s preliminary results of its phase I PrastACT SELECT prostate cancer study showed that its TLX591 product was ‘safe and tolerable‘, but there were notable reactions in patients.

Some patients (25–38%), experienced severe reactions known as grade 3 and 4 haematologic events. These events are changes to blood cells or blood-forming organs that vary in severity.

Grade 3 is categorised as severe or medically significant, while grade 4 is considered life-threatening, requiring urgent intervention.

Telix noted in the study that reactions such as this were ‘in line with profile expected for this class of therapy‘ and the events were ‘transient and reversible‘.

Despite the assurances, the severity of the reactions versus the intended results appeared on paper to the unqualified as a cause for concern, resulting in a heavy sell-off of its stock.

Outlook for Telix

When zooming out from the recent trade action, it appears Telix is still on a solid growth trajectory.

It has expanded its diagnostic and technology portfolio across multiple domains and markets in a very short period. This is reflected in the robust revenue growth the company has seen in the past year.

Source: Telix

Investments such as its newly opened nuclear medicine facility in Belgium show that it is aggressively looking towards the European market as it expands steadily in the US.

Even if the latest trial rattles the market, further studies in this space could turn around its prostate oncology products, as it’s still very early.

The company still has major studies and commercialisation across bone marrow, brain, and renal cancers.

For investors navigating this storm of short-term volatility, a long-term perspective is essential.

Telix Pharmaceuticals’ strong financial position, growing revenue, and strategic initiatives position the company for sustained success.

Investors should consider this dip in share price as a potential buying opportunity, especially if they have a high tolerance for risk. Of course, you should consider your own financial position before investing.

Considering investing?

It’s a tough environment to consider any investments. Conflicts in the Middle East rattle markets, and central banks are raising the rhetoric of further interest rate hikes.

In this market, you need people in your corner to cut through all the noise to find the right signals.

Fat Tail and the Money Morning Editors cover all the market movements that will affect your wealth and provide you with insights amidst all the confusion and chaos.

We provide daily updates to ASX-listed companies and macro movements that you won’t hear on the mainstream media.

If you want to learn how to find the right balance between growth and dividends, Editorial Director Greg believes has found the right balance.

He calls it the ‘Royal Dividend’, and you can find out about it here.

Regards,

Charles Ormond

For Money Morning