Australian carrier Qantas [ASX:QAN] has taken another blow today, finally bowing to the Australian Competition and Consumer Commission (ACCC) and ditching its attempts at acquiring Alliance Aviation Services [ASX:AQZ].

This decision comes after more than six months of deliberation following the rejection of the proposal by the ACCC.

Despite the termination, Qantas is not wholly severing its ties with Alliance, retaining its significant shareholding of almost 20% in the Australian-based’ fly in, fly out’ (FIFO) charter operator.

The deal’s termination looks like a step back for Qantas, which has been struggling to find momentum this year as it hit the headlines for all the wrong reasons.

The scandals eventually led to the early retirement of its ex-CEO Alan Joyce and the planned retirement of long-time Chairman Richard Goyder.

Shares in both companies are headed in opposite directions today, with Qantas down by -2.68%, trading at $4.73 per share, while Alliance is up by 0.64%, trading at $3.17 per share.

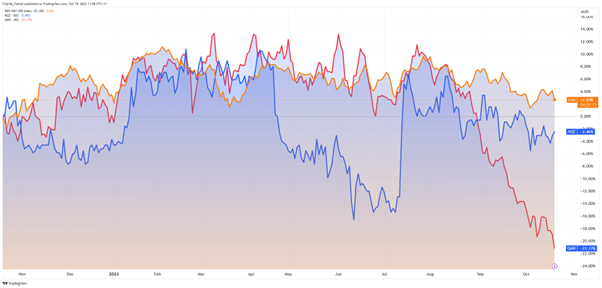

For Qantas, it has been its worst year since the pandemic lockdowns, with the company down -21% in the past 12 months, making it the worst-performing mid-cap stock in its sector.

Source: TradingView (Qantas: Red, Alliance: Blue)

Partnership remains with Alliance

For the ACCC, the move to block the deal was rooted in concern about the lack of competition with the FIFO space. The watchdog noted the importance of the resource industry to Australia and held concerns about the impact on workers in remote areas.

After delaying the decision four times, the final deliberation in April this year by the ACCC noted:

‘Qantas and Alliance currently strongly compete with each other in markets where there are few effective alternatives. The proposed acquisition would combine two of the largest suppliers of charter services in Western Australia and Queensland.’

‘Flying workers in the resource industry to and from their worksites is an essential service for this important part of the Australian economy, so it is critical that competition in this market is protected,’ ACCC Chair Gina Cass-Gottlieb said.

Despite the setback today, Qantas has emphasised its intention to continue serving the resources sector FIFO operations through its existing charters.

With a substantial 27% market share, Qantas is a dominant player in the charter industry.

The airline giant also announced its plans to exercise options for four additional aircraft under its agreement with Alliance.

This move will bring the total number of E190s operated by Alliance for the Qantas Group to 26, with four additional options remaining. These new aircraft are expected to join Qantas’ fleet starting from April 2024.

Qantas Group Executive of Associated Airlines and Services John Gissing said:

‘Alliance is an important partner for the Qantas Group and the E190s have helped us open new routes across Australia. These four new aircraft will provide additional capacity and connectivity in the domestic market.’

Similarly, Alliance Managing Director Scott McMillan tried to remain optimistic about the failure today and remarked that:

‘Despite the outcome of the transaction, we look forward to continuing our long-standing and productive relationship with Qantas.’

So with the deal now scrapped, what’s next for these airlines?

Outlook for Qantas and FIFO

While the termination of the takeover deal might seem like a step back for Qantas, the airline is determined to navigate the situation strategically.

By maintaining its nearly 20% share in Alliance, Qantas retains a significant stake in the charter operator. This decision aligns with Qantas’ long-term vision and commitment to the Australian FIFO market.

Furthermore, the decision to retain its partnership with Alliance allows Qantas to maintain a diversified portfolio, mitigating risks associated with overdependence on any single venture.

For Alliance, the company remains a preferred operator for many resource companies due to its customer-centric approach but will still undoubtedly remain closely tied to Qantas.

According to ex-CEO Alan Joyce, over 50% of Alliance’s revenue comes from business with Qantas after expansions of wet-lease deals, where Alliance offers planes and crew to operate as Qantas flights.

For the partnership, it seemed prudent to abandon the takeover bid, considering the ACCC’s dogged position.

Virgin Australia’s long-standing cooperative agreement with Alliance was also axed due to similar concerns. The ACCC had allowed the pair to ‘cooperate, coordinate and jointly bid’ for FIFO contracts since 2017 but rejected a five-year extension to the deal.

In that decision, the ACCC said:

‘The airlines have not demonstrated sufficient public benefit to outweigh the likely detriment from this proposed co-ordination to satisfy us that the conduct should be authorised.’

From then on, the competition watchdog has had a close eye on FIFO operations and would have made any appeal a drawn-out one for any merger.

While it’s another loss for Qantas, the decision could serve as a long-term win for Alliance as the airline continues investing in aviation infrastructure and projects strong earnings growth into the future.

Strong earning potential favoured

As we move into the third quarter earnings reports for many companies, it’s clear investors are favouring revenue growth in their investments.

But with geo-political risks rising and end-cycle market signals ringing— have you considered other opportunities?

Right now, gold is surging as investors look at high government and public debt and fears of a wider Middle East war.

Gold is up 6.33% this quarter and has spiked in recent weeks with a strong uptrend.

Source: TradingView

But this could be more than just a short-term fear-based move. Our market watcher and Editorial Director Greg Canavan, thinks this is where the financial insiders are moving.

He calls it the ‘Great Gold Lockup‘ and sees it as an engineered parabolic rise in gold demand.

If you want to learn more on how you can position yourself and how to access your ‘Ultimate Australian Gold Gameplan’, then,

Click here before gold goes any higher.

Regards,

Charlie Ormond

For Money Morning