The Australian Competition and Consumer Commission (ACCC) has given the green light for the acquisition of ASX energy powerhouse Origin Energy [ASX:ORG] by Canadian private equity giant Brookfield and partner EIG.

The ACCC announcement is a significant hurdle cleared for the deal, which would see the Toronto-based asset manager take a huge step into the Australian energy market and invest $20 billion into renewable energy and storage.

Shares in Origin are up by 4.58%, trading at $9.13 per share as investors piled into ORG with expectations of gains from the buyout and the potential for further discussions on the final price.

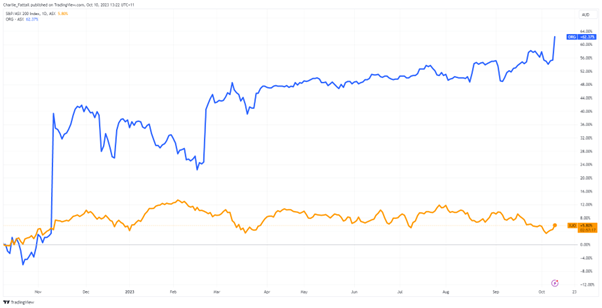

Origin has seen its shares climb steadily since the initial 35% single-day jump when news of the buyout hit the press on 9 November 2022. Shares are up 62.4% in the past 12 months alone, pegging it as the second-best performer in the Utilities sector this year.

Source: TradingView

Battle of the shareholders

Chairwoman of the ACCC, Gina Cass-Gottlieb, said today that the benefits of a faster transition to renewables for the Australian public outweighed the potential impacts on competition.

The decision had been delayed twice before the final tick-off.

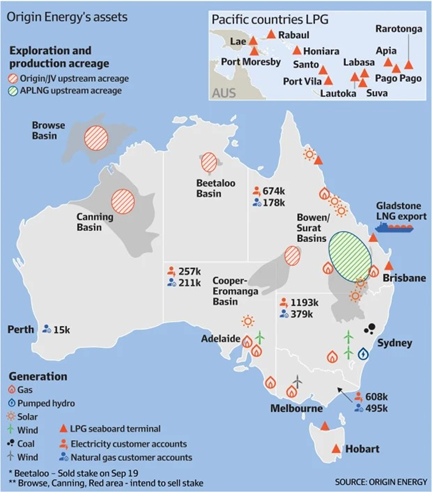

As of August, Origin’s total assets on its balance sheet are just shy of $19 billion and are spread throughout Australia.

Source: Origin Energy

The takeover now faces an uphill battle between major shareholders in the upcoming vote to approve the deal. Since the initial offer lobbed by the two North American suitors, Origin has managed to turn around its fortunes.

Origin posted a $1.43 billion loss last year from significant write-downs of its Perth-basin assets. It had appeared aimless to many shareholders who publicly fought over its strategy moving forward.

In August, Origin surprised analysts with an 83.5% increase in net profit, hitting $1.05 billion in the 12 months to June.

This was partly due to the previous $2.2 billion write-downs clearing, but stronger liquefied natural gas (LNG) prices and gains in the wholesale energy market also buoyed the company.

With the renewed profitability and bolstered share price, major shareholders now think the deal undervalues the company.

AustralianSuper and fund manager Perpetual have been the loudest in this camp, with AusSuper going so far as to spend a further $150 million to buy another 1% of Origin to lift its stake to 14%.

AusSuper CIO Mark Delaney did not mince words after the purchase, saying that the offer’s share price was ‘substantially below our estimate of its long-term value‘.

This sentiment has been echoed by similar major shareholders, such as Kingfisher Capital Partners, who have suggested a price nearer to $11 per share.

The offer price of $8.91 a share at the time represented a 59% premium to the one-month average stock price. That’s now around a 2.5% discount.

So what’s the likelihood of the deal moving forward?

Deal or no deal

The offer price has now been lifted to $9.20 per share— but with today’s gains— that’s only 7 cents off the current price.

Brookfield’s previous attempt to sweeten the deal was the pledge to invest between $20–30 billion over the next decade to add 14 gigawatts of clean energy assets in Origin’s name.

This had previously swayed many shareholders’ onside, but now it appears the majority has lined up behind AustralianSuper.

The deal would require approval from at least 75% of shareholders in a vote scheduled to take place in the coming months.

The takeover seems to hinge on price alone and North Americans’ willingness to pull out the chequebook.

AustralianSuper and Perpetual have shown that they are less concerned with the ‘greenness’ of any proposed buyout. Clearly, they are financial investors, and any deal needs to bring them a healthy profit.

Talk from their offices has clarified that their position isn’t budging. In fact, they have gone on the aggressive and said they would be happy to maintain Origin’s current leadership.

Perpetual’s investment team, led by Vince Pezzullo, met with Origin’s management and made this case in September. He stated that Origin had the capital to make a green transition without the buyout.

With such tough talk, the next offer from Brookfield and EIG may need to exceed the usual 5–10% premium, making it trickier than previous hurdles to clear.

If the deal manages to pass, the next great challenge for Origin will be its transition to renewables.

Energy transitions are hard

Shifting from Origin’s current power mix to a renewable one will be a long and challenging process. It can also play havoc on our power systems.

Renewable energy sources tend to fluctuate in generation as they rely on natural forces we can’t control.

The sun doesn’t always shine, and the wind doesn’t always blow.

Similarly, the demand for power changes throughout seasons and times of day. Often, these requirements can be at direct odds with renewable power sources.

With the flawed intermittent nature of renewable energy, many expensive solutions are required to fill the gaps so that heavy industry, manufacturing, or homes can get reliable power when needed.

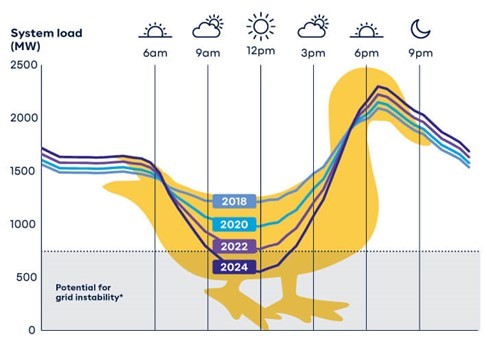

This gap is known in the solar industry as the ‘duck bill curve ‘.

Source: Synergy (WA Estimates)

During the day, when demand is lowest and the sun is shining the brightest, solar can overload transmission lines that are designed for one-way electrical flows, leading to instability in grids.

At the head of the duck, these grids are again put under stress as demand rises and solar output falls to nil.

To make up for these shortcomings, expensive solutions are touted for new battery storage solutions and over 10,000 kilometres of new transmission lines to carry these renewables.

That’s a nine-fold increase in transmission lines that will also require batteries and new infrastructure to manage the needs of renewables.

And all of this is supposed to come in the next seven years.

Our Editorial Director Greg Canavan has been doing a deep dive into the costs and realities of the Net Zero movement.

If you want a different perspective from the mainstream and stocks that could benefit from a u-turn similar to the one we are seeing in Europe then,

Click here to find out.

Regards,

Charlie Ormond

For Money Morning