Last Saturday was a pivotal moment for Australia in many ways.

The referendum on ‘The Voice’ revealed a resounding ‘No’, as almost 61% voted against proposed changes that would effectively remove the separate sovereignty rights of Aborigines and Torres Strait Islanders and provide them with additional rights as Australian citizens in return.

Interestingly, none of the six states had a majority of voters supporting change. Only one territory, the Australian Capital Territory, delivered a majority of ‘Yes’ votes.

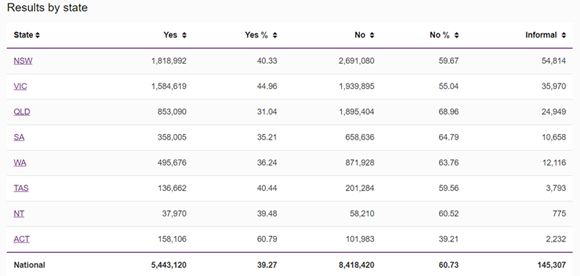

The table below showed the results as of Wednesday at midday:

|

|

| Source: Australian Electoral Commission |

What was most surprising was that a larger proportion of voters from the Northern Territory didn’t support this motion, despite the state having possibly the largest proportion of Aborigines and Torres Strait Islanders in our country.

Furthermore, it was the inner city and the most affluent electorates that voted for the change. Suburbia and rural voters weren’t on board.

Even before the referendum took place, a significant proportion of Aborigines and Torres Strait Islanders voiced their dissent. While it’s hard to estimate exactly the proportion that voted for or against, it was clear that the Albanese government’s claim of more than 80% supporting this move was likely overstated.

The results of this referendum may’ve helped to prevent Australia from the impact of unintended consequences of changing our Constitution.

As they say, the devil lies in the details, which were the glaring omissions from the Albanese government and those in the ‘Yes’ campaign. I covered this in last month’s article ‘Fix the Economy, Stupid!’.

Perhaps the most important outcome of the referendum was that the ordinary Australians raised their voice collectively to tell The Australian Establishment — comprising political leaders, corporations, academia and the mainstream media — that they were out of touch.

History may mark 14 October 2023 as the symbolic Battle of Midway that turned the tide in favour of the ordinary folks.

The subtle and silent robbery of the masses

For many years, people around the world have had their freedoms and wealth silently taken from them.

It happened slowly and subtly and especially here, in the so-called ‘lucky country’.

While governments around the world bailed out failing banks and property trusts during the subprime crisis — using taxpayer funds and newly created fiat currencies borrowed from central banks — Australia was largely sheltered by the commodities supercycle.

We were one of few countries to not live in a zero-interest rate environment — at least until 2020.

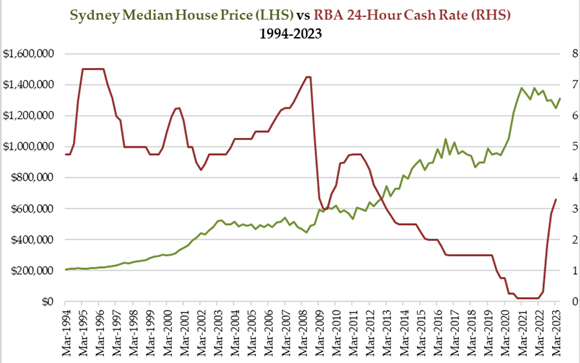

Some of you may recall how the Reserve Bank of Australia started raising rates in late-2009 till late-2011, when it changed course to slowly cut rates to near 0% in 2020.

Many Australians felt uneasy about the rising cost of living and the increasing debt burden as they clamoured on board the property bandwagon. As interest rates slowly dropped, property prices rose at an accelerating pace:

|

|

| Source: Australian Bureau of Statistics, Reserve Bank of Australia |

To make things worse, the salary of an average worker couldn’t keep pace with the rising property prices. Therefore, they took larger mortgages which take longer to pay off, with the banks benefiting the most from a longer stream of interest payments.

This led to a nightmarish combination of working more for less, getting deeper into debt, and paying for longer.

It was a perfect robbery committed 24/7, year after year. Sadly, many Australians were unaware it was happening.

Worse still, trying to get out of this trap was nearly impossible. The only way was to suck it in and chisel away at the ball and chain of debt.

Meanwhile, those at the top make fine promises, concoct trivial controversies and approve the occasional stimulus payments to quell the masses.

The hubris of the elites who ‘failed to read the room’

The elites had invested heavily on their campaign. The government spent some $450 million to run this referendum.

Think of what that amount of cash could’ve done to relieve the hardships of the ordinary Australian household!

But one thing that was worthwhile was to see the salty tears of these elites and their sheer hubris in the face of a crushing defeat.

They had the gall to tell the public that they voted wrong because of misinformation! Celebrities came out and expressed their outrage and browbeat the public because of the majority who didn’t agree with them.

The host of Ten’s The Project, Waleed Aly, might best sum up how insufferable the elites are and the contempt they hold of you and me if we voted ‘No’.

On Monday, he claimed that the messaging for the campaign was too complicated for the ordinary Australian, because there was a strong correlation between the level of education attained with how they voted.

Put bluntly, he wanted to insinuate that Australians were too simple-minded so they didn’t vote as the elites hoped.

Most of you would find this insulting to say the least! I for one have over two decades of working in the tertiary education industry and therefore am an intellectual equal with them.

As for corporations that spent millions of dollars promoting the ‘Yes’ vote, it’s clear how the boards and management now have egg on their face after getting it so wrong.

Given now is the time of the year where companies are holding annual general meetings, I sure hope we see many shareholders hold the boards accountable. They deserve scathing criticism for spending company funds promoting a minority view and destroying shareholder value at the same time.

A revenge served cold, but perhaps too late

Unlike the 2019 Federal Election where Scott Morrison delivered a surprise victory, this referendum was more decisive and delivered a clear punch in the guts against the entire elite establishment in Australia.

The key difference this time was that they went all-in and suffered such a setback.

The neglected majority has had the first taste of vindication against those who lord it over them.

Their voices are now heard loud and clear.

If the elites in Australia don’t want to go the way of what we’ve seen with wokeism in the US (go woke or go broke), they better start changing their strategy.

But alas, are we too late in taking back control of our country from the edge of the cliff?

After all, our country’s national debt is now over $9 trillion and rising fast.

That’s why, despite our nation’s riches in commodities, our dollar isn’t strengthening against the US dollar like it was in 2011–12. It’s fallen to levels seen during the market panic over the global virus outbreak in 2020.

One bright spot to this is gold, which is at all-time record high levels over here:

|

|

| Source: Refinitiv Eikon |

It’s doubled in eight years, meaning those who have bought gold over the years are able to preserve their purchasing power and wealth.

And just so you know, central banks and countries around the world have been scrambling to buy gold — especially in the past two years.

What is it that they know that they’re keeping hidden from you?

I wouldn’t trust them to have your best interest in mind.

Look at how they spent millions of dollars to tell you they know better. When their game backfired on them, they chucked a hissy fit and abused you.

Besides our resounding ‘No’, why not stick it to them by storing some of your wealth in real money and taking back more control of your life?

Precious metals and mining stocks are a great alternative to keeping your house in order. Check out my precious metals investment newsletter, The Australian Gold Report. I’ve got the Ultimate Gold Game Plan to help you get started!

God Bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

|