I’ve attended two precious metals conferences in Sydney over the past fortnight.

The first was the ABC Bullion Precious Metals Conference last Tuesday and the other was the Australian Gold Conference.

The atmosphere in the two conferences was quite different. The ABC Bullion Conference was more upbeat while the mood was more subdued at the Australian Gold Conference.

You might be surprised by this. They’re both focused on precious metals, so what’s the difference?

The ABC Bullion conference catered for bullion owners and those interested in the potential of gold, silver and precious metals in this decade, which we might end up calling the 21st century ‘Roaring Twenties’. Indeed, it was a roaring event with more attendees than seats available!

|

|

| Source: Brian Chu |

Looking at the past seven years, precious metals have done well. Many who bought and owned bullion for several years, even decades, enjoyed a good ride.

Meanwhile, the Australian Gold Conference brought together around 30 gold, silver and base metals mining companies, precious metals dealers, drilling companies and fund managers…allowing mining executives to showcase their mine properties and development progress.

There were other talks from fund managers and industry veterans covering the different ways to invest in precious metals assets, how the gold and silver prices affect potential, and how professionals in this industry make decisions both on a day-to-day basis and for their future.

|

|

| Left: With Ley, an experienced geologist and subscriber of The Australian Gold Report |

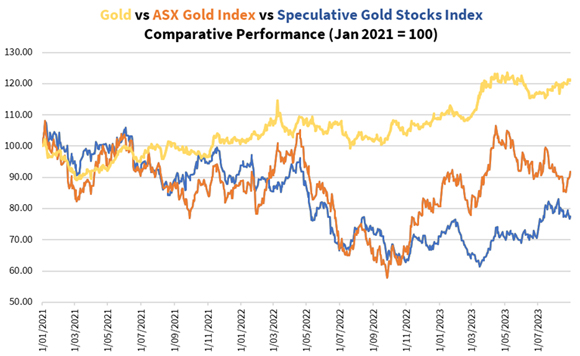

As I said before, this conference was less upbeat in mood. You’ll see why when you look at the figure below showing the relative performance of gold, established gold producers and speculative explorers over the past three years:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

You can see that gold has rallied steadily during this period. Those who bought during this period enjoyed a 20% return. Gold stock investors had a rougher ride and are still down on their investments after hitting a bottom late last year.

But that’s the past. You should focus on looking into the future. That’s what is more important.

Gold: Offering protection and stability in a crisis

Lynette Zang, the Chief Market Analyst at US-based company ITM Trading, delivered a keynote address on Tuesday morning. Most of you may’ve followed her on YouTube as she’s a well-renowned precious metals advocate and crisis investor. She speaks with passion and has a big heart for friends and strangers alike.

Here’s a picture I took as she delivered the address:

|

|

| Source: Brian Chu |

Her address covered what she believes is a global financial crisis ahead and how it’s important to prepare now. This is because the governments that many have come to depend on won’t be there to help. She talked of the falling purchasing power of fiat currencies, the growing debt crisis and how bullion can help households weather the storm.

One of the figures she showed was the declining purchasing power of the Australian dollar. We came out of the British pound system in 1966 and moved to the decimal currency system. If I read the figure correctly that Lynette put up, we’ve lost over 80% of our purchasing power in just over 55 years.

Most of you are familiar with the story of the US dollar since 1913. You can go to the US Inflation Calculator website and find out that something worth $1 in 1913 would be worth $30.88 now!

That’s staggering!

I can still remember that when I arrived in Australia in 1989, a $50 note was more than enough for a couple of days of groceries. Nowadays, it might buy a family of four enough meat and vegetables for a day!

You might remember two weeks ago that I wrote about reclaiming your financial freedom with gold. Given the chaos unfolding around the world — with global conflicts and rising debt crushing governments, businesses and households globally — I can’t stress enough the importance of seeking safety with precious metals.

But there’s more than just seeking safety. Some of us should think about opportunities.

Bountiful opportunities with mining companies

This is where I think the subdued atmosphere at the Australian Gold Conference is a reason for you to get excited about the opportunities in investing in mining stocks.

If you’ve been following gold mining companies for the past two years, it’s been a rollercoaster ride. The more established producers have made back a lot of lost ground from last year’s sharp selloff. This hasn’t been the case for the smaller explorers.

It’s a two-track market right now.

Looking forward, gold producers are well-positioned to weather any near-term challenges that are facing the world. Most of the top players have a large cash balance and aren’t facing threats of looming debt repayments. This should give management sufficient headroom in case their mines aren’t delivering as much profits as the price of crude oil drifts upwards once again.

Looking into 2024, several companies like Evolution Mining [ASX:EVN], Regis Resources [ASX:RRL], Silver Lake Resources [ASX:SLR], Ramelius Resources [ASX:RMS] and Westgold Resources [ASX:WGX] are moving forward to aggressively explore and develop their properties. They’re focusing on longer-term growth during these lean times.

As for explorers, you’d think — looking at their prices — that the bottom has fallen underneath them. Therefore, the mining sites are all quiet on the western front.

There’s nothing further from the truth!

Over these two days, I listened to conference presentations, many of which were by companies I’ve recommended to my Gold Stock Pro readers. All of them are hard at work drilling, exploring and making deals, it’s business as usual for them. However, some are keeping a close eye on their bank accounts as they’re running short of funds in this difficult environment where investors have little interest.

Those with enough cash to cover more than a year’s worth of activity are on more solid ground. These are the companies I’m paying close attention to, and I suggest you consider doing the same.

Think of this, the tide is currently out. Why not take this opportunity to put out a few boats? They could go far when the water rises.

In the short term, things could continue to be rocky for precious metals and mining stocks as the market works out where to seek refuge. Right now it seems to be the US dollar.

But the people that I’ve rubbed shoulders with these past two weeks have their money on gold and precious metals. They know history and they’re not going to let the short term get in the way of prospering in the long term.

Why not join us?

You can get started with a precious metals portfolio — bullion bars and coins and a selection of established gold producers. Find out how to do that with my investment newsletter, The Australian Gold Report.

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia