The entire world is starting to return to some semblance of normality. Even the nations that imposed the most severe restrictions are lifting their mandates.

The global economy is now trying to roar back to life. But things are not the same. The global supply chain is in terrible shape. You can thank the government and public health restrictions on that. It’s like a patient waking up from a coma to find that his carers had needlessly amputated his legs, thinking that doing so would save him.

What is the world facing now?

A strangled global supply chain, greater geopolitical tensions, and countries engaging in trade wars and internal conflict between the government and its citizens.

The oil price and hard and soft commodities have risen sharply. The issue of the global shortage of urea, a major nitrogen-based ingredient for fertiliser and fuel production, is now again in the spotlight due to sanctions placed on Russia, a major global producer.

Expect inflation to continue to hit hard, especially on the grocery store shelves.

Hubris and folly brought us here

There is no doubt that the force of nature, such as natural catastrophes and changes in weather patterns (note I use weather, not climate), is a powerful phenomenon.

Those who live in the eastern seaboard of Australia felt its impact over the last month with fortnight-long heavy rains that flooded parts of Queensland and New South Wales. You would’ve noticed that fresh produce has been selling at much higher prices in the last few weeks. Some of these items cost double and even triple what we paid last year.

You can put the price increase partly on the floods as it wiped out crops.

But don’t forget the significant role of hubris and folly from the governments, public health authorities, and the broader population. There are many people intent on going against actual science (because there is never ‘settled science’ — it is subject to questioning, testing, and doubting). They’re on a power trip to ensure as much of the population experiences misery so that they’ll remain relevant and in control. You can tell by how many leaders and public health officials are now merely walking back on their bold claims rather than admitting their mistakes and stepping down.

I’m talking about the border closures, vaccine mandates, and exorbitant fines in a bid to stop the spread of a virus that increasingly appears to have the severity of a bad cold and flu.

The global supply chain came to a grounding halt. It made sense to take precautions in the first half of 2020, but increasingly became a thinly veiled attempt to make the population know who is in charge and that you must do as they tell you.

The result? Shortages on the store shelves, shipping delays, and rampant price rises. Not to mention, many people could work but are restricted from doing so due to health restrictions.

The decision makers want to blame it on Russia. They have flipped the script from blaming it on the Wuhan virus because Russian President Putin became the new boogeyman last month.

Never mind how daily case numbers remain stubbornly high, the news cycle has moved on and so should you.

Friends, the truth is that human hubris and folly brought us to where we are at. Absurd measures that the authorities pushed onto society have pushed our economy to the brink. And the vast majority of the public, weighed down by financial and social pressure, chose to comply rather than question these measures or even oppose it, for fear of punishment and society shunning them for daring to question ‘science’.

We are now facing one of the biggest existential threats to the global community.

Seek what shines for refuge and opportunity

How could you come out ahead in this crisis?

Firstly, make sure you have an ample supply of food and necessities at home. However, ensure that you don’t go overboard and take more than you need. It is one thing to help yourself and another to do so at the expense of someone else.

Secondly, are your finances in order? You are seeing central banks scrambling to raise rates so they won’t take the blame when the economy crunches under the weight of inflation.

Sure, they caused it, and they won’t be able to get off the hook this time. But you and I will wear much of the losses if we’re not careful. Hence, I’m checking to make sure that I’m balancing my books and curbing unnecessary spending.

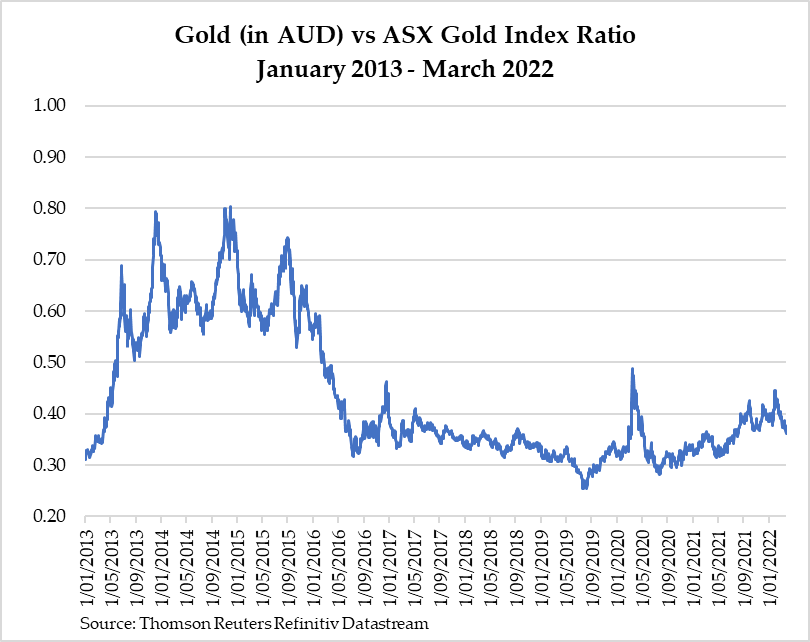

Thirdly, a crisis can offer opportunities. The asset markets may be exuberant but there are still some undervalued assets lying about. I was looking at the relative price levels of gold and gold stocks over the last eight years. Check it out below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

This figure calculates the price of gold in Australian dollar terms against the ASX Gold Index [ASX:XGD]. A higher reading means that gold stocks are undervalued relative to gold and vice versa.

Notice that we are currently trading at around 0.37, which is higher than what we saw in 2021.

2021 was a forgettable year for gold stock investors. But this year is looking better each week. The producers have rallied since late January, many of them returning at least 25%.

Look at what happened in 2016, 2019, and 2020 when the ratio between gold and gold stocks dropped dramatically.

Those were major gold rallies that saw massive gains across the board.

You want to know what happened to gold explorers?

Many increased fivefold or more, even 20-fold.

These explorer stocks are currently sitting near 52-week lows. Producers have taken off, but these ones have not.

Join me here and I will show you how we are positioning ourselves for the imminent gold run.

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia