Is the sharp drop in the price of crude oil this past week a sign of better days for the global economy?

Among those who are hoping this is the case, executives and investors in the mining sector alike are especially anxious to see this happen. The sector has seen a sharp decline in market sentiment, leading to difficulties in accessing funds necessary for developing projects to meet the ever-increasing demand for resources.

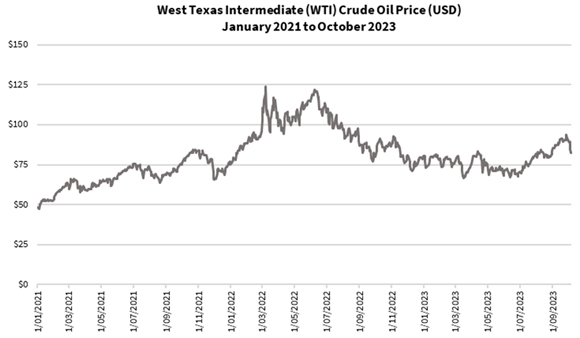

Here’s a figure showing the price of oil in the past three years:

|

|

| Source: Refinitiv Eikon |

Since mid-June this year, crude oil has staged a strong recovery from just over US$67 a barrel to almost US$95 late last month. Last week, oil fell over 10%, taking it down to a little below US$83.

While central banks embarked on an aggressive rate rise cycle in the past 18 months to control inflation, the rising price of oil might’ve caused inflation to accelerate once more. Last month’s release by the US Bureau of Labor Statistics showed that the August CPI increased faster than that in July on a year-on-year basis. It’s expected that the September CPI readings, due for release later this week, will be higher than in August.

Should inflation and high interest rates linger, this could hold back mining companies from rolling out their development plans. In turn, it’ll create a bottleneck in manufacturing, construction and consumption, creating a vicious cycle.

How the oil price moves in the next fortnight could provide a clearer signal on whether there’s relief or pain in the next few months as our global economy hobbles after its near crippling in the last four years.

It’ll also help mining speculators get a better idea of how much longer they’ll need to endure the pain before they can enjoy their rewards.

A Catch-22 situation

The global lockdowns and unprecedented government spending have led to inflation spiralling out of control. It also led to declining living standards and a burgeoning wealth gap, meaning governments are having to step in to reduce the risk of civil unrest.

The recent rally for oil came off the back of the Organisation of Petrol Exporting Countries (OPEC) announcing in June that it’d cut the supply of crude oil so these countries could balance their national budgets.

Many of these countries’ key revenue source is from the sale of oil, which they use to fund their domestic spending, construction and welfare programs.

We’ve seen how our leaders in the western world have faced difficulties managing rising costs, budget deficits and rising disapproval rates after opening up. With countries such as those in OPEC that are often authoritarian and are less prosperous, these problems are even more pressing.

Indeed, some African countries — including Mali, Burkina Faso and Niger — have experienced military coups and populist uprisings in recent times.

So while increasing oil supply would help the world globally in navigating us out of trouble, OPEC nations would end up earning less and thereby risk bearing more risks of domestic instability.

Talk about a Catch-22 situation!

Could uranium and nuclear energy come to the rescue?

Until recently, there was a heavy push worldwide to phase out fossil fuels in favour of renewable energy to reduce carbon emissions. However, that’s fast proving to be a surefire way to slow down the progress of today’s society. Many western countries including the US, the UK, France, Finland and several Eastern European nations have realised that this is an unrealistic policy as solar and wind generators can’t produce baseload electricity and it takes years for them to cover the initial construction and setup costs.

Since early 2022 when the European Union — out of practicality — decided to include gas and nuclear energy as acceptable sources of green energy, it set the scene for countries to allow nuclear reactors to keep the lights on. While Germany sought to set an example to the world on the Green Agenda by shutting down most of its nuclear reactors, they’re nearing their day of eating humble pie when they restart these reactors to avoid being stripped of power for putting ideology over serving the best interest of the people.

The recent surge in the price of uranium and the push by countries like China, India, Japan and several EU nations to redouble their efforts on nuclear energy could help provide a path forward in breaking this deadlock the world is facing.

Only a few days ago, Bangladesh received a shipment of uranium from Russia as it is set to become the 33rd nation in the world to include nuclear energy to power itself.

While nuclear power contributes to around one-sixth of the world’s energy sources, it could increase going forward. As a clean and efficient source of baseload energy, it could help pave a path to redefine the future.

Fortune favours the brave…and patient

In the recent weeks, you’ve heard a lot from us about how this is a great time to consider uranium stocks. Uranium has rallied and some uranium stocks have jumped more than 50%.

I’m not here to join the chorus in saying that you should chase the uranium bull.

There is still lots of steam in that market, no doubt about it.

But there are other resources that you can look to for potential opportunities going forward.

Should nuclear energy provide a viable solution, it could lead to falling energy prices and increased industrial output — which will revive the mining sector and restore its profitability.

Think of what this could do to the many resources stocks that have been plummeting because the market sentiment is so weak!

Gold, silver and copper stocks have been hit hardest in the last two years as mining investors chased after battery metals and other critical minerals.

However, the truth is that the world’s going down a different path of electrification than electric vehicles, solar and wind energy and battery storage.

These will still go ahead, as they have their roles. But I believe the world isn’t going to turn abruptly from petrol driven vehicles, fossil fuels and gas-powered stoves and heaters.

When this dawns on the fund managers who have been kowtowing to the crumbling ESG (Environmental, Social and Governance) agenda, watch the funds flow back to these neglected metals.

Consider signing up to our commodities investment newsletter, Diggers & Drillers, where our in-house resources expert, James Cooper, guides you to build a commodities portfolio that could reward you well in the years ahead.

If you’re interested in precious metals and finding undervalued gold mining companies, now is a great time to join my precious metals investment service, The Australian Gold Report. I’ve got a strategy to help you find opportunities in precious metals and exploit the current lack of interest in gold mining companies!

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments