It appears the world is starting to reject the idea of Net Zero.

Prices of critical minerals needed for batteries, solar panels, wind turbines and electric vehicles such as lithium, copper, cobalt, nickel and other materials have stagnated rather than rallied.

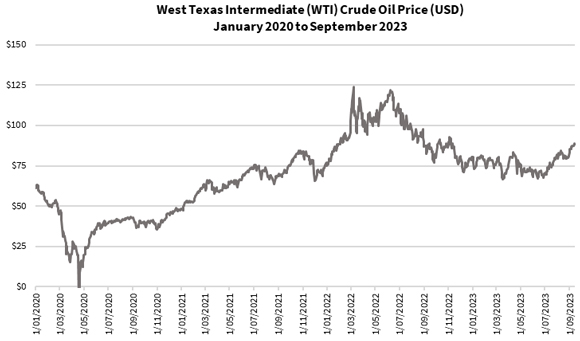

Meanwhile, it’s the price of oil that’s gained significantly over the past two months and is now trading at over US$90 a barrel, as you can see below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Likewise, uranium is now trading at prices last seen in 2011 in the aftermath of the Fukushima nuclear plant disaster…as nuclear power stages a major comeback.

Even some proponents of this agenda are now walking back. It was surprising that the Rothschild family has come out of the curtains to admit that they need to go back to the drawing board.

Yes, you’ve heard it. The matriarch, Lady Lynn Forester de Rothschild, who heads Inclusive (cringe) Capitalism has announced it’s time to throw the Environmental, Social and Governance (ESG) agenda into the dustbin.

Less than three months ago, it was BlackRock’s CEO Larry Fink who admitted that he’d stop using the term ESG as it raised too many negative connotations.

While this signals a major pause to the relentless push to try to reengineer and potentially cripple the world, don’t expect that it’s the end.

If the past is any indicator of what could happen, these people will simply change the name and try to sell the same nonsense. We’ve already seen the shift over time from global warming, to global cooling, and finally the all-encompassing climate change!

In fact, Forbes.com reported only a few days ago that Larry Fink is stating it’ll use executive incentives to try to revive the agenda.

But will this be enough to change public opinion for Net Zero?

That’s the multi-trillion dollar question.

A globalist pipedream, our nightmare

People are now wising up to the Net Zero agenda — and we at Fat Tail Investment Research have been doing our part to educate readers on the matter — and recognise it’s a ploy by globalists who channel their funds into various institutions to reengineer society.

It’s more than just a clean energy revolution aimed at reducing pollution to make the world more sustainable.

You only need to look at how the environment is only one component of ESG.

The other components, being Social and Governance, seek to change life as we know it. I’ll name a few of the most absurd examples.

Take the transition from eating meat to bugs, because of the belief that livestock is responsible for emitting methane and carbon dioxide.

If you don’t believe me, there’re bug farms and bug snacks springing up!

Perhaps it’s a novelty or a prank gone too far…but I’ll pass on that.

How about electric planes that have a range of a few hundred kilometres? So flying overseas will require several stopover flights because the plane needs to land after two or three hours to recharge.

Now, the advantage is that you’ll fly with no more than 20 or so passengers so it’ll likely be less crowded and less waiting time to get your luggage.

But the disadvantages? Where do I start? The likely exorbitant cost of tickets, the inconvenience and the number of places that won’t be accessible because the planes just can’t get there (no more Hawaii, Pacific Island trips, sorry!).

I could go on, but you get the idea. This is what they’re selling us, which sounds so ridiculous already.

Imagine what reality would be like.

Commodities shake off Net Zero, paves path to commonsense

The good news is that the commodities market is clearly not on board with the Net Zero narrative.

For one, the prices of the critical minerals aren’t rallying like they did in the China boom in the early 2000s.

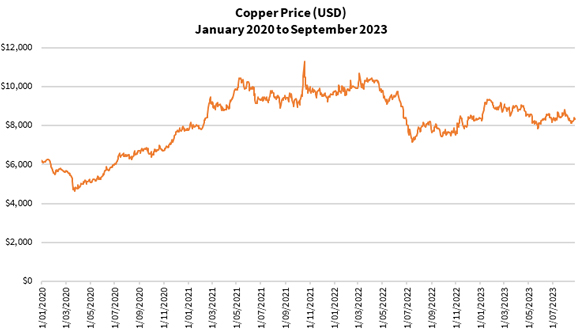

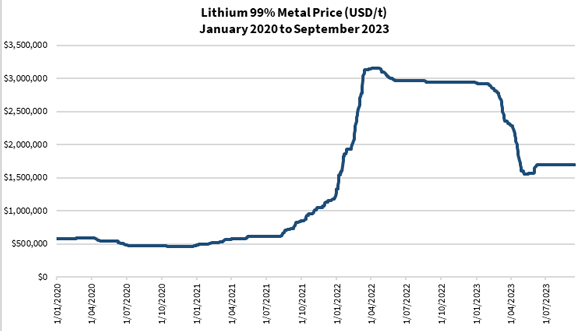

Look at the price of copper, lithium and nickel in the figures below:

|

|

|

|

|

|

| Source: Thomsons Reuters Refinitiv Datastream |

If this agenda were proceeding, a rally would be clear as day.

And it’s not as if the current price levels can be explained away with ‘increased supply’. That would only be possible if mining companies doubled their efforts to increase supply and governments had fast-tracked permitting to develop more mines.

The reality is the mining sector has experienced a similar slowdown these past three years thanks to lockdowns, border restrictions and labour shortages. Progress in this sector was slow, with rising costs hampering development and production.

The current price levels for most metals — lithium perhaps being an exception — show there is resistance toward Net Zero.

Early bird opportunity to invest in a post-Net Zero world

I believe the mining industry has a Gordian knot that needs cutting right now.

The success of an energy revolution, Net Zero or otherwise, hinges on a significant increase in the supply of critical metals and critical minerals. However, that’s not likely to happen while there are few mine operations and deposits that’d be commercially viable under current market conditions.

To break this stalemate, either the oil price falls or there’s a breakthrough in mining technology or process to improve profitability.

Net Zero is the obstacle. It’s a relief that it’s on its way out, at least for now.

The rise of uranium could break the stalemate too, since it’d provide a readily available and tested source of cheap, efficient baseload energy. That’s why many countries are now restarting their nuclear reactors and uranium has surged to its highest levels since 2011.

Meanwhile, investors seeking opportunities to buy low should consider taking their positions now. There are plenty of companies to choose from across so many commodities.

If you’re interested in finding out more about how to move in early on such opportunities, be sure to check out my colleague Greg Canavan’s new NOT ZERO video.

It’s an eye-opening watch, and one you won’t want to miss.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

PS: Is Net Zero about to collapse? Whether you believe in the ‘climate emergency’ or not, it’s becoming increasingly clear that much of what we’re being told about ‘net zero’ is dangerous nonsense. In our most controversial video presentation yet, Greg Canavan explains why the ‘carbon neutral by 2050’ project will not happen…and reveals three stocks to buy ahead of the greatest energy U-turn in history. WATCH ‘NOT ZERO’ NOW…

Comments