Yesterday, I talked about how AI development is leading a race to the bottom.

This incredible technology is proving hard to master, and even harder to monetise!

AI is inherently built upon a foundation that benefits from more input, so by making an AI solution-free or open source, it’s far more likely to develop faster than its competition.

That is why Meta (Facebook), has made its latest AI, Llama 2, free to anyone and everyone.

The bold move could slingshot Zuckerberg’s AI ambitions ahead of his key competitors. It just means that the company and its investors are unlikely to profit from Llama anytime soon…

So, who will profit from this AI boom?

After all, there’s plenty of money being thrown around.

Just look at these headlines from Reutersin the past month alone:

|

|

| Source: Reuters |

The demand for AI is going nuts.

But you’re unlikely to find any good investments by following these headlines…

More than just another piece of software

What too many mainstream pundits are failing to recognise is that AI isn’t like typical tech.

It’s not the latest gadget or software that can be sold to the masses for a huge markup.

Instead, it’s a tool that is going to be refined and honed over time. As a result, the most tangible gains are likely to come from tertiary businesses that will feed the AI boom.

Take Qualcomm, as an example.

This chipmaker has almost nothing to do with software and algorithms. But it’s still likely to be a winner of the AI boom because it will make the microchips that can power AI on our everyday devices.

As was announced earlier this week, Qualcomm’s chips will fully support Meta’s Llama 2 AI from 2024 onward. A partnership that will bring AI to the masses by powering it in our phones and laptops.

In other words, Qualcomm is your typical pick-and-shovel stock pick.

A solid company that will provide the means to ensure that people will actually get their hands on AI.

But that’s just the tip of the iceberg. Once you start digging into the real weeds of chip design and architecture, you can find even more promising AI opportunities…

In fact, that’s exactly what Ryan Dinse and I do for our Exponential Stock Investorsubscribers, hunting down the best AI opportunities within the heavily overlooked hardware sector.

They’re certainly not the only winner going under the radar at the moment, though…

Big data’s big opportunity

Cathie Wood, head of ARK Invest, is another AI proponent.

But unlike us, Wood is searching for big winners amongst a cohort of already big stocks. Her one advantage is that she at least seems to understand the importance of data.

For instance, she is a big believer in Tesla as an AI play.

That’s because the company’s self-driving tech, Autopilot, is built upon the same principles as most AI. It must learn and adapt on the fly, just like an AI-powered chatbot.

The only difference is one is behind the wheel of a two-tonne vehicle that can drive at high speeds…

Safety concerns aside, though, the point is that AI has incredible potential in the automotive space. And the main reason Tesla is so far ahead of the competition is because of data.

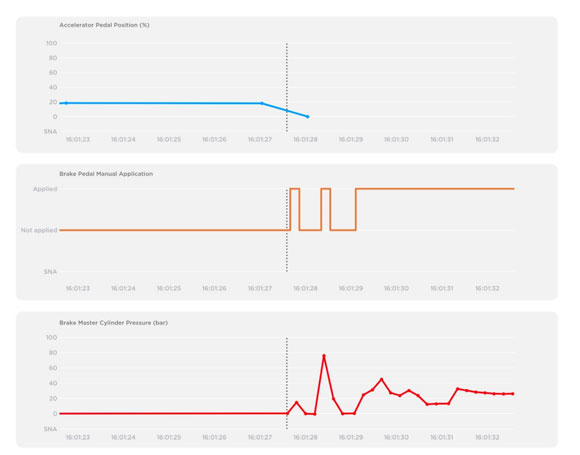

It’s no secret that Tesla collects a lot of information on their customers’ driving. In fact, you can even request a data report at any time to see for yourself. That’s exactly what one Tesla owner did earlier this year after they were involved in a minor collision.

Here are just a few examples of the kind of data they’ve received upon request:

|

|

| Source: Not A Tesla App |

It’s simple information but it’s the fact that Tesla tracks and records it that is important. Because by feeding data like this into an AI system like Autopilot, they can teach it to respond better in a situation like this crash.

And for investors like yourself looking to invest in AI, it’s this use of data that should excite you.

There are hundreds of companies, like Tesla, that collect this kind of information. For tech firms developing AI, that data could be extremely valuable. Which is why, if you’re looking for the best way to invest in AI, you should consider this avenue.

It’s not necessarily easy to find the companies producing the best data, but it is worth considering.

Because despite all the hype and the money being thrown around, AI is extremely reliant on data.

Just keep that in mind the next time you see another AI-led headline.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning