Elon Musk once said that the most entertaining outcome is usually the most probable.

With investing, it’s a little different.

In my experience, it’s the outcome that hurts the most people that usually plays out!

This is known as the ‘pain trade.’

Consider this…

In recent months, the biggest ‘pain trade’ has ironically been staying in cash.

Lured by increasing interest rates and the fear of economic collapse, global fund managers are holding more cash in their portfolios than at any time since the 9/11 terrorist attacks back in 2001.

Anecdotal evidence from a survey of our subscribers suggests a big flight to cash at an individual investor level too.

There’s no doubt everyone feels ‘safer’ in cash right now.

But comparatively speaking, it’s been a losing move.

Right now, this overweight cash position means a lot of people have missed out on a raging hot streak in markets.

The S&P 500 Index of top US stocks is up 7.66% over the past month. And it’s up a whopping 16.78% over the past 12 months.

The tech-focused Nasdaq is doing even better, up 11.46% for the month and up an amazing 24.18% for the year.

Here in Australia, things have been a bit more muted.

The ASX 200 is about break even for the month, but it’s still up a healthy 9.19% (before dividends) for the past 12 months.

But what’s past is past.

What’s more important now is what comes your way over the next 12 months…

Something for the bulls

Right now, many people will be sitting in cash, wondering if they should get back in the market.

And I wouldn’t be surprised if the next pain trade will be for markets to keep surging higher as everyone waits for a pullback that never comes.

When those sitting on the sidelines finally capitulate and invest, then, and only then, will we get the pullback everyone is waiting on!

Don’t blame me, I don’t make the rules…

Of course, I could be wrong on this, but here are some charts that support this view.

First up, inflation:

|

|

| Source: Truflation |

While official data still has the US at 4% inflation, my unofficial source suggests we’re already back down to 2.49%.

Either way, you can see the strong trend down.

The Fed’s decision to pause interest rates last week certainly threw some fuel on the recent stock market rally.

And even though Jerome Powell still said he expected to raise rates at least twice more this year, the market clearly doesn’t believe him.

That plunging inflation number lends credence to the view that we’re done with any more interest rate rises.

On that note, an interesting piece of news came out of China late last week.

The People’s Bank of China cut short-term interest rates from 2% down to 1.9%.

As reported:

‘“Now we are going to see the Chinese [monetary] policy will become more supportive,” Atlantis’ Chief Investment Officer Yang Liu told CNBC’s “Street Signs Asia.”

‘“Basically what the Chinese government is [expected] to do [is] to try very hard to prop up the domestic consumption, especially in the private sector,” she said.’

China is already back in stimulus mode.

This is especially important for Australia and our commodity exports.

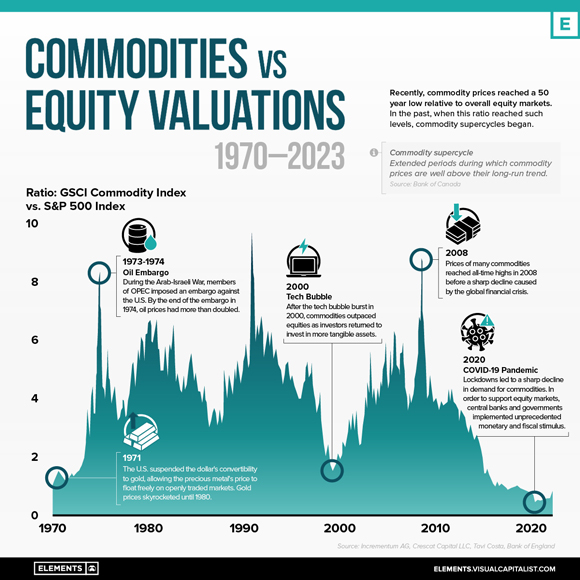

Right now, commodities are priced amazingly cheap compared to the stock market. Check it out here:

|

|

| Source: Visual Capitalist |

In recent years, commodity prices have reached a 50-year low relative to equity markets, so if you’re after good, long-term value, I’d say the Aussie market is the place to look.

On a related note, the Australian Financial Review reported on Friday that the ANZ bank plans to invest more in China after a top executive visit.

As reported:

‘A senior ANZ executive says the banking giant will expand its operations and seek new licences in China following talks with clients and regulators in Shanghai and Beijing this week about the country’s economic prospects.’

That’s certainly an interesting development in my opinion.

And the Australian dollar — traditionally a good barometer of global growth — has surged to a four-month high on the back of his renewed China optimism.

Then there’s artificial intelligence (AI)…

While many people think this is just a fad, we’re already seeing it affect the top line of many companies.

First, there was Nvidia’s stunning results, then last week it was Microsoft.

Stock in the famous computer pioneer hit record highs as executives predicted US$10 billion in annual AI revenue.

The share price is up an amazing 46% for the year.

As an added kicker, AI is set to be a strong deflationary tailwind in coming years, which will reign in interest rate rises further, too.

So all is looking pretty rosy then.

Or is it…?

Something for the bears

The bears see all this but are undeterred.

They think this is a typical ‘crack up’ boom phase before the real crash.

They could be right.

I mean, you can easily make the argument that any optimism about China and/or AI is premature.

The market is already pricing in a lot of success.

And sentiment-driven rallies can reverse very fast when reality doesn’t live up to the wishful thinking.

As optimistic as I am about AI as a disruptive technology, I know markets will get ahead of themselves at one stage.

The question is, when?

Similarly with China, we had a surge in stocks last year based on the ‘China reopening’ narrative, and that fell flat on its face!

It’s better to rely on hard data.

And on that front, this chart is more telling:

|

|

| Source: Yahoo! |

The oil price is a great barometer for economic activity, and as you can see above, the trend is clearly down.

Two weeks ago, I wrote about how we could be in the early stages of a price turnaround on this front.

But that theory was based on OPEC cutting back supply, not raging demand.

And you can clearly see the oil price has reacted pretty mutedly to the announced Saudi supply cuts, which suggests demand remains weak.

It’s not a good sign.

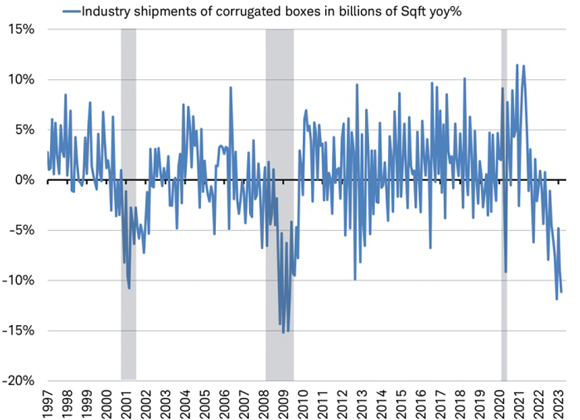

The Cardboard Box Index — an informal indicator of real economic activity — is also trending down:

|

|

| Source: Schwab International |

This is starting to look dangerously weak.

The lagged effects of this will likely take some time to play out, but as Schwab note in their report, we’re already in a ‘cardboard recession’.

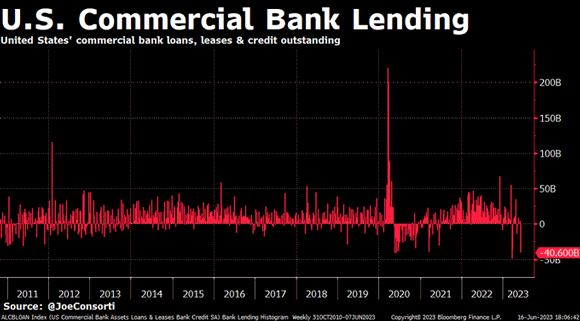

Lastly, the US banking drama is far from finished.

Check out this chart:

|

|

| Source: Joe Consorti |

US commercial bank lending decreased by $40.6 billion this week — the second-biggest drop since the Global Financial Crisis.

Why are US banks cutting back on lending so fast?

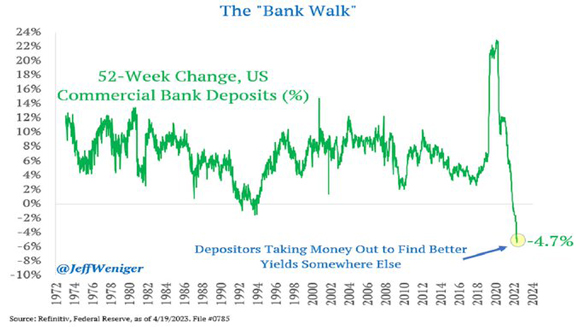

This chart shows why:

|

|

| Source: Jeff Weniger |

US banks continue to see deposits flying out the door in search of the higher yields offered by investing directly in US government bonds.

And until that interest rate dynamic changes, there’s nothing to suggest this trend will change.

The question is, what will break next?

My favourite chart of the week

As I’ve just shown, you can find evidence to support either outlook.

And to be honest, your guess is as good as mine.

But as this last chart will show, you could still make money regardless of which way markets turn.

Here it is:

|

|

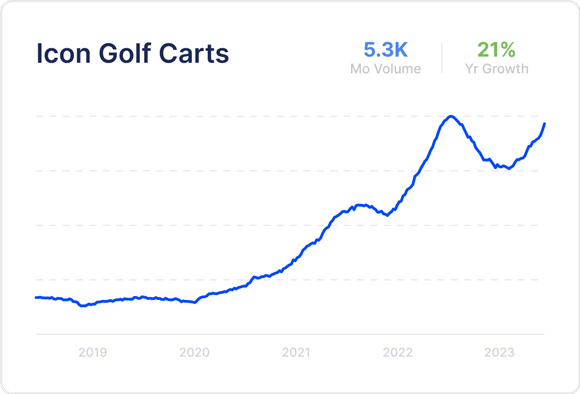

| Source: Glimpse reports |

This exponential chart shows you Google search results for the term ‘golf cart’. It’s rising at a stunning 21% per year!

Why?

As Glimpse reports notes:

‘While many investors looked to the scooter market as the next big thing in mobility, there’s another massive shift happening beneath their eyes: Golf carts.

‘A few key differences between cars and golf carts are driving a surge in demand. For one, insurance is optional in most states and golf carts are, on average, 1/8th the price of a car. It’s a big deal when American consumers spend almost $700 billion each year on auto loans and insurance.’

Retirees moving to small communities are a big driver of this trend.

For example, in the town of Peachtree, Georgia, there are 10,000 registered golf carts for the town’s 13,000 households!

Now, I couldn’t find any golf cart stocks to invest in, but here’s my point.

This trend is a great example of looking for weird underlying trends utterly immune to the bigger-picture dramas.

Even in recessions, people still spend money.

Working out who is relatively immune from any economic downturn and where they will spend is a great strategy to keep you focused on what really matters in investing.

And that is, finding great companies, selling great products to people who have the means to keep buying.

Good investing,

|

Ryan Dinse,

Editor, Money Morning