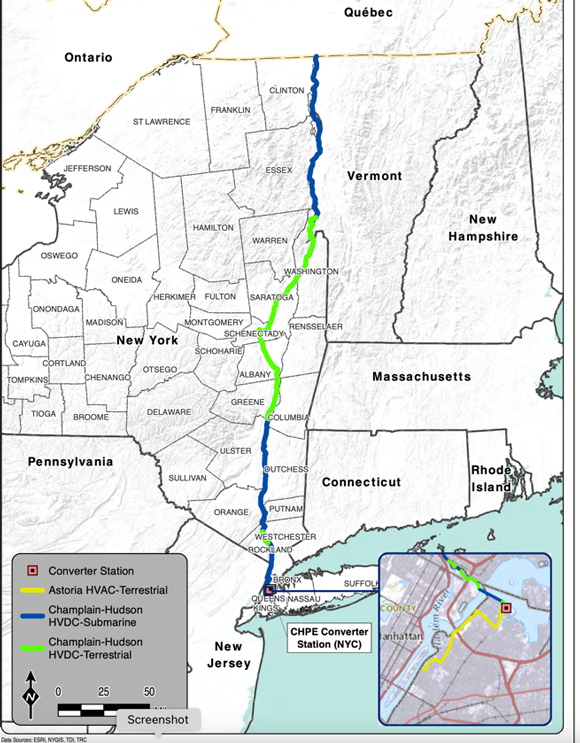

Chippy, AKA the Champlain Hudson Power Express (CHPE), is quite the infrastructure project.

The US$6 billion transmission line, which is scheduled to start operating from 2026, will bring hydropower from dams in Quebec, Canada to Queens, New York.

You’ve likely seen those high, ugly, and bulky transmission line towers before.

So what’s interesting about CHPE is that much of it runs underground and underwater through the Hudson River:

|

|

| Source: Champlain Hudson Power Express |

Once finished, the CHPE will be the largest built underwater and underground transmission line in the US, supplying about 20% of New York’s electricity needs.

CHPE is a big step in helping New York get closer to its target of getting 70% of its power from renewables by 2030.

But it’s not the only US transmission line project in the works out there. As you can see below, there are several firing up at the moment:

|

|

| Source: Bloomberg |

As Bloomberg reported this week:

‘For more than a decade, multibillion-dollar power-line projects have struggled to advance, slowed or halted by bureaucracy, NIMBYism or general industry stasis. Now suddenly, several are progressing — and with them the prospect of newly unleashed clean energy as well as more resilient grids in the face of ever-dangerous storms and extreme heatwaves.

‘“All of a sudden things are happening,” says transmission pioneer Michael Skelly.

‘While long-distance power lines are tedious to get permitted and approved, building transmission is now a top priority for the US renewable industries.’

Much has to do with the passing of the US Inflation Reduction Act, which set aside US$760 million in grants for transmission lines, while creating confidence the energy transition will continue to move along.

But the US isn’t the only country where power line projects are coming to life…

China is planning on investing US$300 billion in a national network of power lines.

And, here in Australia, Queensland just announced it’s spending $5 billion on the CopperString 2.0 power line. The line will connect Mount Isa to the grid and will be an important power source for mining in the area.

And expect to hear more about transmission lines because…

Transmission lines are key to the energy transition

While much has been talked about solar, wind, and battery, transmission lines are a crucial part of the energy transition.

You see, the renewable energy system is different from the fossil fuel system, where power plants are close to cities and oil and gas is transported through pipelines and railways.

While homes are installing solar panels in roofs, much of renewable energy will be coming from large-scale projects built in sunny and windy areas far away from the cities.

So as more wind, battery, and solar projects are approved, we will need transmission lines to connect these projects to their consumption centres with power lines.

All in all, the Australian Energy Market Operator expects we will need to build about 10,000km of transmission lines to transport renewable energy.

What’s more, along with batteries, transmission lines will play an important role in helping with intermittency in renewables. These lines can move energy around from one place to another to use or store electricity where it’s most needed.

So think of them as electric highways.

Demand for electricity is only going to grow

Building these electric highways will mean we will require plenty of materials like aluminium.

But as the energy transition moves along and we electrify more in our economy, our electricity demand is only expected to grow.

Global electricity demand was 13 petawatt hours in the year 2000, and had almost doubled by 2020:

|

|

| Source: TradingEconomics |

By 2040, that electricity demand could reach 35 petawatt hours.

But more transmission lines, electric vehicles, solar panels, batteries, etc. means we’re going to need plenty of minerals.

And one that could do quite well is copper.

In fact, as my colleague James Cooper recently put it:

‘Future copper supply is absolutely at odds with demand expectations. But a lack of new discoveries is just one of the reasons behind looming supply issues.

‘There’s a perfect storm brewing for copper.

‘2023 is setting up for a breakout year.

‘When the world finally wakes up to the looming crisis at hand, companies holding quality copper assets are set to reap handsome returns.’

So, if you haven’t already, check out James’s new presentation. You can do so here.

Best,

|

Selva Freigedo,

Editor, Money Morning