A whiff of panic is in the air…

Markets are falling sharply, perma bears are out of hibernation, and consumer confidence has turned shockingly low.

As reported by The Guardian on Friday:

‘Consumer confidence has plunged as sharemarkets fall and the cost-of-living soars because of surging inflation and rising interest rates.

‘The Westpac-Melbourne Institute consumer sentiment index toppled 4.5% in June, reaching 86.4 — nearly as low as the levels seen during the global financial crisis and at the height of the Covid pandemic.

‘Excluding the Covid crisis, the figure is the worst since February 2009.’

That’s right, fear is already just as bad as it was during the low point of the GFC.

And that’s before interest rates have ticked up too much higher or the stock market has gone too much lower.

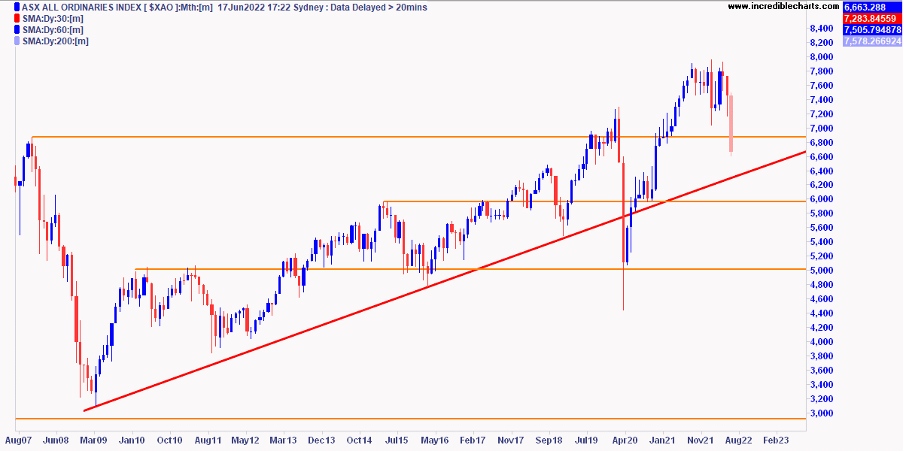

Check out the chart of the ASX All Ordinaries Index:

|

|

| Source: Incredible Charts |

This is a monthly chart since the GFC of 2007/08.

Yes, market falls have accelerated this month, but we’re nowhere near as bad as the GFC turned out to be…yet!

And that seems to be the fear…that the worst is still to come.

I was an advisor during the GFC. And I’ve seen firsthand what fear can do to people’s decision-making processes.

When panic sets in, you get a negative feedback loop of selling that feeds in on itself until everything crashes.

And right now, there’ll be a lot of nervous retirees — and soon-to-be retirees — watching their nest eggs decline just at the time they can least afford it.

Even worse, like the GFC, there’s no place to hide right now either.

Stocks are down, bonds are down, crypto has popped, and cash is getting inflated away at 8.6%…

It’s a tough place for investors, that’s for sure.

But I think perhaps the fear is overdone.

Let me explain why…

It makes no sense

Just as the Fed pumped stocks higher in 2020 with cheap cash, they’re now the ones causing the market to crash by tightening into a slowing economy.

The reason is, of course, inflation (also their fault!).

It’s running red-hot, and central bankers — desperate to be seen to be doing something — do the only thing they can.

They tighten monetary policy and raise rates.

As of now, they seem to be sticking to their ‘tough on inflation’ rhetoric.

Fed Chief Jerome Powell said last week after raising rates 0.75%:

‘Clearly today’s 75 basis point increase is an unusually large one and I do not expect moves of this size to be common. From the perspective of today, either a 50-basis point or a 75-basis point increase seems most likely at our next meeting. We will, however, make our decisions meeting by meeting.’

Markets initially took that last line as perhaps a softening in their resolve.

But the next day, things turned back down sharply again as more and more investors questioned the Fed’s ability to get a soft landing.

And let’s be honest, recent decisions don’t instil much confidence.

Remember when inflation was transitory!?

It seems like central banks are vastly underestimating the risk of causing a recession and there are multiple signs we’re close to one.

As mentioned in an excellent note from Daniel Oliver at Myrmikan Capital:

‘…some prices (like trucking rates) are already plunging. Lumbermay be at 2018 all-time highs, but it is down 50% compared to a year ago as the housingmarket collapses. Copper is near its all-time high, up 60% from 2018 levels; but it is downmarginally compared to a year ago.

‘Other prices are about to plunge as stores liquefy excess inventory. Many retail prices spiked last April (the Biden regime sent $1,400 to most Americans in March, and by June Powell was forced to accept that inflation was real), so the year-over-year decrease in theprices of retail goods over the next few months should be pronounced.’

These are early signs that the real economy is starting to turn down fast.

In other words, the ‘fear’ is working.

To me, it therefore makes no sense to tighten rates much further. That’ll only turn fear into panic.

Plus, how will higher interest rates even bring down the prices of the big-ticket items people care about?

Right now, the big drivers of inflation are energy, food, and housing.

But these are essential items, and no amount of interest rate rises are going to magically reduce demand.

Unless you’re expecting people to freeze or starve to death?

Anyway, I’ll give the central bankers the benefit of the doubt and say this isn’t their intention.

And that’s why they’ll change course…

An Autumn reprieve in store

My best guess is they’re trying to sew these seeds of fear with the idea they won’t have to follow through as much as markets are pricing in.

They’re hoping if we feel poor, we’ll stop spending.

And as I said, it might be working already.

I think they’re also simply hoping to buy themselves time for supply chains to recover and energy and food prices to come down.

Indeed, the Bank of Japan said as much last Friday:

|

|

| Source: Twitter |

As soon as inflation shows any signs of coming down, central banks can claim victory and walk back from the more aggressive rises.

But what if inflation doesn’t come down?

That’s a risk they might actually be contributing to.

Well, even if they can’t bring inflation down fast, I think the Fed has to halt their current course sooner than many think.

Because the risk of tightening too far, too fast will result in a massive unwinding of global credit markets.

And that’ll turn a calamity into a catastrophe.

We already saw the European Central Bank (ECV) rapidly walk back from a policy on intervening in sovereign debt markets after yields on Italian bonds blew out.

It only took them a week to back track from intervening!

If this is what’s already happening at the level of nation state loans, think about what’s about to hit commercial and emerging market debt…

Indeed, the BBB corporate bond yield has already moved from 2.2% in September to 5.2% today. CCC debt (high-risk debt) has gone from 7.2% to 14%.

What happens if these companies can’t refinance or repay when debts fall due?

That brings about the kind of black swan credit risk we saw in 2008.

As Quincy Crosby of LPL Financial said last Friday:

‘What the market is worried about, even before you get to a recession, is a policy mistake, that the Fed breaks something,’

Inflation might be bad, but debt contagions are a lot worse.

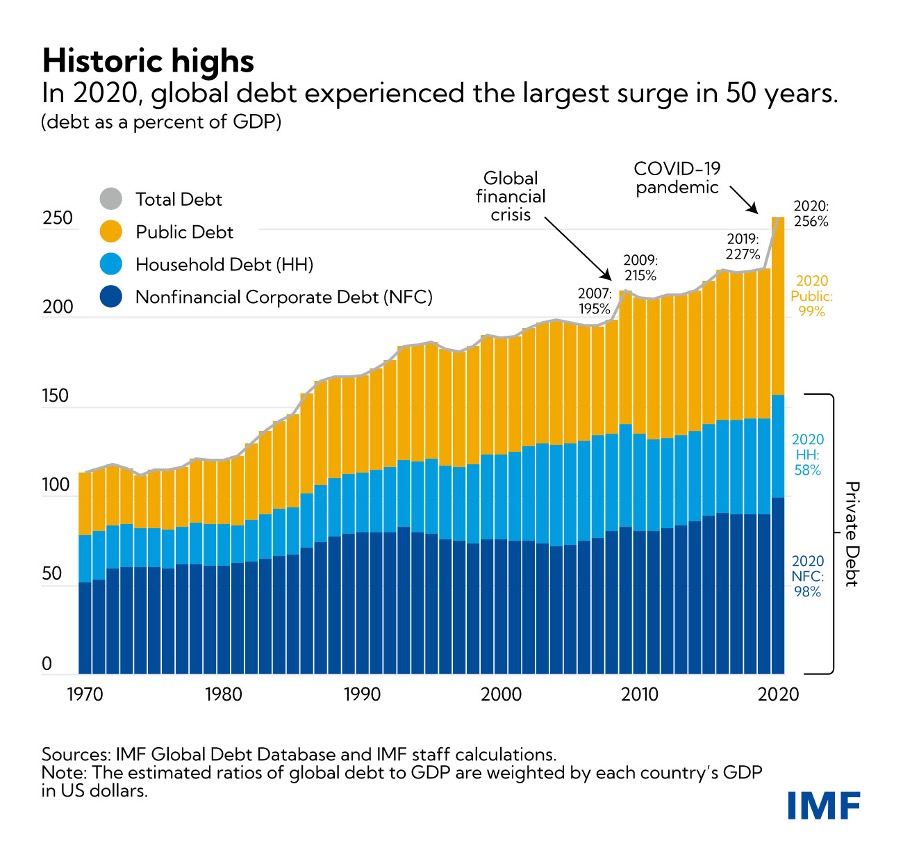

And total global debt is now a lot higher than it was in the GFC:

|

|

| Source: IMF |

The higher the debt load, the bigger effect each basis point rise (0.01%) in interest rates has.

Take all this together, and there are signs we’ll get an Autumn (October for us) reprieve.

As Daniel Oliver concluded in his note:

‘Looking forward, then: the late Autumn promises rising unemployment, plunging

asset prices, soaring deficits, a temporarily softening official CPI number (even while the costs of living continue to increase), and more war—and, if the adjustment is quick enough, all in the context of a looming mid-term election.‘It will be like the Autumn of 2008: everyone, from the Left to Right, from Elizabeth Warren to the Wall Street Journal, will be clamouring for Fed intervention.

‘Is the Fed really so independent as to crucify the market and the economy and the government on the cross of a strong dollar?

‘Deflationary shocks are the handmaidens of hyperinflation. As in 1970 in the U.S. and 1922 in Weimar, the pain will be too much: the Fed will print again and faster.

‘Listen carefully and you will hear Senator Schumer beginning to growl: “Get to work, Mr. Chairman.” As it did in 2009 and 2020, gold will get the message first.’

Gold and maybe even Bitcoin [BTC] — yes, despite the carnage right now — could be great buys if this is how it plays out.

We’ll see…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.