As a major step in its strategy towards zero-emissions lithium production, AZL [ASX:AZL] will buy Nikola Tre battery-electric vehicles (BEVs) to support its Big Sandy lithium project in Arizona.

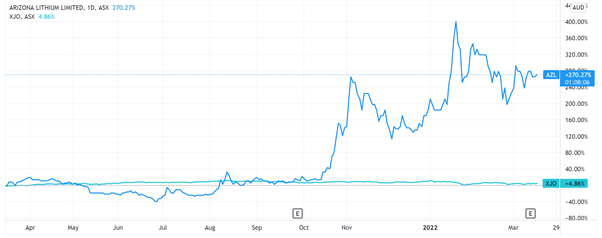

Arizona Lithium shares have seen some marked peaks and troughs in recent months.

Year-to-date, the AZL stock is up 15%:

Source: TradingView

Why are Nikola’s BEVs a good fit for the Big Sandy project?

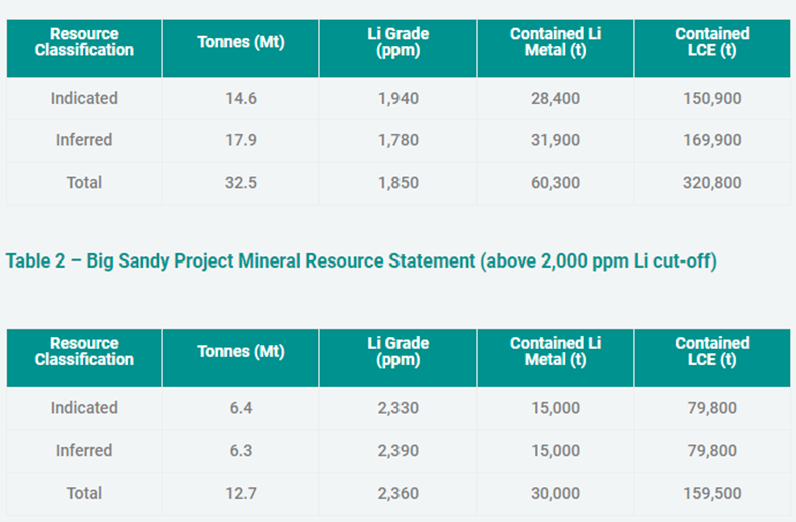

The Big Sandy Lithium project is a shallow, flat-lying lithium resource in Arizona.

Due to its available infrastructure, Arizona Lithium believes it has the potential for successful development — with a significantly minimal environmental impact.

Source: AZL

That’s why AZL thinks the use of Nikola BEVs is a good fit.

AZL Managing Director Paul Lloyd stated:

As we continue to advance the sustainable development of the Big Sandy Lithium Project, we see it highly fitting to utilize Nikola Tre BEVs for hauling ore and to explore sustainable charging options for the trucks.

‘The intended result would be to significantly reduce the carbon emissions produced through mining lithium at Big Sandy as countries globally strive to meet net zero carbon emission targets.’

The BEVs will aim to support two development stages of the Big Sandy project — the Research Facility phase and the Processing Facility phase.

Currently, AZL is conducting a scoping study for the Big Sandy project. The next steps will be to set up a demonstration plant and product qualification capabilities.

Arizona Lithium estimates that once the Processing Facility is operational, it may need to acquire ‘up to 50 Nikola Tre BEVs’.

AZL has the option to purchase up to 100 trucks depending on future Big Sandy output.

Source: AZL

Is now a good time to buy lithium stocks?

The lithium buzz is real.

The EV revolution is real.

And the switch to cleaner energy is well underway.

There’s no doubt there has been plenty of big winners who rode the lithium boom over the last 18 months.

But the market is forward-looking and doesn’t pay too much attention to the rear-view mirror.

As always, the question is, how much of the growth story is already priced in with the lithium theme?

Lithium juniors like Lake Resources [ASX:LKE], for instance, have run up in price recently, with LKE up over 300% in the last 12 months.

So has the market already priced in plenty of growth in junior lithium stocks like LKE?

As the authors of Mind, Money & Markets noted, when everyone is looking in the same direction, no one is really looking.

So where’s everyone looking in the ASX lithium sector?

That’s the question our research team has been studying deeply over the last few months.

But the findings are now in.

And they’ve identified three overlooked ASX lithium stocks they believe could stand out above the rest in 2022.

To get the names, ticker symbols, and full research behind all three of them, download your free report here.

Regards,

Kiryll Prakapenka,

For Money Morning