In today’s Money Morning…should he, or shouldn’t he?…hated stocks can be the perfect bet…what’s hated today?…and much more…

Today, I ask you…

Is any figure in the financial world more polarising than Elon Musk?

Some people love him and think he’s a modern-day Thomas Edison, pushing the bounds of what’s possible. Or maybe even an alien from the future!?

But a lot of people loathe him and think he’s nothing more than a charlatan, selling snake oil to the ignorant masses.

Whatever side of the fence you sit on here, I think we can all agree on one thing…

And that’s that Musk is the master of attention.

One week he’s smoking pot on The Joe Rogan Experience, the next he’s badmouthing any regulators who get in his way. Most days, he can be found on Twitter pumping various cryptocurrencies, and every now and again he comes out with a Bizarro World-move, like restating his official title at Tesla as ‘Technoking’.

Not a day goes by without Musk hitting the headlines.

And over the weekend, he was at it again…

Should he, or shouldn’t he?

The tweet read:

‘Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock. Do you support this?’

Musk added a poll function so users could vote ‘Yes’ or ‘No’.

He added:

‘I will abide by the results of this poll, whichever way it goes.’

This time Musk was responding to the criticism that billionaires avoided taxes by holding onto their shares, thereby avoiding capital gains tax.

This has been a hot topic of late among Democrats in the US with people like Janet Yellen sounding out the idea of taxing unrealised gains.

That’s a very dangerous path to go down, and the pushback against it if they tried to make it law would be intense, in my opinion.

For one, it’s almost straight out highway robbery by claiming for the State that which it never earned before a taxable event was even realised.

But, practically speaking, it could create a vicious cycle of successful companies being sold down by rich founders, which could, in turn, cause share price volatility for everyone else.

Maybe Musk is going to prove that very point?

Though, I also read that Musk was already planning to sell some stock anyway, so that he could raise some cash to buy some very profitable options he owns that are close to expiring.

So perhaps this is just typical Musk, inserting himself into the headlines of the day to mask his real motivations.

Who knows?

Anyway, as I write, the poll has attracted an astonishing 2.48 million votes with 56% of people saying he should sell.

If this result holds, it’s sure to be an interesting week for Tesla shareholders!

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Hated stocks can be the perfect bet

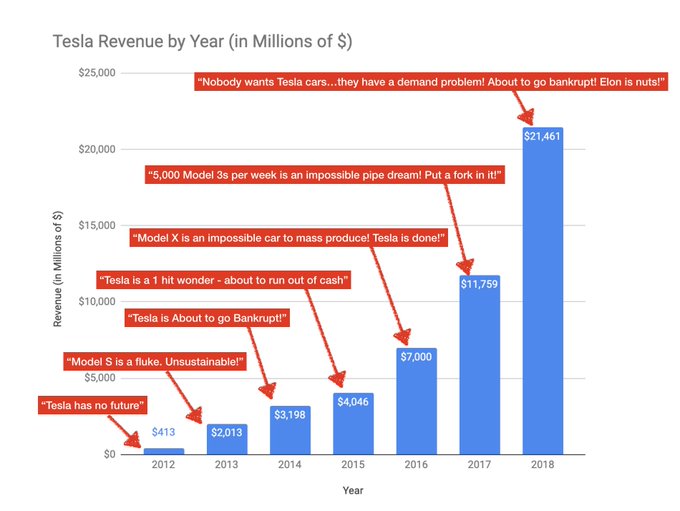

Like I said the start, Musk’s Tesla has attracted its fair share of critics. In fact, it’s been one of the most hated stocks in the US for a long time.

The finance guys hate it…

The US$1.2 trillion company has been one of the most shorted — or bet against — companies on Wall Street for years.

The TV pundits hate it…

Jim Cramer has constantly bemoaned it as ‘going up endlessly on nothing’.

The newspapers hate it…

|

|

| Source: New York Times |

Yep, it’s no secret that the establishment has been willing Tesla to fail for years.

And yet, despite their negativity, Tesla’s share price has defied the critics and continued to go higher.

|

|

| Source: Twitter @hamids |

Betting against the ‘mainstream hate’ would’ve been very lucrative in Tesla’s case…

$1,000 invested in Tesla one year ago would be worth $2,940 today. If you’d invested five years ago, it’d be worth $31,286 as of last Wednesday morning.

10 years ago, and you’d be sitting on $204,000 today from a $1,000 grub stake.

Interesting, isn’t it?

And I’ve seen this scenario play out many times…

With Afterpay, with Bitcoin [BTC], with Amazon…they’re ideas that have withstood constant negativity from the professional finance sector and their media lackeys.

And yet, the value of these ideas has risen astronomically.

Which makes you think…

What’s hated today?

Scepticism is actually very easy to do.

Anyone can do it, especially when it comes to new ideas or grand ambitions.

But I find most sceptics are lazy. They don’t do the research required to actually make proper criticisms.

Instead, they rely on scorn and innuendo to try and ‘win’ the argument.

We saw that last week with Facebook’s Meta announcement. The rebrand was pilloried in the press.

Maybe that’s an opportunity for you?

The oil and gas sector is another hated area. Everyone thinks we’re going to move to a clean energy future ‘just like that’.

And yet the oil price has been on a relentless rise since May 2020. In fact, it’s close to a three-year high right now.

Maybe that’s an opportunity for you too.

Nuclear energy and bitcoin are two other ideas that get a lot of hate in the mainstream. And yet both are moving higher in price.

The simple truth is this…

Sometimes hated ideas are the most profitable you can find.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here