In today’s Money Morning…Facebook becomes Meta…property buyers weren’t betting on this…place your bets…and more…

There were two big pieces of news to get investors talking over the weekend…

First, the rebranding of Facebook to the new name of ‘Meta’.

The second was a stunning move in bond yields with big implications for mortgage holders and property investors.

But let’s start off with Zuckerberg’s big name change…

Facebook becomes Meta

Despite much derision, as my colleague Ryan Clarkson-Ledward (RCL) wrote on Friday, this was a bigger deal than most realise.

He wrote:

‘Now you might scoff at all this as some sort of digital delusion — a pipe dream that seems as bizarre as its name.

‘But I’d urge you not to be too quick to judge.

‘We’re already seeing digital proto worlds being successfully commodified.

‘The US$47.6 billion Roblox Corp is a perfect example. It’s a game developer that has built an entire ecosystem, including payments, for a digitally-creative world aimed at kids. It pulled in almost US$1 billion in revenue last year.’

RCL is right on the money here.

Zuckerberg’s no dummy and he knows what he’s trying to tap into.

You might still think it’s pie in the sky stuff, but in my opinion, fortunes will be made in the Meta-verse if you know where to look.

And Facebook certainly has the reach to become a big player here.

Plus, I’ve seen enough loud-mouthed financial pundits in my time scoff at ideas they don’t understand — such as Afterpay, Tesla, Amazon, and Bitcoin [BTC] to name but a few — shoot up the charts, to be careful not to fall into instinctive scepticism.

Though, I’ll admit, I did chuckle at this Wolf of Wall Street reference on Twitter:

|

|

| Source: Twitter |

To be clear, I’m certainly no fan of Facebook, either as a product or as a company. All I’m saying is don’t be too quick to write off the deeper trend in play here.

Virtual worlds, augmented reality, an the like, might sound like a quaint ‘80s visions of the future, but we now live in a world where dog meme cryptocurrencies can be worth US$30 billion.

So perhaps we’re already living in a fantasy world!

But the title of today’s piece was about house prices…and that brings me to the second big bit of news…

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

Property buyers weren’t betting on this

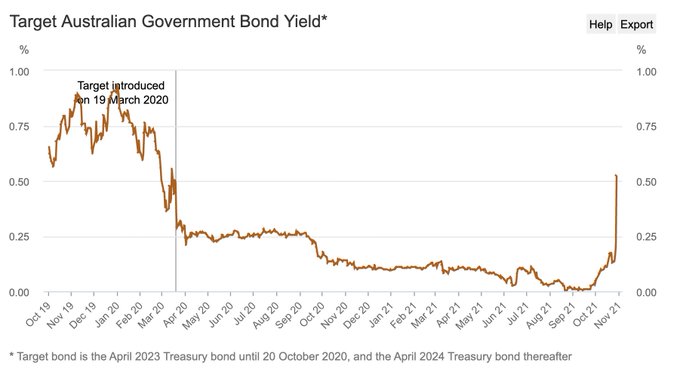

As you’ve probably read about by now, the RBA surprised the big end of town by letting bond yields rise last week.

This was despite saying previously they didn’t see interest rates rising until as far out as 2024.

The mechanics of this are that three-year bonds were sold off by the market, which has the effect of increasing the yield or interest rate.

The selling pressure was big enough to overcome those that might have believed the RBA would step in and buy to ‘control the yield curve’ as they previously said they would…

But they didn’t.

Or if they tried, they were quickly overwhelmed by the market.

Check out the chart:

|

|

| Source: Twitter |

You can see the steepness of the rise.

Anyway, the move surprised many bond investors who are now holding bonds with a market value much lower than the day before.

And I’m sure some bond traders might be needing Master of Wine to win in tomorrow’s big race to make up for hefty losses — it’s listed by TAB at 126-1 as I type…

But bond investors aren’t exactly going to get any sympathy from the general public.

What will concern many is the effect this unexpected rate rise will have on home loan rates.

It appears the market — and probably the RBA too — now believes the inflation figures aren’t ‘temporary’ after all and that interest rates will need to rise to help slow down spending.

When and by how much are the big questions.

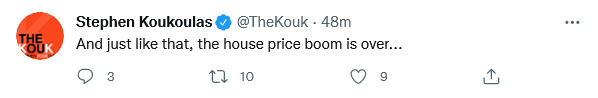

But some commentators think this was a turning point for the house price boom.

Economist Stephen Koukoulas tweeted:

|

|

| Source: Twitter |

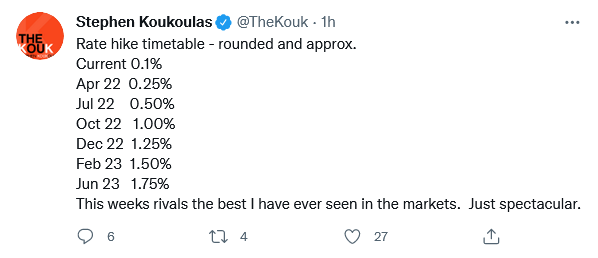

In a previous tweet, he noted his expected rate hike timetable as follows:

|

|

| Source: Twitter |

If he’s right, that’s a fairly hefty rise in rates coming to mortgage holders very soon.

And the panic merchants are already, well, panicking.

The AFR put out a piece on Friday stating that house prices ‘Could fall by as much as 20 percent after rate increases’.

Expect more of these predictions as the usual doom merchants come out of the woodwork.

Could they be right?

Your guess is as good as mine.

All I would say is that interest rates can only rise so much before they harm the economy.

We’ve got the highest level of private debt in the world. So small increases can have a big effect on consumer spending and the economy.

Plus, with the economic recovery from COVID still uncertain, as well as Chinese trade tensions still in play — I think extrapolating this move too far out in time is probably unwise.

But, as ever, that’s what makes a market — opinions…

Place your bets

There are fortunes to be made and lost in the years ahead.

So place your bets.

Will Facebook — erm, I mean Meta — conquer new virtual worlds?

Will property prices in Australia finally succumb to gravity?

Like tomorrow’s Melbourne Cup winner, no one really knows. But I can assure you there will be plenty of opinions!

The best you can do is study the form, check the odds, and then back your judgement.

Good luck with it all!

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here