The Essential Metals Ltd [ASX:ESS] share price is down despite announcing its Dome Lithium Project is advancing to development-ready status.

Essential Metals’ project is located at the heart of Western Australia’s lithium corridor in the Eastern Goldfields, approximately 130km south of Kalgoorlie and 275km north of the Port of Esperance.

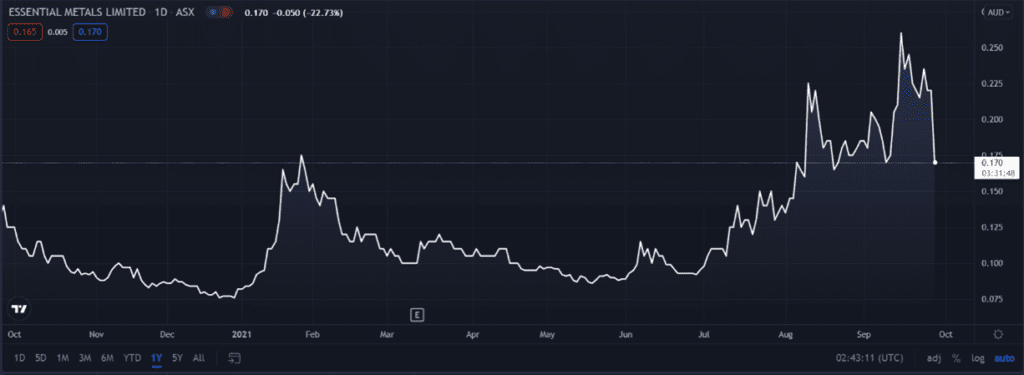

While the Dome project is advancing, ESS shares are not.

ESS stock took a hit today and is currently changing hands at 17 cents per share, down 22% at the time of writing.

Let’s take a closer look at today’s announcement.

Dome Lithium Project nears development-ready status

Essential Metals reported that initial steps are being taken to transition the Dome North Resource area to a development-ready status.

These steps include an application for a mining lease over the Dome North Mineral Resource, followed by a capital and operating cost study for two process plant scenarios.

The next step would be a flora and fauna study, followed by a hydrology study.

Apart from this, two drilling programs are also being planned for the December quarter.

At Dome North, shallow diamond core drilling into upper zones of the Cade and Davy deposits will aim to upgrade them from Inferred to Indicated category and provide samples for metallurgical test work.

Meanwhile, at South Dome, air-core drilling will be carried out to test various targets in the southern area of the Pioneer Drone Project.

Assay results from the recent Dome North drill program are expected to be delivered in the first half of October.

These results will be important for the company for further targeting of pegmatites in and around the Dome North Resource, which is still ‘very much under-explored.’

However, preliminary observations were not able to identify a new, large lithium-mineralised pegmatite, likely contributing to the share price fall today.

Essential Metals noted that ‘geological logging of the drill chips does not indicate the presence of visual spodumene.’

Remaining upbeat, Essential Metals Managing Director Tim Spencer said:

‘We are pleased to announce a range of programs designed to move our exciting Pioneer Dome Lithium Project, one of only a dozen lithium hard rock projects in Australia, towards development.

‘The continuing significant improvements in outlook for lithium should make the business case for Dome North even more compelling and we want to be ready to develop the Project at the right time.’

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

ESS share price outlook

Essential Metals is focused on the discovery of key global demand-driven commodities. Its portfolio comprises the Pioneer Dome Lithium Project, Juglah Dome Project, and the Golden Ridge Project.

Essential Metals recently raised $5 million via a placement to fund the advancement of its Pioneer Dome Lithium Project.

This helped ESS reach a cash position of $5.5 million as of 30 June, holding no debt.

The junior explorer said stakeholders across the lithium supply chain are all pointing to a ‘tightening supply dynamic in the face of burgeoning demand, flowing through to higher pricing for lithium-bearing spodumene.’

However, investors may be worried ESS is not in a position to capitalise on the surging demand based on its disappointing preliminary spodumene assay readings.

Investors will likely closely monitor ESS’s upcoming drilling results.

Now, if you are interested in more stocks that have the potential to dominate the lithium sector, I suggest checking out this report.

The report takes you through the resurging Australian lithium industry as well three lithium stocks with exciting potential.

Governments and private interests alike are converging on electric vehicles and renewable energy.

So if you’re wondering exactly what this trend means for savvy private investors, I also recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you could capitalise on the US$95 trillion renewable energy boom.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here