In today’s Money Morning…after another big crypto pump…the FUD was inevitable…why did BTC crash today? Depends on who you listen to…don’t buy the FUD hype…and more…

|

It sometimes triggers a little chuckle when I wake at around 6am to see whatever played out in markets overnight and start scanning the major outlets to see what’s going on.

I usually start with The Australian Financial Review, Bloomberg, and the AP website.

Then I generally swap over to CoinDesk and a few other outlets to get a sense for things.

The stark contrast in headline content is deeply amusing today.

Point is, I read these outlets to get an idea for what the mainstream narrative is, and more importantly, what not to think.

Don’t get me wrong, there’s some quality journalism in there…occasionally.

But I scan through hundreds of headlines a day, so you don’t have to.

And today, the headlines we’re most interested in are the ones regarding a Bitcoin [BTC] ‘crash’.

Here’s what’s going on in the charts.

After another big crypto pump…the FUD was inevitable

This is the bitcoin price in USD:

|

|

| Source: Tradingview.com |

Remembering that the BTC/USD pair is the only currency pair that carries weight, it bounced off the US$30,000 mark and went vertical, ran into headwinds at the US$40,000 mark, then went on a run.

The run to US$50,000 was a run that sort of ‘curved off’ as it approached that mark.

Then it had a brief spike above US$50,000 only to shed around 17% in short order.

Hence the headlines today about a crash.

The headlines are classic fear, uncertainty, and doubt (FUD) headlines.

Check this out…

Why did BTC crash today? Depends on who you listen to…

There’s the AFR’s headline which comes via Bloomberg below, for example:

|

|

| Source: The Australian Financial Review |

|

|

| Source: Bloomberg |

It’s definitely copy and paste stuff in the media these days, and this is no exception.

Bitcoin vs Gold: Which Should You Buy in 2021?

Here’s how Bloomberg explained why BTC crashed today:

‘The swiftness of the plunge was likely accelerated as more than 336,000 traders had their accounts liquidated over the past 24 hours, equal to around $US3.6 billion ($4.9 billion) worth of crypto, according to data from Bybt, a crypto futures trading and information platform.

‘The retreat comes as bitcoin faces one of its biggest test in its 12-year history as El Salvador became the first country to adopt it as legal tender. The Central American nation’s president, Nayib Bukele, said on Twitter that the digital wallet being used in the project can now be downloaded after it was shut down earlier because of technical glitches.

‘The wallet, known as Chivo, comes pre-loaded with $US30 worth of the currency for users who register with a Salvadoran national ID number.

‘Users on platforms including Twitter and Reddit had discussed plans to buy $US30 worth of bitcoin en masse on Tuesday to mark El Salvador’s law coming into effect. The potential coordinated price pump echoes previous online campaigns targeting meme stocks like GameStop.

‘Bukele also said during the price slide that he was buying the dip, commenting on Twitter that 150 new coins were added and that the country now holds 550 bitcoin. “Cryptocurrency” and “cryptocurrencies” were trending on Twitter at one point.’

Meanwhile, over at CoinDesk, this was the headline:

|

|

| Source: Coindesk.com |

It’s like polar opposites.

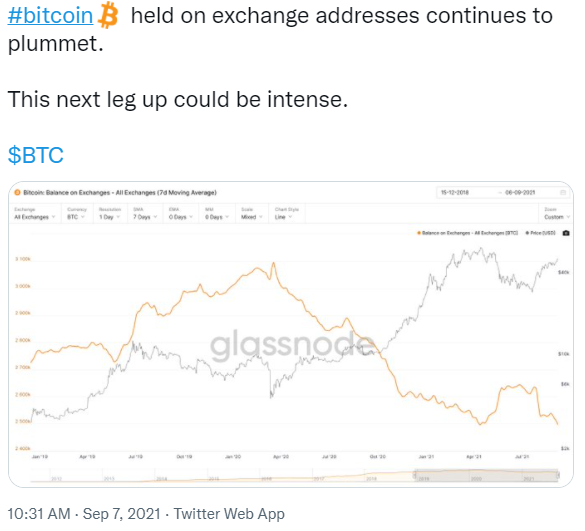

Maybe the real story is coming out of a few choice Ryan Dinse tweets, which you can see below:

|

|

| Source: Twitter |

|

|

| Source: Twitter |

What Ryan is saying here is that if you back crypto for another leg up after the El Salvadorian FUD subsides, well, the next move could be huge.

There’s no shadowy cabal coordinating the false media narratives around BTC and crypto more generally.

It’s actually far bigger than a cabal — which normally implies a small group.

No, we’re talking about an army of millions of traditional finance middlemen, or ticket clippers, that can see the writing on the wall.

It’s an all-out media narrative war between suits in skyscrapers and hoodie-clad crypto enthusiasts in modest buildings.

Who’s your money on when technological change comes?

It may sound outlandish, and there are always going to be suits clipping tickets somewhere, but my money is on the hoodie-types.

So don’t buy the FUD hype.

George Harrison was onto something when he said, ‘All things must pass.’

And the age of ticket-clipping suits will soon pass as well.

If you’re like me and have a keen interest in crypto but don’t know where to start, be sure to check out Ryan Dinse’s work for the New Money Investor service.

Happy HODLing and ignore the FUD.

(In layman’s terms — enjoy hanging onto your crypto assets and don’t worry about false media narratives.)

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.