The Lake Resources NL [ASX:LKE] share price is seeing a steady incline today after news rolled in of heightened interest in the funding of its flagship Kachi Project.

In response, the share price has hiked up 11% at 64 cents in morning trade.

The lithium developer, which operates in the exploration and advancement of clean lithium projects, is positioning itself to prosper in the current EV (electric vehicle) industry revolution. An industry almost singlehandedly powered by lithium.

In an update to the ASX, it was announced that UK Export Finance (UKEF) indicated a strong expression of interest (EOI) in supporting roughly 70% of the Kachi Project’s funding requirements.

Lake’s management has described this as a ‘watershed moment’ for the company.

What’s the story behind the announcement?

The Kachi Project is a clean lithium project based in the resource-rich Catamarca Province in Argentina.

It aims to contribute to local community and the international drive toward zero net emissions.

The fact that UKEF has pledged an EOI is good news not only for Lake, but also the wider community and its key stakeholders.

UKEF is the United Kingdom’s official export credit agency, which in the last five years has provided £14 billion (A$26.4 billion) of support for UK exports and international trade.

If UKEF’s expression of interest becomes a full-fledged binding agreement (and bear in mind this hasn’t happened yet), then it’s likely that this project will continue to go full speed ahead.

Investors are clearly taking note.

But the EOI remains subject to standard project finance terms and due diligence and no names have been signed on the dotted line just yet.

Taking UKEF’S interest from A to B will take ‘significant work’, management admitted.

Nevertheless, this morning’s news is undoubtedly a positive development for Lake and the share price is reflecting that.

LKE’s strong 2021

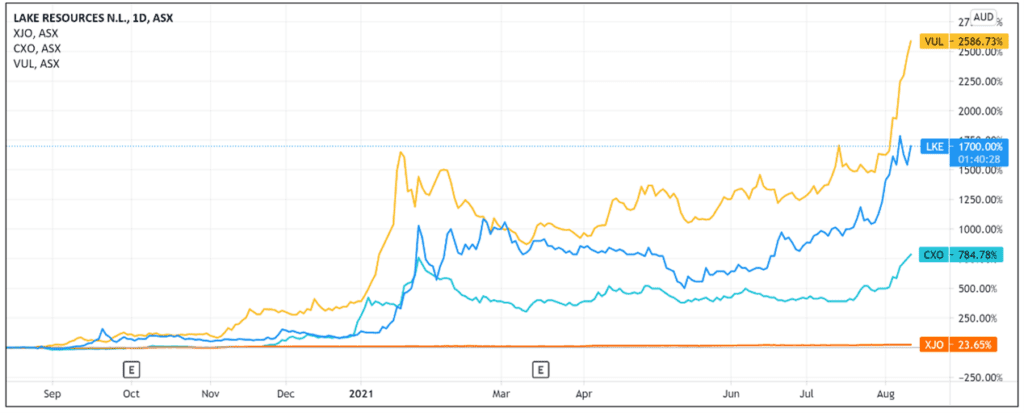

Lake Resources shares performed well this year. The LKE stock is up 700% since January.

However, whether this stock has room to run could well depend on how the Kachi Project fares.

Right now, the project arguably relies on more concrete funding agreements before investors can have full confidence in the future.

Clean energy investors will want to stay abreast of any developments from here, but today’s news can serve as good reason to believe further support lies ahead.

‘To have a leading ECA willing to indicate financial support for Kachi provides an enormous vote of confidence in our clean energy project,’ commented Lake’s Managing Director Steve Promnitz.

‘The support reflects not only Kachi’s robust financials but also its considerable ESG benefits such as a small environmental footprint, satisfying a number of defined Sustainable Development Goals.’

LKE share price outlook

Lake Resources is not the only lithium stock enjoying an up trend amid investor excitement over the sector.

For instance, Core Lithium Ltd [ASX:CXO] is currently up 12% on the back of a successful $92 million placement. CXO shares rose 80% in the last month alone.

Big name Vulcan Energy Resources Ltd [ASX:VUL] is also gaining, up 82% in the last month and 50% in the last week.

The growing uptake of EVs, and governments switching to greener, cleaner energy, is seeing renewed interest in the lithium sector.

Importantly, the sustainability focus is helping the likes of VUL and LKE differentiate themselves in the eyes of some investors.

Both VUL and LKE aim to develop cleaner lithium projects, with VUL going so far as to aim for carbon neutrality for its project in Germany.

So, lithium stocks are on a lot of investors’ minds.

But with so many news items coming out almost daily, it’s hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Additionally, governments and private interests alike are converging on electric vehicles and renewable energy.

But if you’re wondering exactly what this trend means for savvy private investors, I recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the US$95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: Along with your lithium report, you’ll also get a free subscription to Money Morning, an e-letter that has been designed to deliver the most exciting investing opportunities straight to your inbox every day. Click here to get started.