The Magnis Energy Technologies Ltd [ASX:MNS] shares are well up today after MNS secures $20 million from two US institutions.

Today’s news comes after trading in Magnis Energy shares was suspended for almost a week, pending clarification of the capital raise.

MNS shares last traded on 29 July for 27 cents.

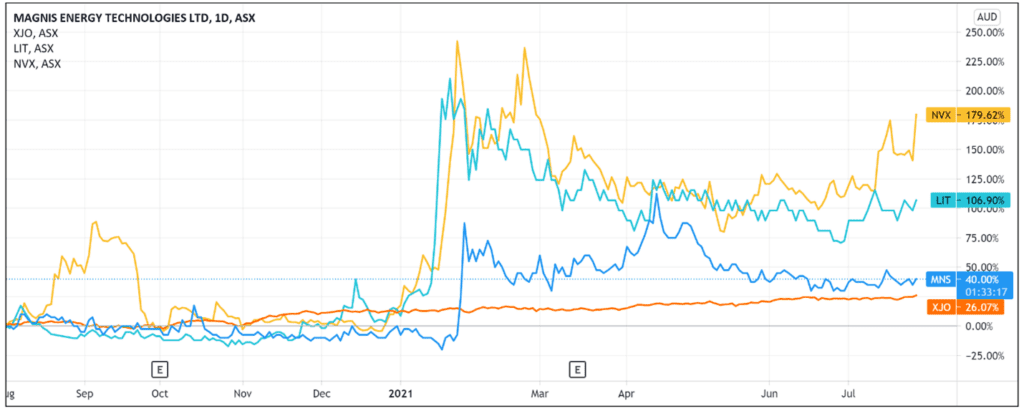

The lifting of MNS’s trading halt was met with investors bidding up the lithium stock. At time of writing, Magnis was up 11.11%, trading for 31 cents a share.

Magnis secures $20 million

Magnis today revealed it was able to secure funding worth $20 million from two US-based institutions — Lind Partners and SBC Global Investment Fund.

The investors will assist MNS with its ‘aggressive’ growth plans in the lithium-ion battery industry.

Under the funding arrangement, each investor committed to provide Magnis $10 million.

Magnis said it plans to immediately invest $17.6 million of the secured capital into its Imperium3 New York (iM3NY) battery plant.

Part of the capital will also fund iM3NY’s potential listing on the Nasdaq or NYSE.

Regarding the potential listing, Magnis said the board of iM3NY has already reviewed several groups with ‘significant experience in US listings.’

A mandate is expected to be signed in the ‘near future.’

John Hancock, Senior Advisor to The Lind Partners, was excited to fund a company with the potential to seize market share:

‘We are very pleased to fund Magnis Energy Technologies, an innovative Australian company focusing on producing green high performing lithium-ion batteries and developing technologies for rapid charging.

‘The global lithium-ion battery market is expected to grow at a compound annual growth rate (CAGR) of 15% from 2020 to 2026, and US$41.1 billion in 2021 to US$116.6 billion by 2030.

‘Companies that can deliver better-performing batteries at scale will be rewarded with market share, and we look forward to being part of Magnis’ journey in this space.’

Overview of MNS’s quarterly report

Magnis also released its quarterly report to the market after the close of last Friday’s trading sessions.

Following the success of fast charging battery results using unoptimised cells in September 2020, Magnis’ cathode technology partner — C4V — announced successful results using optimised commercial cells.

Production is also ramping up as the iM3NY battery plant produced its first full-sized lithium-ion battery cells using commercial-grade components.

To top this all off, a US$85 million funding round allowed iM3NY to be fully funded at Gigawatt hour production.

To tackle the exponential increase in demand for lithium-ion batteries, the New York battery plant boosted its annual capacity to 1.8GWh following A123 Systems equipment purchases.

The bottom line is that efforts are being made to scale up the production and be at par with competitors.

What’s the outlook for MNS Share Price?

From 2021–30, the global lithium-ion battery market is predicted to grow from US$41.2 billion to US$116.6 billion at an expected CAGR of 12.3%.

Further, by 2040, it is estimated that global EV market sales will climb nearly 60%.

The question investors likely have is — can Magnis capitalise on these positive market tailwinds?

Today’s successful capital raise indicates Magnis is serious about investing aggressively in its business and production capacity.

Amidst the rising demand for lithium, many investors are likely to keep an eye on MNS stock.

In the meantime, if you are interested in finding out more about the hot lithium sector, I suggest checking out Money Morning’s free 2021 lithium report.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report