The AVZ Minerals Ltd’s [ASX:AVZ] logistics arm secures 1,227-hectare site to advance its plan to export finished products produced at the Manono Lithium project.

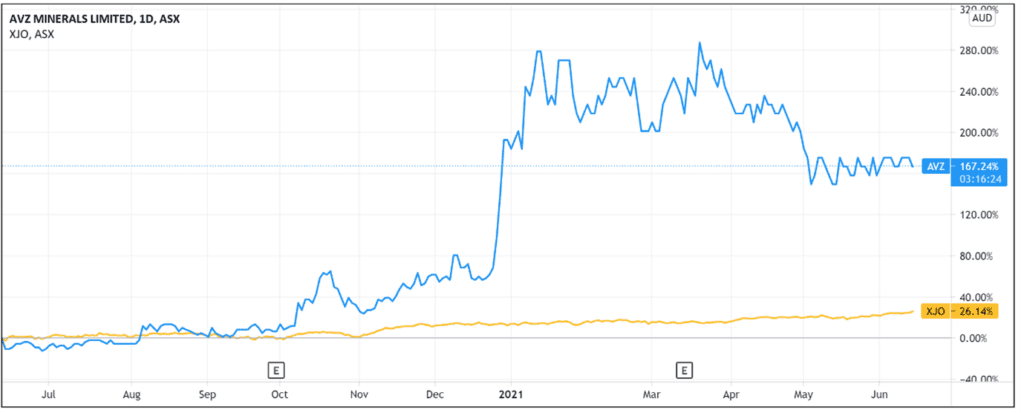

The AVZ Minerals Ltd share price fell on the news, however, down 3.15% at noon.

The lithium producer is in a slight slump this year, with the stock down 8% year to date.

While 30% from its 52-week high, AVZ is still up 195% over the last 12 months, reflecting the strong surge in the ASX lithium sector. Source: Tradingview.com

Source: Tradingview.com

AVZ’s logistics infrastructure plan

AVZ Minerals today announced that its wholly-owned subsidiary — Nyuki Logistics — secured a renewable 25-year lease on a 1,227-hectare site.

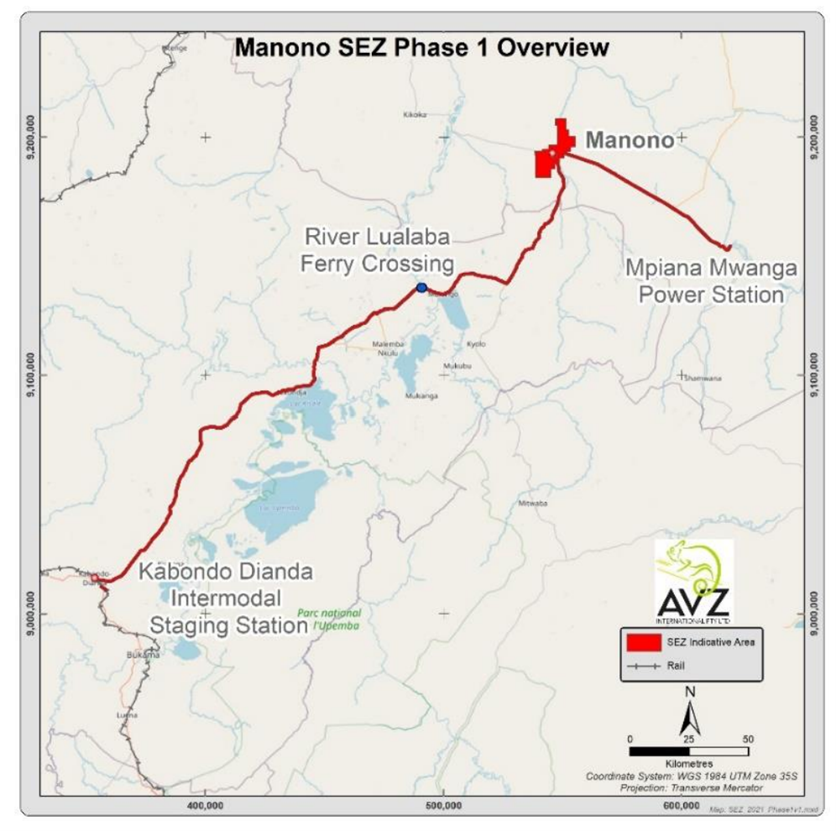

The site will host AVZ’s Kabondo Dianda Intermodal Staging Station, a vital part of the company’s logistics infrastructure plan to export finished products produced at AVZ’s Manono Lithium and Tin Operation (MLTO).

Nyuki was formed as a ‘dedicated logistics arm’ for MLTO and is responsible for commercial and operational management of MLTO’s logistics, including road haulage, rail, and port services, and logistics infrastructure maintenance.

In its latest investor presentation, AVZ disclosed that Nyuki Logistics is ready to manage road transportation from Manono to Kabondo Dianda, as well as for the ferry operations.

AVZ’s Managing Director Nigel Ferguson commented:

‘Signing the agreement to lease industrial land at Kabondo Dianda is another important milestone in the Company’s logistics plan, which will see MLTO’s finished products exported through the ports of Lobito in Angola and Dar es Salaam in Tanzania.

‘Our Nyuki Logistics team has visited Kabondo Dianda several times to conduct community meetings with key local stakeholders.

‘These meetings have resulted in successful ESIA’s being approved for the rehabilitation of the road from Manono, the proposed new ferry crossing site, material handling site and depot for both finished products being exported to global markets and in-bound consumables and materials, bound for MLTO and the greater community.’

AVZ Share Price ASX outlook

Having greater control of the exporting process will likely make AVZ’s lithium shipments more attractive for potential buyers.

So, why are AVZ shares down on the news?

The answer may lie, as it frequently does, with cash.

In its latest cash flow report for the quarter ending 31 March 2021, AVZ had only about 1.6 quarters of funding available after notching on $3.7 million in total outgoings on $6 million in total available funds during the quarter.

Despite the short economic runway, AVZ commented that:

‘AVZ is making good progress and are in continuous discussions with a variety of commercial banks, non-commercial lenders and equity institutions who expressed keen interest in funding the development of the Manono Project.

‘AVZ management is confident that the necessary funding will be acquired.’

In a May operational update, the lithium producer reiterated it was:

‘Actively engaging with various commercial banks, finance brokers, private equity investors and non-commercial lenders such as Pan-African Development Finance Institutions (DFI’s) to secure funding for the development of the Manono Lithium and Tin Project.’

However, AVZ did not elaborate when these engagements will morph into actual project finance.

On 26 May, the company released an investor presentation where, tucked away just before the appendix, AVZ disclosed that it’s in ‘advanced discussions’ with a potential syndicated facility, while discussions with private equity investors are ‘ongoing’.

The Manono Project timeline shows that the Final Investment Decision, construction commencement, and a memorandum of understanding with syndicated DFI groups are all slated for Q3 2021.

Today’s share price drop may reflect a market wishing to hear more updates on AVZ’s financing rather than its logistics arm.

After all, an infrastructure network is redundant if the business runs out of cash.

No doubt, investors will be eagerly awaiting the results of AVZ’s recent discussions with equity investors and syndicated DFI groups.

Despite the potential challenges, lithium stocks have enjoyed positive momentum lately as investors seek to position themselves advantageously for an electric vehicle future.

If you want to learn more about investing in lithium stocks, then you should read our free 2021 lithium report.

It outlines three stocks that could surge on the back of renewed demand for lithium in 2021.

Click here to read the report.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.