The Altium Ltd [ASX:ALU] rejected a formal offer from Autodesk to acquire 100% of Altium via a scheme of arrangement worth $38.50 a share price.

Autodesk’s proposal and Altium’s rejection were powerful signals for investors, with the market sending ALU’s share price up 34%.

Having closed at $27.21 per share last Friday, Altium traded as high as $38.26 a share in early trade following its announcement.

Today’s spike brought Altium close to its 52-week high of $40.21 achieved last October.

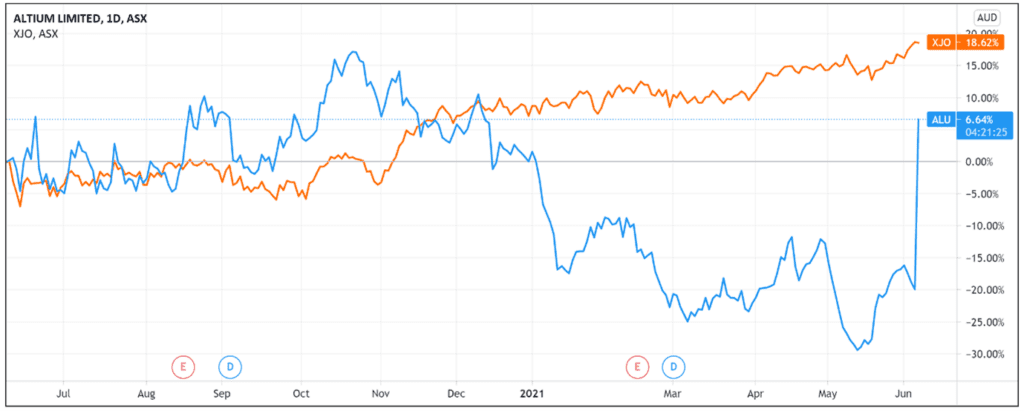

Today’s large jump went a long way in correcting the ALU stock’s recent downward trend, having underperformed the ASX 200 benchmark by 15% over the last 12 months.  Source: Tradingview.com

Source: Tradingview.com

How much are ALU shares worth?

How much would one pay for Altium shares?

US software corporation Autodesk, Inc [NASDAQ:ADSK] is prepared to pay $38.50 per ALU share.

Altium today revealed it received a formal, non-binding, indicative and unsolicited proposal from Autodesk to acquire 100% of Altium via a scheme arrangement.

Autodesk has a market capitalisation of US$62 billion. It offers software products and services for architecture, engineering, construction, manufacturing, media, education, and entertainment industries.

Autodesk’s proposal represents a 41.5% premium to Altium’s last closing price of $27.21 but a 4.2% discount to its 52-week high.

Thanks, but no thanks

While the Altium board appreciated Autodesk’s interest, it nevertheless rejected the offer at the current price because the proposal ‘significantly undervalues Altium’s prospects.’

ALU revealed Autodesk’s offer evolved from an initial discussion about a strategic partnership.

Why is Altium bullish on its prospects?

The company believes it has a ‘unique position in the electronics ecosystem.’

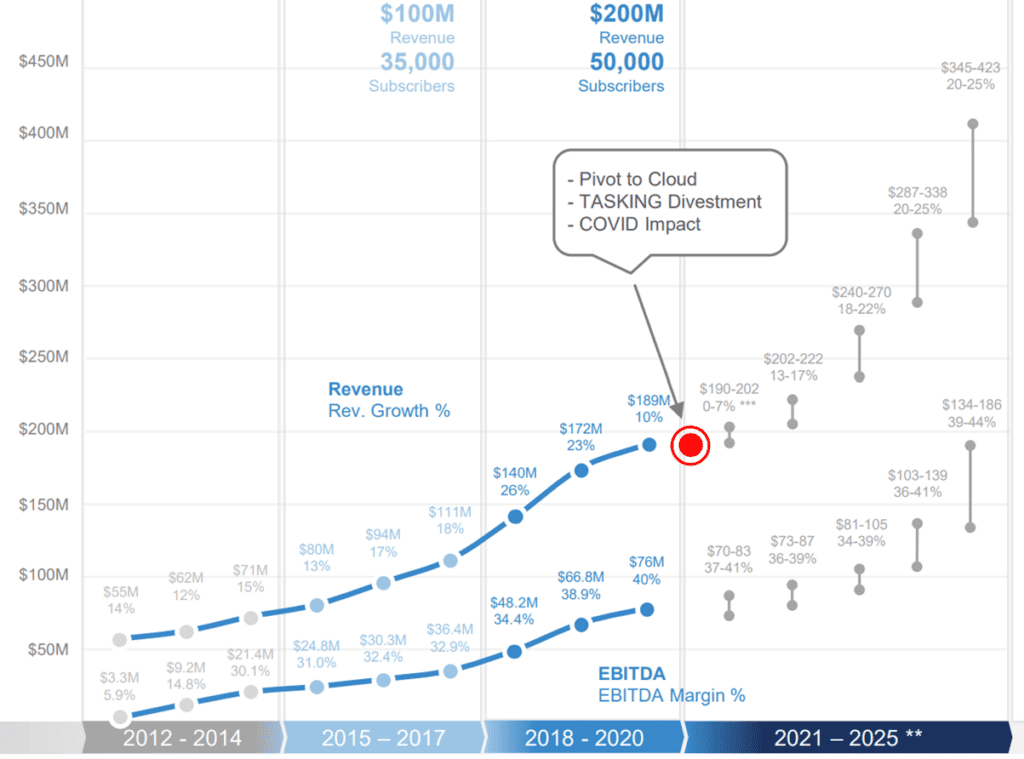

Specifically, Altium is confident it can achieve its 2025 financial goals on the back of a ‘transformative strategy for the electronics industry.’

ALU is targeting 80% recurring revenue by 2025.

In its half-year 2021 update, Altium 65% recurring revenue on total revenue of $80 million.

The company aims for $345–423 million worth of revenue in 2025. 80% recurring revenue would be in the range of $278 and $338 million.

Altium concluded that its pivot to the cloud positions it to ‘pursue market dominance and industry transformation.’

ALU ASX outlook

Altium did not categorically rule out any further offers.

Commenting on Autodesk’s proposal, ALU stated that ‘as consistent with past unsolicited acquisition interest, the Altium Board will engage with interested parties in the context of an appropriate valuation of Altium and it will continue to review all potential strategic alternatives for the Company.’

So it is not out of the question that Autodesk returns with a higher bid or another party throws its hat in the ring.

Autodesk’s bid also raises the question concerning the ‘appropriate valuation of Altium.’

ALU shares haven’t traded at Autodesk’s bid offer of $38.50 since October 2020.

This year saw Altium’s share price drop as low as $23.6.

Its 200-day moving average is $30.3.

What to make of all this?

Some investors could infer that Altium’s share price floor is now about $38.50 per share, based on what a big player like Autodesk is prepared to pay.

Those more bullish may infer that the appropriate valuation is even higher, based on Altium’s claim the offer ‘significantly undervalued’ the firm’s prospects.

More bearish investors may point to ALU’s P/E for the trailing 12 months (TTM). The P/E TTM is more than 110.

They may think the current price is already stretching valuations. The company is worth $3.57 billion on total revenue (FY20) of $189.98 million and a net profit of $30.88.

This all suggests a lot rests on how prosperous Altium’s prospects are five years from now and beyond.

Consensus analyst estimates aggregated by MarketScreener for Altium have the company trading at a P/E of 44 in FY23. A far cry from the current triple-digits, but still somewhat expensive.

With market volatility and global uncertainty about inflation and bond yields, it can be tough to know where and how to put your money to good use.

However, our very own Greg Canavan’s been investing for 20 years, and he thinks the time to enter the market is now.

He doesn’t look at small-caps, cryptos, or hyper growth stocks.

Instead, he thinks the time is ripe to invest in good old-fashioned fundamentals and healthy balance sheets.

If you want to find out more, check out the following link.

Regards,

Lachlann Tierney

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here