Incannex Healthcare Ltd’s [ASX:IHL] share price is up today after its ASX update shows positive results from IHL’s arthritis treatment test.

Incannex shares are up 9.7% as of 3:00pm today.

It was placed in a trading halt last Friday at the request of the company, pending today’s announcement.

Investors were eager enough upon the lifting of the trading halt to send the Incannex share price up as much as 17% from the previous close of 20.5 cents, reaching a high of 24 cents.

Today’s positive update reflects the positive investor sentiment towards the IHL stock over the last year.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

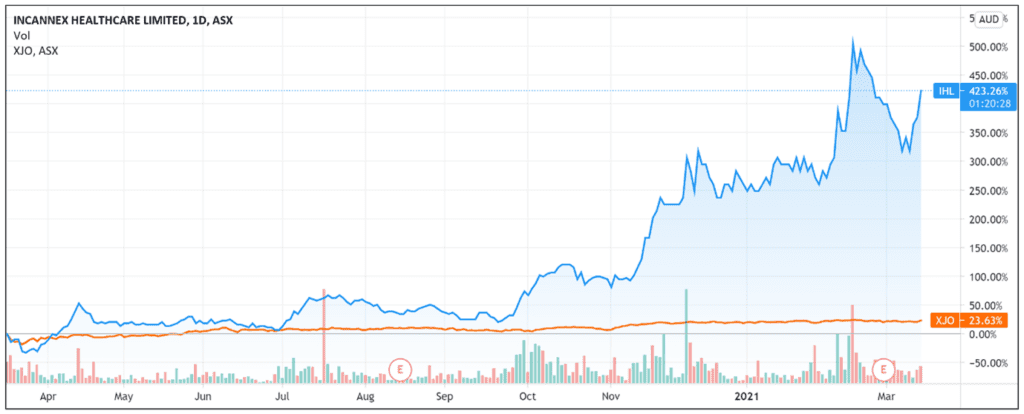

Incannex’s share price is up 45% YTD and up 500% over one year.

Source: Tradingview.com

Source: Tradingview.com

Incannex update on arthritis treatment test results

Here are the important highlights:

- Incannex’s IHL-675A treatment outperformed hydroxychloroquine and cannabidiol for anti-inflammatory properties in a pre-clinical in vivo study, according to today’s release.

- Results from an in vivo model of rheumatoid arthritis indicate that ‘IHL-675A has a benefit in the treatment of rheumatoid arthritis greater than that of CBD or HCQ alone’.

- The study’s results suggest that IHL-675A’s combination of CBD and HCQ has the potential to ‘permit a ten-fold reduction in HCQ dose, without sacrificing efficacy,’ in treating arthritis.

- Given the encouraging test results, Incannex will launch a sixth clinical program to target rheumatoid arthritis.

Incannex share price outlook

ASX pot stocks are catching the eyes of investors seeking growth markets.

Just yesterday, I covered Elixinol Global Ltd [ASX:EXL] and how its share price jumped 12% after announcing the acquisition of a leading CBD brand with exposure to the European market.

For Incannex, I think the key is seeking and securing FDA registration to leverage the large US market.

Updates like today contributes to persuading investors that Incannex has the necessary proprietary products in the pipeline to secure approval from regulatory bodies.

As I’ve also mentioned last month, legislative changes back in Australia can also see IHL products being sold over the counter in local pharmacies, a development sure to boost sales and IHL shares outlook.

According to Incannex, the global addressable rheumatoid arthritis treatment market is US$57 billion per annum.

Today’s ASX announcement that Incannex will launch a sixth clinical program to target arthritis treatment will please investors who will no doubt watch the progress of the clinical program closely.

If you are interested in seeing how you can invest in the growing CBD healthcare industry and what other intriguing pot stocks are out there, then this free report is highly recommended.

It is well worth a read.

Regards,

Lachlann Tierney,

For Money Morning

Comments