In today’s Money Morning…coal for China and India…cold showers for Germany…an ironic opportunity…what’s our plan B?…and more…

Last week the Australian House of Representatives passed Australia’s first climate change legislation in a decade.

The new bill commits us to a 43% reduction in greenhouse gas emissions by 2030 (over 2005 levels) and a net-zero target by 2050.

How?

Well, no one’s quite sure yet.

The bill mostly relies on beefing up the powers of the Climate Change Authority.

Whatever that means…

Anyway, it seems we’ve finally joined in the ‘war on C02’.

We’ve been a bit of a laggard in international terms due to the previous government’s lack of action on this.

Their position was that if big nations like China and India didn’t come to the party, it didn’t matter what we did.

And look, like them or loathe them, they’ve got a point on this…

Coal for China and India…

The fact is…

There’s no sign that China or India are slowing down on fossil fuels.

In 2021, the number one emitter, China, commissioned 56% of the world’s new capacity for coal-powered power stations.

Similarly, India is the number three emitter in the world and relies on coal for 70% of its electricity generation.

And like China, their priority right now is on cheap, reliable energy.

As reported in Clean Energy News:

‘The surging demand has led to power rationing in the Punjab, Haryana, Uttar Pradesh, Rajasthan, Madhya Pradesh, Jharkhand, Bihar, Goa, Telangana, Andhra Pradesh, and Karnataka states, with residential, industrial, and farming areas all affected. The situation could worsen—the summer peak demand season has yet to arrive.

‘Looking forward, some players are signaling a shift back to coal to avoid chronic power shortages.

‘State-run NTPC, India’s largest electricity supplier, will reportedly award a contract to build a 1.32-GW coal plant in Odisha in eastern India later this month.

‘If confirmed, this would be NTPC’s first coal expansion project in six years. The company might also seek to revive two stalled projects in Lara and Singrauli, according to media reports.’

Make no mistake, many countries — especially poorer ones — are turning back to coal to secure energy.

And you can’t really blame them.

Who are we to tell them they can’t enjoy higher living standards by using cheap energy after we’ve just spent a century benefiting from it?

Not only that, in an increasingly uncertain world, coal is a pretty safe choice for most countries.

And we’re seeing that’s not the case for other types of fuel.

Take the situation in Germany right now…

Cold showers for Germany

Germany thought Russian gas would fill the gap as they made the long transition to renewables.

So secure, they thought, they closed down their only source of self-sovereign power — nuclear power generators.

Now they’re left with cold showers!

As the BBC reported last week:

‘The German city of Hanover has turned off the heating and switched to cold showers in all public buildings because of the Russian gas crisis.

‘It’s the first big city to turn off the hot water after Russia dramatically reduced Germany’s gas supply.

‘Germans have been told to expect sweeping gas reduction measures and extra charges on their energy bills.’

It makes you shake your head…

I mean, how could the industrial powerhouse of Europe let themselves get into such a position?

As German news site The Local stated:

‘“Da hat die Politik mal wieder ihre Hausaufgben nicht gemacht” — “Once again, the politicians haven’t done their homework!”’

This is what happens when you let inept bureaucrats and mediocre politicians run your energy policy.

And it’s a wake-up call for the rest of us to pay close attention.

Then there’s the elephant in the room…

Even with the best will in the world, can the world even meet these targets?

Well, if we do, we’re going to need a gigantic boom in these industries…

An ironic opportunity

An irony for the Greens…

If we’re going to transition to a renewable future, we’re going to need to do a heck of a lot of mining first.

I’m talking A LOT!

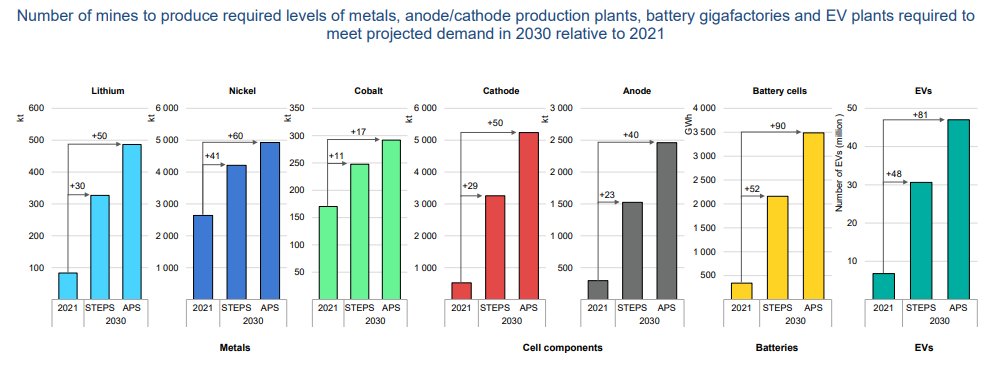

For example, as this chart from the International Energy Agency shows, if we’re going to produce enough batteries to meet our targets, we’re going to need the material to make them:

|

|

|

Source: IAEA |

That’s 50-times more lithium, 60-times more nickel, and 17-times more cobalt needed for starters.

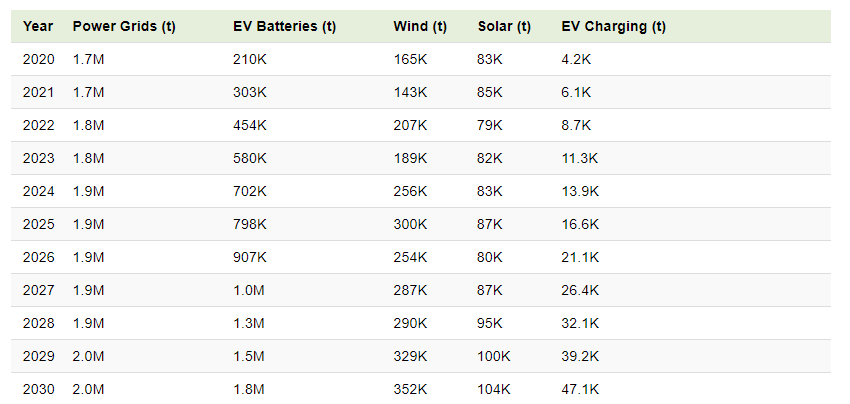

And this table shows you just how much copper we’re going to need:

|

|

|

Source: Mining.com |

The average electric vehicle has four times more copper than a petrol-powered car. And as you can see above, battery demand is set to soar.

We’re talking huge increases in multiple raw materials needed across the board if we’re to replace fossil fuels in line with targets.

Finding such large-scale deposits to satisfy these projections isn’t going to be easy, especially in just eight short years.

And it’s my best guess we’ll get nowhere near it.

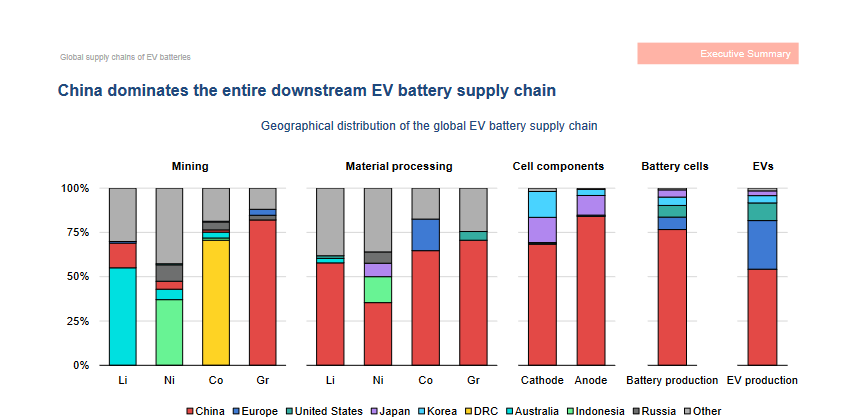

Then there’s this chart:

|

|

|

Source: IAEA |

As you can see, China dominates the downstream production of electric vehicle batteries.

Given how fraught international relations are between the US and China right now, it seems this is a very unreliable partner to pin your energy future on.

Again, creating the infrastructure to convert raw materials into useful battery components is no easy feat.

It takes years for approvals, financing decisions, manufacturing testing, and other processes to complete.

In short, a 2030 timetable looks super optimistic…

What’s our plan B?

So what happens if the reality of a renewable transition takes a lot longer and is more costly than hoped?

What happens if we don’t have enough coal, oil, or gas to help with the transition?

Are we in for a future of cold showers?

Are we willing to live with ultra-high energy costs for years to come?

Morally, are we willing for already poor countries to have to pay more for their energy with all the hardship that brings?

These are all realities we’ll have to account for if we don’t do our homework on energy.

There’s no ‘green’ bullet that makes this transition easy and painless.

There’s a great interview here between Kyle Bass and Wil VanLoh, the CEO of Quantum Energy Partners, that goes into great detail on the many issues that need addressed.

I highly recommend giving it a watch to get informed on this.

After all, this is too important an issue to let tribal politics take charge of…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also the Editor of Crypto Capital. This service looks beyond the hype and the hate regarding the fast-evolving world of cryptocurrencies. An area, Ryan believes, is set to become the most disruptive force on how the world works since the internet. For information on how to subscribe, click here.