[Editor’s note: This was originally published on Wednesday, 3 March in The Insider.]

Gold has had it rough lately. Since peaking in August last year at an intraday high of just over US$2,060 an ounce, the yellow metal has been in correction mode.

As I write this, it now trades at US$1,734 an ounce. That’s a decline of around 16% from the high.

In Aussie dollar terms, the decline from the top is around 22%. It’s worse than the US dollar price decline due to the rise of the Aussie dollar.

Gold stocks have had an even tougher time. That makes sense. Gold stocks are nearly always leveraged to the gold price. The US Gold Bugs Index, the HUI, is down more than 30% from last year’s peak, while Australia’s ASX Gold Index is down nearly 40% from it’s intraday peak on 28 July.

I know there is a lot of confusion about gold. I mean, why is gold falling when central banks are expanding their balance sheets and governments are running huge deficits? Surely gold should be going up in such an environment, not down?

As I’ll explain, the move in gold makes perfect sense. But you should look at it as a gift. It’s the market giving you the opportunity to buy a crucial asset at a reasonable price.

The most important thing to understand about gold is that it is highly correlated to REAL interest rates. That is, nominal rates minus inflation.

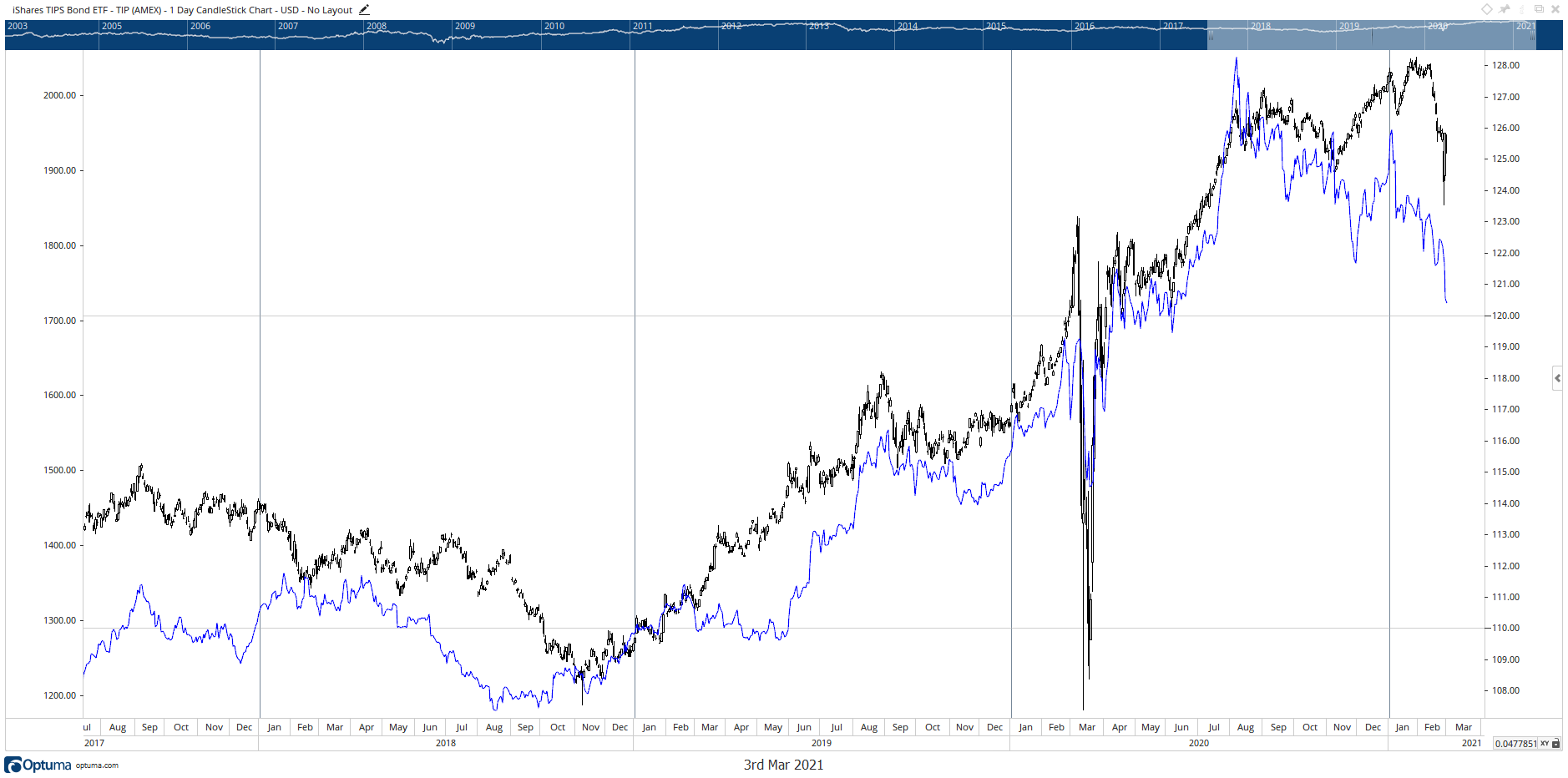

You can see this relationship most clearly when you overlay the gold price with the iShares TIPS Bond ETF. This represents the price of ‘treasury inflation protected securities’. When the price goes up, it’s an indication of real yields falling. When the price of the ETF falls, it tells you real yields are rising.

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

As you can see in the chart, there is a decent correction between real yields and the price of gold:

|

|

|

Source: Optuma |

I’m not exactly sure how the ETF manages its TIPS portfolio. But looking on the US Treasury site gives you real yields for government bonds across all maturities.

To make it easy, I just used the ‘Long-Term Real Rate Average’, which Treasury describes as ‘the unweighted average of bid real yields on all outstanding TIPS with remaining maturities of more than 10 years and is intended as a proxy for long-term real rates.’

When the gold price peaked on 6 August last year, long-term real rates made a low of minus 52 basis points. Then, they started falling, as the market began to price in a recovering economy. Real yields fell again, hitting minus 50 basis points on 4 January. You can see in the chart that this is when gold spiked momentarily.

But since then, the recovery story has become more widespread. Real yields have increased again and on 25 February moved into positive territory. But just for a day. The most recent reading (2 March) showed a real yield of minus seven basis points.

Given the increase in real yields, it should come as no surprise to see the gold price under pressure. And if real yields continue to rise, the gold price will continue to fall.

But this is where you need to think about the financial system and the role of gold over the longer term. When you do so, you’ll see that gold is on its way to becoming another great buying opportunity.

Right now, we’re in a reflationary phase. This is where all the stimulus thrown at the global economy over the past year starts to gain a bit of traction. The market sees this and thinks inflation is coming! So nominal yields rise faster than actual CPI inflation, which causes real yields to rise.

This increase in real yields puts pressure on gold. The story is that because the economy is recovering, gold loses its appeal.

There is certainly truth to this. Rising real yields do indicate a recovering economy. And in this environment, gold isn’t required as a portfolio hedge as much as it was when things looked decidedly worse.

Here’s the thing though. The global economy and financial system is structurally broken. The more this ‘recovery’ continues, and the higher real interest rates rise, the closer we get to another ‘problem’ for the global economy.

I have no idea where that point is.

But to give you an idea, at the start of 2019, real long-term US yields were 1.15%. They then began declining all through the year, and finished at 0.53%. That was before COVID was really an issue.

In other words, a slowdown was on its way before the COVID shock. COVID just made things much worse. It was a shock on par with 2008, only this was an income crisis, not an asset price crisis as happened in 2008.

It resulted in massive fiscal stimulus that has increased the global debt burden to an insane level.

Check this out, from Reuters:

‘LONDON (Reuters) — The COVID pandemic has added $24 trillion to the global debt mountain over the last year a new study has shown, leaving it at a record $281 trillion and the worldwide debt-to-GDP ratio at over 355%.

‘The Institute of International Finance’s global debt monitor estimated government support programmes had accounted for half of the rise, while global firms, banks and households added $5.4 trillion, 3.9 trillion and $2.6 trillion respectively.

‘It has meant that debt as a ratio of world economic output known as gross domestic product surged by 35 percentage points to over 355% of GDP.

‘That upswing is well beyond the rise seen during the global financial crisis, when 2008 and 2009 saw 10 percentage points and 15 percentage points respective debt-to-GDP jumps.

‘There is also little sign of a near-term stablisation.

‘Borrowing levels are expected to run well above pre-COVID levels in many countries and sectors again this year, supported by still low interest rates, although a reopening of economies should help on the GDP side of the equation.’

How is the global economy going to overcome this massive debt load?

The only way it can do so is to see real yields move deeply into negative territory. That could mean allowing inflation to rise while central banks hold down nominal yields.

The path doesn’t matter. The destination is important and the only way for the economy to survive is to have real yields deep in negative territory, so as to inflate away the nominal value of the debt.

This is why I believe gold must be a part of your portfolio. You might continue to suffer in the short term, as the ‘recovery’ takes hold. But every tick higher in real yields just gets us closer to another inflection point.

I’m telling subscribers of my new advisory service to ‘accumulate’ quality gold stocks during this downturn. That doesn’t mean buying aggressively. It just means using sell-offs to top up and maintain exposure.

Gold is just another investment angle to surviving ‘Life at Zero’. This is what I’ve called my special presentation to help you survive years of zero interest rates and negative real returns on your savings.

Regards,

|

Greg Canavan,

For The Daily Reckoning Australia

P.S: Discover what is probably the easiest way to start investing in gold in Australia. In fact, it’s as easy as buying a book on Amazon! Click here to read the FREE report.