Meta-description: Zip Co Ltd [ASX:Z1P] is set to acquire fellow BNPL stock Sezzle Inc [ASX:SZL] in an all-scrip deal valuing Sezzle at $491 million.

First it was Block Inc’s [ASX:SQ2] historic acquisition of Afterpay Ltd [ASX:APT].

Then it was Humm Group Ltd [ASX:HUM] selling its BNPL division to Latitude Group Holdings Ltd [ASX:LFS].

And finally, after months of rumoured talks, Zip is set to acquire Sezzle.

The consolidation of the crowded — and depressed — BNPL market is on.

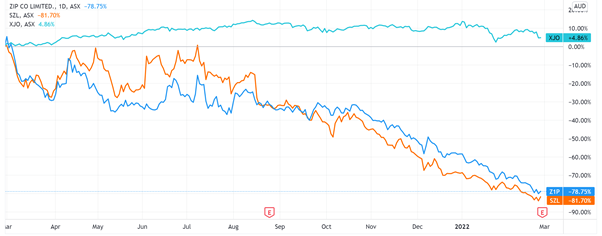

Source: Tradingview.com

Zip and Sezzle deal: the essentials

- All-scrip deal with SZL shareholders entitled to 0.98 Z1P ordinary shares for every Sezzle share

- Total consideration of the Sezzle shares values Sezzle at around $491 million

- The $491 million deal values SZL shares at a 22% premium based on 25 February spot prices and at a 31.7% premium based on a 30-day volume weighted average price

- Upon closing the deal, Z1P shareholders will own about 78% of the combined group, while Sezzle shareholders will own the remaining 22%

- Zip to undertake an equity raising via an underwritten institutional placement to raise roughly $148.7 million

- Zip expects to raise a further $50 million via a non-underwritten share purchase plan

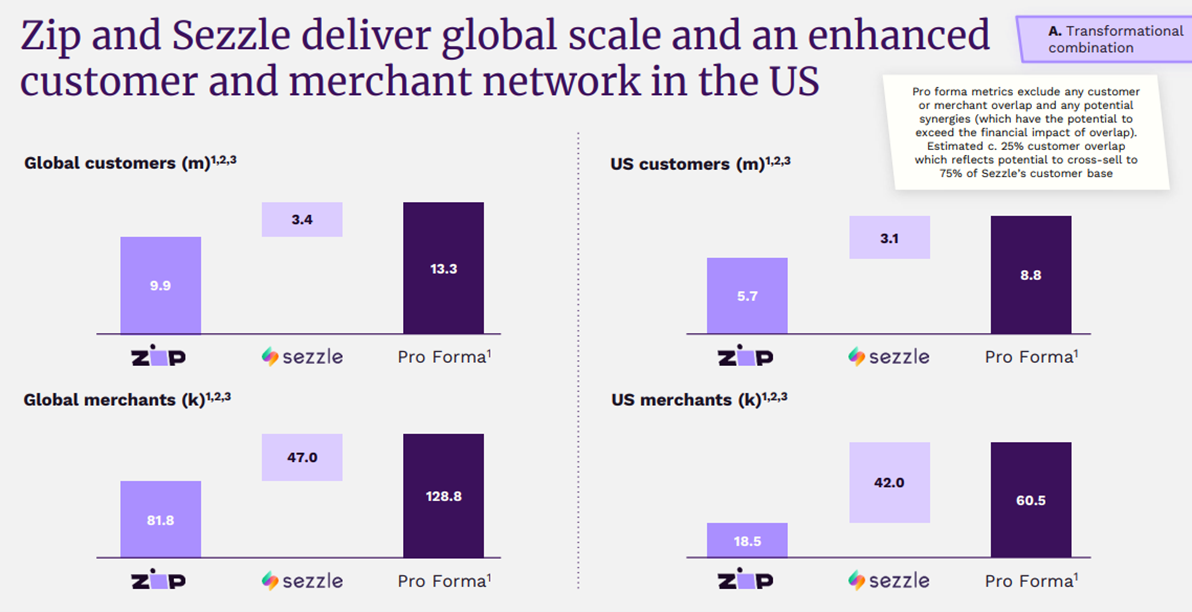

Source: Zip

Zip and Sezzle join forces: the big questions

Both stocks have suffered from souring investor sentiment regarding the once-hot BNPL sector.

In the last 12 months, Z1P shares are down 79% and SZL shares are down 81%.

So the acquisition raises a few questions.

Why does Zip’s management think it needs Sezzle’s assets? And why now?

What can Zip achieve with Sezzle that it cannot achieve alone?

What is the upside for existing Zip shareholders, especially when the upcoming capital raisings will lead to large dilutionary effects?

Did Zip pay a fair price or was the premium too steep?

If the name of the BNPL game is volume — raise total transaction volume enough until it hits a magical critical mass — will the addition of Sezzle’s customer and merchant network be enough?

The two BNPL stocks summarised the rationale for joining forces in the table below:

Zip said the deal is ‘expected to be accretive to revenue per share and accretive to EBITDA pe share in FY24F.’

Additionally, Zip thinks the deal has the ‘potential to realise material cost synergies and opportunities for revenue and margin uplift with EBITDA benefits of up to $130m EBITDA in FY24.’

So, there is the potential of financial benefits…in the distant FY24.

Is that enough to sway investors who’ve become growingly sceptical of the industry?

And will the ‘cost synergies’ be enough for a business notorious for large cash burn?

In a timely reminder of the cost-intensive nature of buy now, pay later, Zip tacked on another announcement to its acquisition update…its H1 FY22 results.

While Zip registered record transaction volume of $4.5 billion (up 93%), the revenue margin was a modest 6.7%…with interest rates (and rising cost of capital) looming.

While revenue rose in the period to $301.3 million, so did bad debts and expected credit losses.

Bad debts and expected credit losses rose from $29.5 million to $148.3 million.

In other words, bad debts accounted for 49% of Zip’s operating revenue in the latest half-year.

Zip ended the half-year with a net loss of $214.3 million.

During the period, Zip also reported:

‘The cash transaction margin declined to 2.1% (from 3.7% in HY2021) reflecting rising bad debt costs reflective of current credit headwinds as well as increased weighting towards rest of world.’

Now, if you’re interested in fintech stocks, check out our report on three new small-cap fintechs with exciting growth potential.

Regards,

Kiryll Prakapenka,

For Money Morning