Zip Co Ltd’s [ASX:Z1P] shares were flat this morning after the buy now pay later (BNPL) stock released its Q2 results ending 31 December 2021.

Z1P hit record quarterly revenue of $167.4 million and record quarterly transaction volume of $2.6 billion.

But, despite the quarterly records, Zip’s share price was moribund, as investors turn a cold shoulder to a once-booming BNPL sector.

Will the significance of today’s results percolate and lead the market to rerate the struggling stock?

Or does the market not even place any significance on record quarterly transaction volume and revenue any longer, instead worried about the profitability of the BNPL business model?

Let’s investigate Zip’s results in detail…

Higher transaction volumes fuel growing revenue

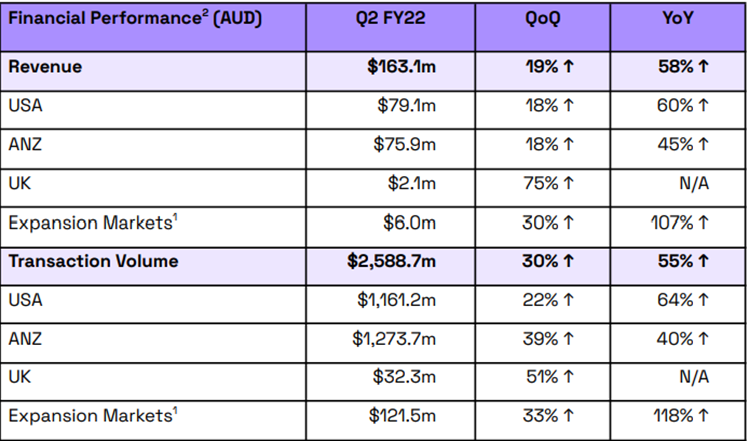

Here are the key numbers from Z1P’s Q2 FY22:

- Quarterly revenue rose 58% year-on-year (YoY) to $167.4 million

- Quarterly transaction volume rose 53% YoY to $2.6 billion

- Transaction numbers rose 85% YoY to 22.4 million

- Customer numbers reached 9.9 million, up 57% YoY

- Merchants rose to 81,800, up 110% YoY

In the December quarter, Zip also managed to sign up merchants like Footlocker, Electronics Express, Nespresso, Virgin Australia, Culture Kings, and Under Armour.

As we covered earlier, last year Zip made a play for a central European BNPL Twisto.

In the December quarter, Z1P managed to complete the acquisition. Zip said Twisto provides it a ‘regional HQ and passport for European expansion.’

Segment breakdown — US versus ANZ growth

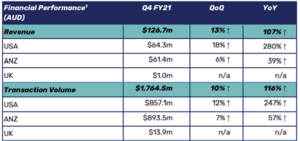

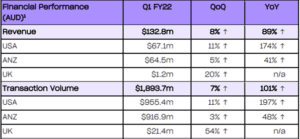

In today’s update, Zip also provided a segment breakdown. The breakdown offered interesting insights.

Source: Z1P

As you can see from the above tables, the US segment continues to bring in the most revenue for Zip in the last three quarters.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

But the gap between US revenue and ANZ revenue has not widened in that time.

That’s despite Zip’s US customers growing from 4.4 million in Q4 FY21 to 5.7 million in Q2 FY22.

Whereas Zip’s ANZ customers rose from 2.8 million in Q4 FY21 to only three million in Q2 FY22.

In other words, Zip’s Aussie and New Zealand customers are punching above their weight.

Are ANZ customers buying more often than their more numerous US counterparts?

In the December quarter, Zip’s US customers made 6.5 million transactions on a transaction volume of $1.16 billion.

Zip’s ANZ customers, on the other hand, made 13.4 million transactions on a transaction volume of $1.27 billion.

So the US segment had 1.14 transactions per consumer, with the average transaction worth $178 million.

The ANZ segment had 4.47 transactions per consumer, with the average transaction worth $95.

As a hypothetical, if Z1P’s US segment was to make 4.5 transactions per consumer (with the average transaction worth $95), it would register a transaction volume of $2.43 billion in the quarter.

That would annualise to about $9.72 billion…for the US segment alone.

In FY21, Zip’s total transaction volume was $5.8 billion.

Assessing Zip’s record December quarter — are investors impressed?

Records fell…and the share price with them.

Not a usual relationship we associate with a company that breaks its quarterly revenue, transaction volume, and transaction amount records.

But we are not talking about any old company in any old sector. Zip is one of the biggest stocks in the once-hot, now cold BNPL space.

And BNPL stocks are experiencing a sharp sell-off after much enthusiasm in 2020 and early 2021.

Zip reached an all-time high of $14.53 in February 2021 but — nearly 12 months on — the BNPL stock is trading at $3.65, a 74% drop.

A steep fall that may explain the lack of interest in today’s results, despite the record numbers.

Past Z1P shareholders may not believe in the stock’s long-term future. Once bitten, twice shy.

And prospective investors may be leery to jump in when so many are jumping out.

But Zip CEO Larry Diamond is undeterred ‘despite external noise’:

‘The business continues to execute on its strategy with growth driven by both customer and merchant acquisition, and the increasing levels of engagement as we pursue our mission of becoming the first payment choice everywhere and every day.

‘The growing contribution from expansion markets is pleasing and should continue to build in the medium term in line with Zip’s global strategy. Despite external noise and challenges the business continues to deliver and we are very well placed to continue the growth and momentum in 2022.’

If you’re interested in fintechs and want to find out more, I suggest reading through our latest fintech report for 2022.

It profiles three promising fintechs. Coincidentally, one of them is the only profitable BNPL stock in Australia.

Regards,

Kiryll Prakapenka,

For, Money Morning

PS: Along with your report, you’ll also get a free subscription to Money Morning, an e-letter that has been designed to deliver the most exciting investing opportunities most mainstream outlets miss. Click here to subscribe now.

![Zip Co Ltd’s [ASX:Z1P] share price was flat this morning after the buy now pay later (BNPL) stock released its Q2 results ending 31 December 2021. Source: Tradingview.com Z1P hit record quarterly revenue of $167.4 million and record quarterly transaction volume of $2.6 billion. But, despite the quarterly records, Zip’s share price was moribund, as investors turn a cold shoulder to a once-booming BNPL sector. Will the significance of today’s results percolate and lead the market to rerate the struggling stock? Or does the market not even place any significance on record quarterly transaction volume and revenue any longer, instead worried about the profitability of the BNPL business model? Let’s investigate Zip’s results in detail… Higher transaction volumes fuel growing revenue Here are the key numbers from Z1P’s Q2 FY22: - Quarterly revenue rose 58% year-on-year (YoY) to $167.4 million - Quarterly transaction volume rose 53% YoY to $2.6 billion - Transaction numbers rose 85% YoY to 22.4 million - Customer numbers reached 9.9 million, up 57% YoY - Merchants rose to 81,800, up 110% YoY In the December quarter, Zip also managed to sign up merchants like Footlocker, Electronics Express, Nespresso, Virgin Australia, Culture Kings, and Under Armour. As we covered earlier, last year Zip made a play for a central European BNPL Twisto. In the December quarter, Z1P managed to complete the acquisition. Zip said Twisto provides it a ‘regional HQ and passport for European expansion.’ Source: Z1P Segment breakdown — US versus ANZ growth In today’s update, Zip also provided a segment breakdown. The breakdown offered interesting insights. Source: Z1P As you can see from the above tables, the US segment continues to bring in the most revenue for Zip in the last three quarters. But the gap between US revenue and ANZ revenue has not widened in that time. That’s despite Zip’s US customers growing from 4.4 million in Q4 FY21 to 5.7 million in Q2 FY22. Whereas Zip’s ANZ customers rose from 2.8 million in Q4 FY21 to only three million in Q2 FY22. In other words, Zip’s Aussie and New Zealand customers are punching above their weight. Are ANZ customers buying more often than their more numerous US counterparts? In the December quarter, Zip’s US customers made 6.5 million transactions on a transaction volume of $1.16 billion. Zip’s ANZ customers, on the other hand, made 13.4 million transactions on a transaction volume of $1.27 billion. So the US segment had 1.14 transactions per consumer, with the average transaction worth $178 million. The ANZ segment had 4.47 transactions per consumer, with the average transaction worth $95. As a hypothetical, if Z1P’s US segment was to make 4.5 transactions per consumer (with the average transaction worth $95), it would register a transaction volume of $2.43 billion in the quarter. That would annualise to about $9.72 billion…for the US segment alone. In FY21, Zip’s total transaction volume was $5.8 billion. Assessing Zip’s record December quarter — are investors impressed? Records fell…and the share price with them. Not a usual relationship we associate with a company that breaks its quarterly revenue, transaction volume, and transaction amount records. But we are not talking about any old company in any old sector. Zip is one of the biggest stocks in the once-hot, now cold BNPL space. And BNPL stocks are experiencing a sharp sell-off after much enthusiasm in 2020 and early 2021. Zip reached an all-time high of $14.53 in February 2021 but — nearly 12 months on — the BNPL stock is trading at $3.65, a 74% drop. A steep fall that may explain the lack of interest in today’s results, despite the record numbers. Past Z1P shareholders may not believe in the stock’s long-term future. Once bitten, twice shy. And prospective investors may be leery to jump in when so many are jumping out. But Zip CEO Larry Diamond is undeterred ‘despite external noise’: ‘The business continues to execute on its strategy with growth driven by both customer and merchant acquisition, and the increasing levels of engagement as we pursue our mission of becoming the first payment choice everywhere and every day. ‘The growing contribution from expansion markets is pleasing and should continue to build in the medium term in line with Zip’s global strategy. Despite external noise and challenges the business continues to deliver and we are very well placed to continue the growth and momentum in 2022.’ If you’re interested in fintechs and want to find out more, I suggest reading through our latest fintech report for 2022. It profiles three promising fintechs. Coincidentally, one of them is the only profitable BNPL stock in Australia. Regards, Kiryll Prakapenka, For Money Morning PS: Along with your report, you’ll also get a free subscription to Money Morning, an e-letter that has been designed to deliver the most exciting investing opportunities most mainstream outlets miss. Click here to subscribe now. ASX Z1P - Zip Share Price Chart](https://daily.fattail.com.au/wp-content/uploads/2022/01/zip-share-price-chart1.png)