Zip Co Ltd [ASX:Z1P] has announced its Q1 FY22 results along with the completion of a rebrand.

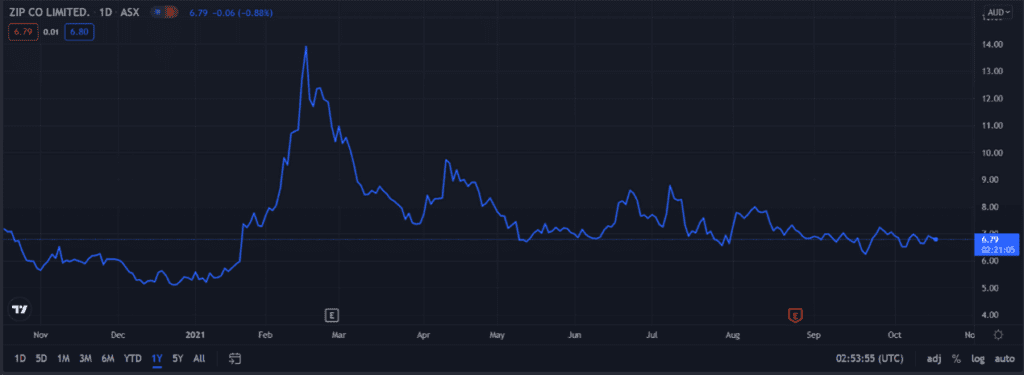

Despite strong uptick in key growth metrics, the Z1P share price is trading flat. Zip Co Ltd [ASX:Z1P] share price is currently exchanging hands for $6.79 a share, a slight drop of 1% at time of writing.

Like many of its BNPL peers, Zip endured a tough year after February’s highs, with the BNPL stock underperforming the ASX 200 benchmark by 20%.

Despite posting strong growth across important metrics, the market didn’t budge. Does this indicate investors are moving past impressive growth figures?

Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.

Zip and its Q1 FY22

Zip posted record quarterly revenue of $136.8 million, a jump of 89% year-on-year (YoY).

This was driven by a record quarterly transaction volume of $1.9 billion — up 101% YoY.

Unsurprisingly, the related transaction numbers also rose to a record of 14.7 million, an increase of 177% YoY.

Zip’s customer numbers increased to eight million, up 82% YoY.

Merchants on the platform rose to 55,200, a bump of 71% YoY.

App downloads — frequently tracked by analysts as an indirect measure of market share — remained ‘robust’, according to Zip.

Zip US registered 1.5 million downloads (now 7.3 million in total). Zip ANZ registered 412,000 (now 3.7 million in total).

The above segment breakdown neatly captures the importance of the US market for BNPL players like Zip and Afterpay Ltd [ASX:APT] as Australia becomes saturated.

This quarter also saw Zip complete a global rebrand in six counties with the US segment changing from Quadpay to Zip.

The lack of movement in Zip’s share price may have something to do with the quarter-on-quarter growth, which might have disappointed some.

For instance, transaction volume in the saturated ANZ segment rose only 3% over the prior quarter.

Zip did note, however, that it maintained ‘market leading BNPL margins’ with revenue as a percentage of TTV standing at 7%.

Zip Managing Director and Global CEO Larry Diamond said:

‘Another very strong set of numbers for Q1 as momentum for the global Zip business continues, with more than 8 million users now on the platform.

‘The quarter saw the successful completion of the global rebrand, which now sees Zip unified under a single payments brand at checkout globally.

‘In support of the rebrand, we are running a major brand campaign across the US to increase awareness and acquisition. I was excited see the Zip brand take center stage in Times Square as we launched the campaign earlier this month.’

If you’re interested in fintech stocks, check out our report on three new small-cap fintechs with exciting growth potential.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here