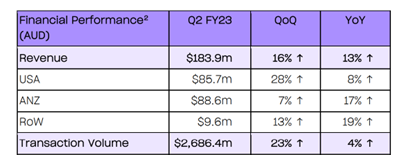

Financial convenience platform and BNPL (buy now, pay later) service provider Zip [ASX:ZIP] has revealed a leap of 12% of year-on-year group quarterly revenue for the second quarter of FY23.

Zip also reported a new record in transaction volume, climbing 22% quarter-on-quarter, and a lift in cash transaction margin, which lifted to 2.6% in the quarter.

The company deemed this a ‘a great result in a rising interest rate environment’.

The financial service company now believes it is on target to reach its EBTDA positive goals for the financial year 2023.

Despite its cheerful news this morning, shares up more than 6%, the tables unexpectedly turned, ZIP shares sinking 9.5% by early afternoon.

Sezzle [ASX:SZL] was also up this morning, two consecutive days after a major upswing yesterday, only to drop 8% alongside Zip; however, Block [ASX:SQ2] continues rallying over the past two days.

Source: TradingView

Zip grows quarterly revenue and transactions

Earlier this morning, the BNPL and small lending platform provided its second quarter results for the three-month period ending 31 December 2022.

These were the highlights:

- ‘Record group quarterly revenue of $188.0m (up 12% YoY)

- ‘Record transaction volume for the quarter of $2.7b (up 22% QoQ)

- ‘Record transaction numbers for the quarter of 22.6m (up 15% QoQ)

- ‘Cash transaction margin lifted to 2.6% for the quarter, a great result in a rising interest rate environment, and in line with medium term targets (up from 2.2% in Q1 FY23)

- ‘Revenue margin remained solid at 6.9%, (reflecting seasonality vs 6.4% in Q2 FY22)

- ‘Zip US delivered positive cash EBTDA in November and December

- ‘Zip ANZ delivered strong revenue growth of 17% YoY’

Zip is now live with Jetstar, Uber, and eBay Australia, as well as US book retailer Barnes & Noble.

As at 31 December, Zip had available cash and liquidity of $78.5 million, a figure that the company expects can support its journey to EBTDA profitability.

Zip’s Co-Founder and Global CEO Larry Diamond said:

‘We are very pleased to deliver another strong quarter of record volumes despite the challenging external environment and adjustments to our risk settings. During the quarter Zip continued to make great progress on the strategy to deliver sustainable growth, right-size our global cost base and accelerate our path to profitability.

‘It was very exciting to onboard great brands such as Uber, Jetstar and eBay to our payments platform in Australia and deliver positive cash EBTDA for the US business in November and December, including very strong results on credit performance.

‘The underlying business remains strong, and we are pleased with the benefits and reduction in cash burn from the ongoing simplification of the business footprint and focus on core products and core markets.

‘In the current environment of heightened inflation and cost of living pressures, Zip continues to provide a simple, fair and easy to use product.’

Source: ZIP

From fintech to Australia’s commodity boom

Turning away from the fintech genre, you may like to hear what James Cooper, Fat Tail Investment Research’s in-house resources expert and trained geologist has to say.

James thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

He is convinced ‘the gears are in motion for another multi-year boom in commodities’…a boom where Australia and its stocks stand to benefit.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

If that isn’t enough to sate your curiosity, check out the recent interview with James and Greg with Ausbiz, recorded in December last year.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia