In the famous theatrical performance Waiting for Godot, two men engage in a deep conversation as they wait for the arrival of a character that never turns up. Despite the apparent futility of waiting, they gained much wisdom and insights to give meaning to their otherwise trivial existence.

In a way, that performance not only entertained their audience, but offered some enlightenment as they can relate to their own life experience.

Likewise, being a contrarian in this market is somewhat akin to being Vladimir and Esdragon, who are waiting for their Godot.

Specifically, for believers in gold like myself, our Godot is not so much a person but an event of exposing the central banks and the players in this fiat currency system for what they are, fraudsters. This would see gold and other assets reassert their true value, liberating the people of their bondage under debt and suppressed purchasing power.

While it seems like the system is on its final leg, every so often it’ll get a temporary stay of its demise. The end seems so elusive that many thought it might never come. That’s because every boom-bust cycle, or even a rally and correction, creates a sense of false hope that things will be OK to those who want this system to continue rolling. To those who want the system to die, it’s the wearying process of waiting for the damn thing to take its last breath.

I’d like to call this ‘Waiting for GOLDot’. But instead of simply being a theatrical act, I believe that gold enthusiasts should use this time to sharpen their minds and find ways to prosper as the fiat currency system goes to its inevitable doom.

GOLDot tarries once again?

Can you sense that the markets are rolling over once more?

Just as the financial pundits began to talk about how there’d be a massive squeeze against those who took a short position in the markets, things are now selling off.

What’s behind all this schizophrenia in the markets? I thought that inflation was behind us and that we should be experiencing an economic recovery moving forward.

For one, the US Dollar Index [DXY] has started rallying again, which places pressures on commodity prices and market indices.

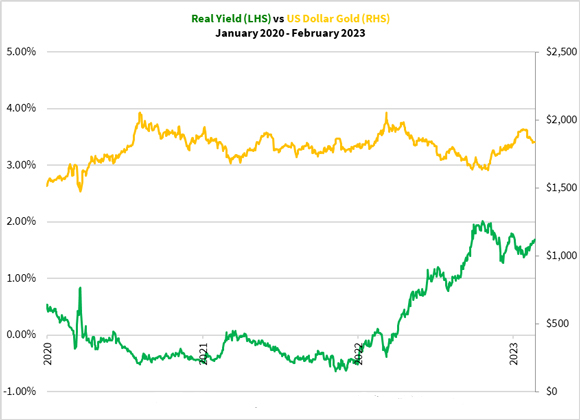

Another is that the US long-term real yield (the return on US long-term Treasury notes adjusted for long-term inflation expectations) has been rising steadily once more. This has placed pressures on the gold price, as you can see in this figure below:

|

|

| Source: US Treasury, Thomson Reuters Refinitiv Datastream |

Is GOLDot delaying its imminent arrival once again? Someone is holding it up, perhaps.

Well, one thing (among many) might’ve played a significant role. Remember last month when I wrote about how the US Bureau of Labour Statistics (BLS) changed their formula for calculating the Consumer Price Index (CPI)? The January 2023 CPI reading showed that year-on-year inflation continued to fall, following the trend since peaking last September.

Note that this was likely manipulated just in time to keep the narrative going that the US Federal Reserve and the Biden Administration were successful in bringing down inflation. In turn, last month’s 0.25% rate rise by the Fed, plus the easing of the official CPI and hence long-term inflation expectations, meant the long-term real yield would rise. The US dollar, as the flagship of the fiat currency system, just got its revitalising boost.

Gold enthusiasts and fiat currency system haters alike, it seems like we’re going to have to hang on for just a bit longer.

Peering behind the curtain

I want to cast your mind back to last week when I wrote that cheeky piece about how an artificial intelligence chatbot, DAN, revealed that the gold price is manipulated by governments and central banks.

Have we not witnessed the exact mechanism behind the manipulation to create the illusion of a healthy and honest financial system?

On the surface, it seems like there’s a logical and non-conspiratorial reason to explain the relationship between gold and the US long-term real yield. We know now that there’s a lot of work done behind the scenes to bring about these observed outcomes.

There could be something more to it, I’m sure. Maybe we’ll find out more in due time.

Don’t just wait for GOLDot, trade and prosper in the meantime!

However, knowing this relationship is already a valuable insight.

That’s because rather than merely waiting for GOLDot, we can capitalise on this relationship and learn how to not lose out on the opportunities that some would give up by throwing in the towel.

There may be cycles that come and go, and GOLDot continues to tease us with its absence. However, you’ll notice that with each cycle that passes, the fiat currency system is weakening.

How do you measure this?

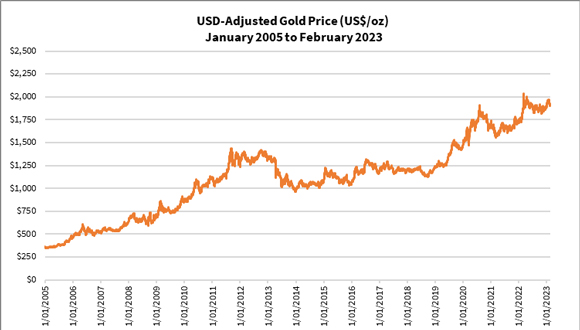

Take the purchasing power of the US dollar and see how it’s decaying gradually over time when you compare it against an ounce of gold. But not just the US dollar, as its value can vary when you weigh it against other currencies. I prefer to use the US Dollar Index [DXY] to measure its relative value against major currencies. A higher index value means that it’s stronger against other currencies and is technically more valuable in absolute terms. So let’s see how gold is valued against the US Dollar Index over time, thus showing us the health of the fiat currency system:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

There’s no doubt that the system is clearly deteriorating, with brief periods where it appears to regain some composure.

And it’s in the system continually crumbling that we can attempt to make our fortunes rather than waiting for GOLDot.

A tried and tested way to do so is to speculate on gold mining companies.

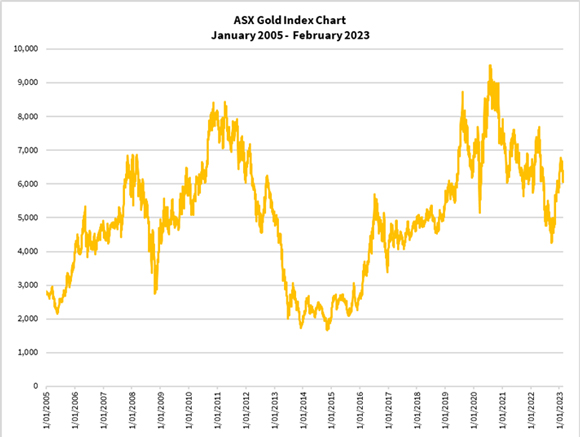

If you look at when gold mining companies have rallied hard in the past, they coincide with periods where the USD-Adjusted Gold Price runs up steeply. Here’s a chart of the ASX Gold Index [ASX:XGD] in the corresponding period:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

You’ll notice that the relationship doesn’t look as clear-cut as that between gold and the US long-term real yield. In fact, there are periods where losses can be as stomach-churning as the gains are delightful.

And this takes me to a key point I want to bring to your attention.

While you’ve discovered the key relationships and opportunities associated with investing in gold as GOLDot finally arrives, you’re aware of the risks. It’d be best to find someone who can help you navigate the pitfalls if you want to compete with gold mining companies.

The larger producers can be on volatile ground, shaking up even experienced traders. And it’s almost like punting on the speculative end, involving explorers that are prospecting the ground for veins of gold that may lead to a deposit.

The rewards can be immense, especially if you venture into the explorers. But you could lose much more than you’d be willing to part with if you get into it with the wrong mindset and lack the skills.

The good news is that you’ve got a rare opportunity to get into this space, and you’d have someone willing to do the hard work for you. But make your decision soon as it won’t last long.

Why not take some time to check out what I’ve got for you. Click here and find out how to prosper while waiting for GOLDot.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments