In today’s Money Morning…in reality everything is crashing…except one thing…we’re in the endgame…why the last year has been a perfect storm for renewables…and more…

Being on the wrong side of 40, I’m probably too old for TikTok.

And yet, a big part of my job is to always keep an eye out for new ideas and in turn work out if there are any good investment opportunities from them.

So, just before Christmas, I took one for the team and downloaded the latest millennial app fad, TikTok.

The original idea behind TikTok was to allow people to record themselves lip synching to their favourite songs.

A sort of public karaoke thing.

But the app took a life of its own and turned into a great way for ordinary people to produce and consume micro-video content.

From singing to dancing to travel to comedy…basically whatever short — most are under a minute or two — videos people wanted to post.

The clever thing about TikTok is that an algorithm behind the scenes sees what things you’re watching (and what you aren’t) and personalises future content accordingly.

Which means my own TikTok experience has gradually morphed from watching videos of teenagers doing strange dance moves to actually getting some interesting things on my feed!

One such bloke who appears in my feed regularly is a doctor who goes by the tag @dr.karanr.

He’s a surgeon in the UK and produces interesting clips explaining weird and wonderful medical situations in an easy-to-follow way.

My favourite series of his is one called ‘Your life is a lie’.

This six-part micro series shows a selection of videos that fool your brain into creating its own reality.

As he proves to you, this reality is not the true reality but a construct of your mind.

Check out this example here (after you’ve finished reading this piece, of course!).

It’s amazing how easily you can be fooled into thinking something that turns out to be patently false.

As the good Dr explains, a lot of this is due to evolutionary processes that have made your brain act efficiently in the face of a constant barrage of stimulus.

Basically, your brain takes short cuts!

Which leads me to the point I want to make today…

In reality everything is crashing…except one thing

I’m going to show you now why your investing life is a lie. Why what you think is happening in markets isn’t.

Well, not really.f

Let’s start with a question…

If I asked you how the stock or property market was going right now, you’d tell me it’s on the up.

That’s what the charts tell us has been happening for the past decade.

Bitcoin vs Gold — Which Should You Buy in 2021? Download your free report now

However, check out these three charts instead:

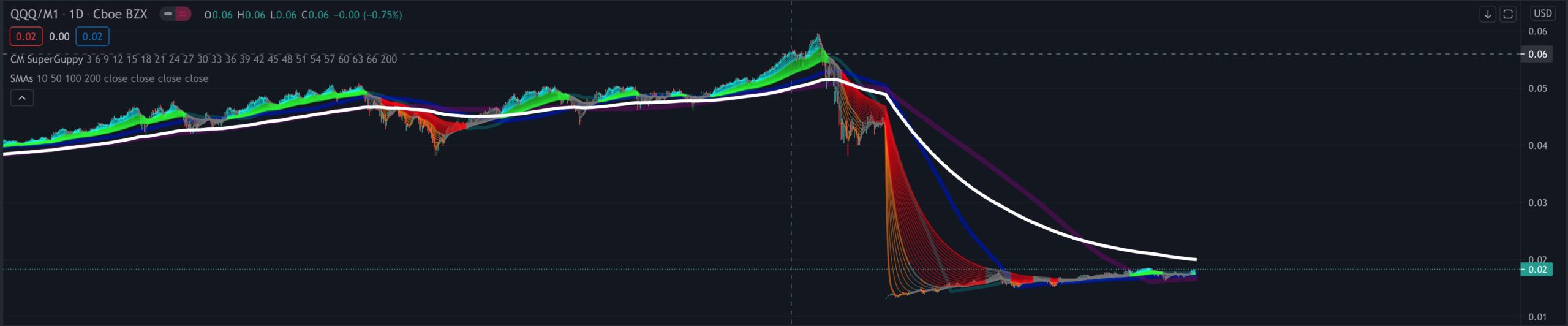

Exhibit A: The stock market

|

|

|

Source: Trading View |

This chart uses M1 — which is a measure of money supply — to adjust the total value of the companies listed on the Nasdaq exchange. The normal — non-tech — stock market is even worse by the way.

The fact is, the huge falls in valuations in the 2008 GFC have nowhere near recovered when you account for increases in total money supply.

What about the traditional monetary inflation hedge, gold?

Exhibit B: Gold

|

|

|

Source: Trading View |

Denominated in M1, gold has collapsed too.

In fact, only one asset has managed to rise in the face of ridiculous increases in the money supply…

We’re in the endgame

Long-time readers will have guessed where I’m going with this…

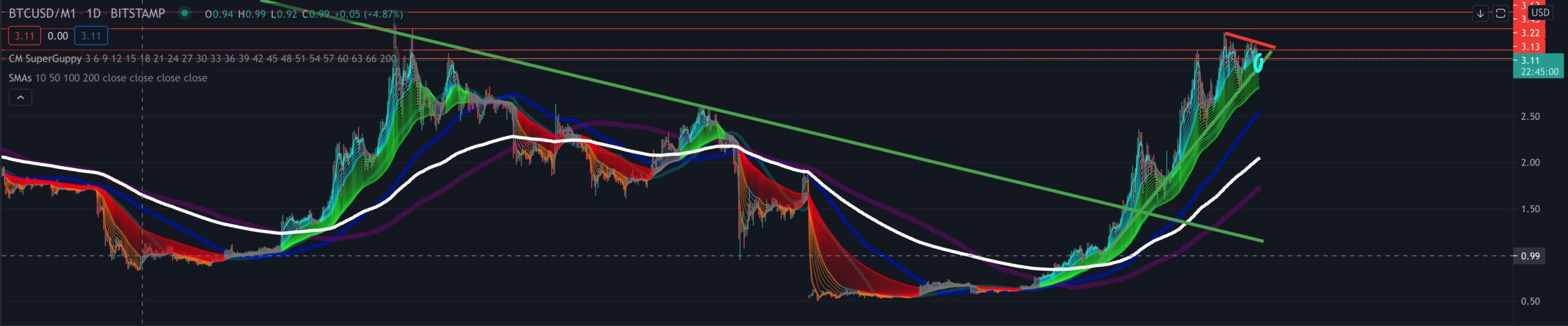

Exhibit C: Bitcoin

|

|

|

Source: Trading View |

While it collapsed more recently in the 2018 crypto bear market, you can see how strongly Bitcoin [BTC] has risen over the past year, as central bank money printing has gone into overdrive.

It’s the only asset rising faster than M1 money supply.

The market is telling you something important here…

And while a lot of people remain sceptical about bitcoin and crypto in general, in my opinion, it remains one of the only feasible life rafts left for those who see the fiat endgame approaching.

The old game of money is imploding before our eyes, yet few realise it yet.

Because it’s only when you overlay the reality of asset values with never-ending money supply that you realise what is actually happening.

The truth is, we’re not in a bull market for everything.

No, instead we’re witnessing a changing of the monetary guard. It’s a slow motion collapse of our current fiat system of money.

Every investing decision you make hinges on what happens next.

I’ll have more to say about this later this week…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

P.S: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.

Why the Last Year Has Been a Perfect Storm for Renewables

Dear reader,

Today, Editor James Allen and I (Selva Freigedo) from New Energy Investor join up to speak about how the pandemic has accelerated the transition into renewables, the opportunities to look at here in Australia, and why it’s the perfect time to get involved.

New Energy Investor looks for the best and brightest clean energy prospects on the market to help investors capitalise on this huge megatrend. To find out more about New Energy Investor, click here.

To watch the video, please click the play button down below.

Regards,

|

Selva Freigedo,

For Money Morning