‘Who wants gold? It’s just a pet rock.’

‘Gold does nothing but look at you.’

‘Gold will go to zero when everyone accepts payment in bitcoin and cryptocurrencies.’

‘The government will confiscate gold and you’ll be left with nothing. Why own gold?’

And the arguments against gold go on and on.

I am sure there are plenty more arguments against gold, all of which may sound logical and reasonable. But the funny thing is that something can sound logical and reasonable and still be wrong.

Take the theory of evolution, for example. Many claim that living creatures came to be what they are today because they sprang from simpler forms of life. It just needed millions of years to happen.

Ask an engineer or statistician, and they will state that the theory is logical but not operational.

For me, this theory breaks down in the timeline. At exactly what point did thousands of a single species evolve, produce offspring that remained alive long enough to reproduce themselves — which in turn created an entirely new species?

The argument that it takes millions of years to occur just doesn’t cut it. It doesn’t matter how many more billions of years there are to make it possible, there is never an instance of time that such evolution and reproduction can occur. Nor will it occur.

Basically, the theory has a flaw in its premise, so it breaks down.

But don’t let that stand in the way of a popular theory.

I believe those who believe in the premise of gold, rather than its detractors, will stand the test of time.

The detractors have a massive flaw in their belief in why people want gold.

I am confident that we are about to see gold flex its muscles once again in the face of what could be the biggest depression in our lifetime.

Didn’t the World Economic Forum even have a name for it? The Great Reset?

Warren Buffett famously stated on CNBC’s Squawk Box in March 2009:

‘I have no views as to where (gold) will be (in the next five years), but the one thing I can tell you is it won’t do anything between now and then except look at you.’

In a way, what he said reminds me of evolutionary scientists claiming that we evolved from some single-celled organism millions or billions of years ago.

Buffett isn’t wrong in his claim that gold doesn’t do anything, and that won’t change.

But that is in gold’s favour.

Gold doesn’t need to do anything. It keeps track of the mistakes that the financial system makes.

And that’s its flaw, according to gold critics.

Gold — a ledger of human folly

The original intent for fiat currencies was to use less expensive substitutes for gold and silver as there wasn’t enough gold and silver to pass around for trade. Using less expensive substitutes could facilitate more economic activity — trusting that people kept an honest account of the actual exchange in gold and silver terms.

But this breaks down because of human nature.

Individuals generally have good intentions and are likely to act decently. But faced with challenging circumstances (or the opportunity for a big gain), the temptation to not be decent becomes overwhelming.

So over time, people stray from honesty to dishonesty.

And gold keeps track of it. There will be more fiat currencies than gold as time goes by. And as a result, in currency terms, gold will rise in price.

Let me show you how this has played out in the last 50 years.

The pre-1971 price of gold was US$35 an ounce. However, this began to change as many countries that had deposited gold in the US for safekeeping asked for it back. The demand for gold caused it to rally.

On 15 August 1971, US President Richard Nixon declared that there would be a temporary closure of the exchange for gold and the US dollar.

From there, gold took the backseat as a means of exchange, and the US dollar became the dominant form of ‘money’.

Gold decoupled from the US dollar. The increasing demand for the US dollar meant that more of it came into existence. The price of gold would rise in US dollar terms simply due to the relative supply of the two.

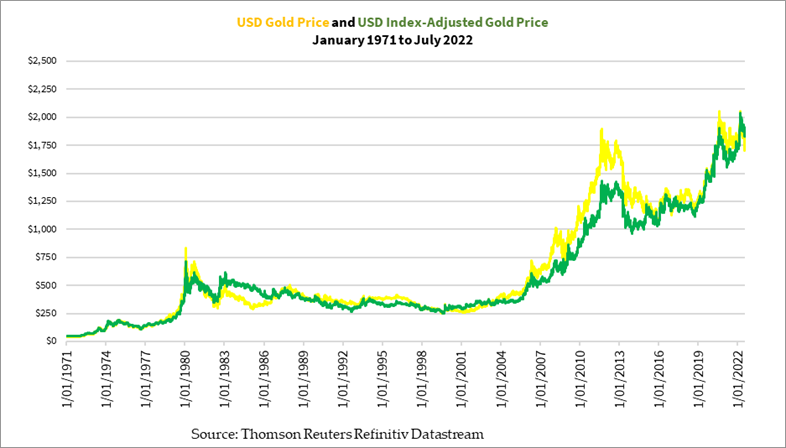

Let me show you gold’s performance in US dollar terms in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

I have plotted two prices in the chart above. The yellow line is the one that most people are familiar with, the price of gold in US dollar terms.

And you can see that over the last 50 years, gold, the ‘pet rock’, just looked at you and rose more than 5,000%.

So sorry, Mr Buffett, but I guess you got it half right.

The rise and rise of gold

Now the green line is more interesting. It is the price of gold after considering the changing value of the US dollar against other major world currencies.

You’ll notice that gold approached US$2,000 an ounce for the first time in September 2011, before tumbling hard for the next four years. Many swore off gold in that sell-off.

Did gold just regain what it lost in the 2015–20 rally from US$1,045 to US$2,000?

The green line tells you that gold did more than that. This is because the US Fed tried to raise interest rates from 2015 to 2018 to fix the economy and backtracked in mid-2019. Inflation and negative real yield hit hard with a vengeance. The COVID outbreak gave gold another boost in early 2020.

The most recent round of rate rises began earlier this year and has created a world of hurt. Inflation is out of control, causing business confidence to plummet as the world’s debt pile threatens to implode the global economy.

Do you think that the central bankers and governments can fix this one so easily?

If you think so, then perhaps gold will pull back and crash.

As for me, I’d take the gamble that gold will prevail. The failure of the financial system adds another notch to gold’s belt in this perpetual battle.

That’s why I believe gold serves its purpose well even today. It may come in very handy in the near future as ‘The Great Reset’ looms, and man’s folly exposes itself once again.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments