‘Of all the offspring of Time, Error is the most ancient, and is so old and familiar an acquaintance, that Truth, when discovered, comes upon most of us like an intruder, and meets the intruder’s welcome.’

Charles Mackay,

Extraordinary Popular Delusions and the Madness of Crowds

Nothing has changed since Charles Mackay published his seminal book in 1841.

People still treat truth as an intruder…something to be viewed with suspicion. As a society, we prefer the illusion. It’s much more fun.

Being told the truth is confronting.

The most ancient offspring of Time, Error, has been pampered and indulged by central bankers for the past decade.

The error of interest rate suppression has been compounded by the error of (seemingly) limitless QE and market intervention.

The unwelcome truth is we are building to a crisis…and not just any old crisis.

This has gone well beyond a simple case of reckless subprime lending.

Asset price distortion exists in a broad range of asset classes…with the notable exceptions of cash and precious metals.

In November 2021, Bitcoin [BTC] soared to US$68,789, and the NASDAQ posted an intraday high of 16,212 points. This was the month of peak speculation.

During this heightened state of irrational exuberance, the November 2021 issue of The Gowdie Letter offered a more sombre outlook on the permanency of speculative pricing:

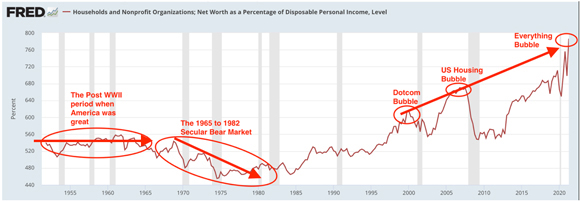

‘Based on data back to 1950, the longer-term relationship between Net Worth and Disposable Income is around 550% to 560%:

|

|

| Source: Federal Reserve Economic Data |

‘The Fed’s misguided attempts to accelerate the wealth creation process beyond its natural level (by encouraging leveraged investing and speculation) is evident in the recent bubble manias…dotcom, US housing, and now.

‘Each previous attempt has worked for a while. Households do feel wealthier for a period of time. But it proves to be temporary, not permanent.

‘The bursting of the two previous bubbles has drawn the Net Wealth to Disposable Income percentage back to its 70-year trend of…550% to 560%.

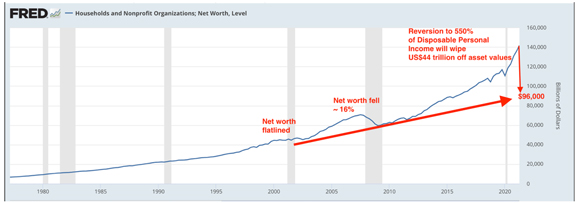

‘Here’s a reminder from last month’s issue of what that means in dollar terms:

“…it’s all paper wealth…waiting to be shredded by the reality of the underlying mathematics that underpin long-term values.

“This is why, after each modern-day bubble, US net worth has fallen back into the 550% to 560% of Household Disposable income range.

“This next chart puts a dollar figure on the ‘fake wealth’ the Fed has created in to enable the US Empire to keep up appearances.

“Reversion to the 550% to 560% range will shred US$44 trillion of paper wealth.

“That wealth currently sits in shares, property, and cryptos.

|

|

| Source: Federal Reserve Economic Data |

“For a little perspective, in 2009, US Household Net Worth shrank from US$70 trillion to US$59 trillion…wiping out US$11 trillion (which, at that time, equated to 80% of GDP).

“A potential loss of US$44 trillion is the equivalent of 200% of US GDP.”’

12 months ago, the prospect of a loss on this scale was deemed, by some, to be ‘alarmist’ and another example of your editor parading around in his ‘Chicken Little’ suit.

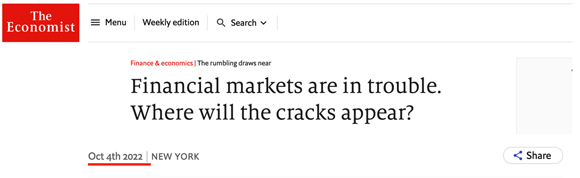

On 4 October 2022, The Economist published this article:

|

|

| Source: The Economist |

The article included this extract on year-to-date US asset price losses (emphasis added):

‘It is hard not to feel a sense of foreboding. As the Federal Reserve has tightened policy, asset prices have plunged.

‘Stocks, as measured by the Wilshire 5000 all-cap index, have shed $12trn of market capitalisation since January. Another $7trn has been wiped off bonds, which have lost 14% of their value. Some $2trn of crypto market-cap has vanishedover the past year. House prices adjust more slowly, but are falling. Mortgage rates have hit 7%, up from 3% last year. And this is all in America—one of the world’s strongest economies.’

Let’s add up those (year-to-date) losses…US$12 trillion + US$7 trillion + US$2 trillion = US$21 TRILLION, plus the slowly downwards adjusting house prices.

Looks like we’re about halfway there.

The everything bubble is in the process of deflating.

For a little perspective, the losses to date are merely the froth being blown off the top. Somewhat like the first six months in 2008…prior to the Lehman moment in september 2008.

The cut-deep-to-the-bone losses are coming in the next US$20–$30 trillion of asset price vaporisation…and it is coming.

How do I know?

Because, unlike central bankers, maths and history do not lie.

Decades (and even centuries) of human behavioural patterns can be measured in multiples and/or ratios of greed, fear, and rationality.

What cannot be calculated is the duration of these cyclical patterns.

Courtesy of the Fed’s unprecedented commitment to compounding errors, the everything bubble’s lifespan has exceeded that of all other bubbles.

For every action, there is an equal and opposite reaction

Newton’s Third Law of Motion (another truth) foretells the busting of this massive asset bubble — whether it be short and sharp or long and protracted — is destined to inflict a great deal of financial pain.

Will the notable exceptions of this bubble — cash and precious metals — offer refuge from a hostile marketplace intent on correcting central bank errors?

Cash is king, for now. However, even I acknowledge it’s not a long-term wealth creation solution.

Gold and silver are both struggling to get off the mat at present, but what about longer term?

Should you include gold and/or silver in your portfolio?

The September 2022 issue of The Gowdie Letter went in search of the truth on the role precious metals may or may not play in a portfolio.

Is gold an inflation hedge? Is gold a defence against money creation? How reliable is the Dow/Gold ratio?

The answers to these and more questions are not as straightforward as you’d think.

Understanding the truth of how markets function has never been more important. An error of judgement in a brutal secular bear market can come with a high price tag.

Over the next two weeks, I’ll share with you some edited extracts on what our search for truth uncovered in the September 2022 issue of The Gowdie Letter.

Here’s a sample (emphasis added):

‘Truisms aren’t always true

‘When it comes to precious metals, I’m indifferent. Neither bull nor bear. To me, they’re just another asset class. At times undervalued and at other times, fair to overvalued.

‘Gold has long been considered the only true store of wealth…a proven antidote to inflation.

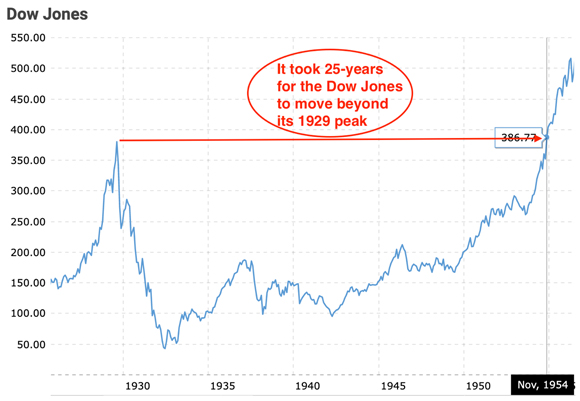

‘This sort of broad-sweeping, all-encompassing, easy to roll-off-the-tongue statement reminds me of the old investment industry chestnut…shares always go up in the long term.

‘These sort of statements, while based in the truth of long, long, long-term performance, may or may not be true in the context of your investment time frame.

‘Shares go up in the long term…really?

|

|

| Source: Macrotrends |

‘And, in inflation-adjusted terms, the purchasing power of a dollar invested at the peak of the Roaring Twenties market was not recovered until…1990…60 years later.

|

|

| Source: Macrotrends |

‘In 1929, a 60-year-old, who went all-in on the belief stocks had reached a permanently high plateau, would be 85 before they recovered their 1929-dollar value…and if you take inflation into account, they’d qualify, at 120, to be the world’s oldest living person.

‘In the long, long-term, the Dow Jones has well and truly surpassed its 380-point high in 1929…but that’s cold comfort to a late 1920s retiree.

‘And, if someone thought the high inflation of the late 1970s was to become a permanent fixture in the global economy, they might have decided to go all-in on the proven inflation hedge…gold.

|

|

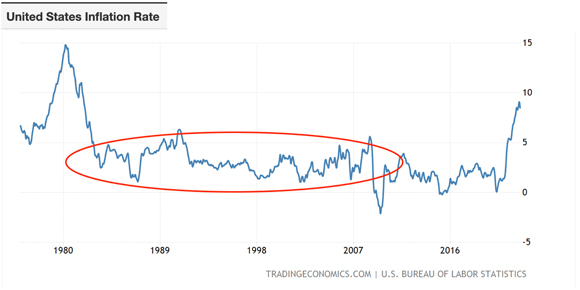

| Source: Trading Economics |

‘Faith in gold being the ultimate store of wealth, was sorely tested for almost three decades.

‘During the 1980 to 2008 period, gold FAILED to live up to its billing of…“an inflation hedge”.

‘The annual US inflation rate ticked along in the 2% to 5% range…while the gold price went on a long and bumpy ride to nowhere.

|

|

| Source: Trading Economics |

‘The reason for showing you the WORST of times with shares and gold, is to impress upon you how throw-away lines of “shares always go up” or “gold maintains your buying power” or “property prices never fall”…are just that…lines to be literally thrown away.

‘The “truth” in these sweeping statements may or may not be your lived truth.’

What will be our lived truth?

Stay tuned for Part Two next week.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…