Dear Reader,

I wasn’t.

I really wasn’t going to write to about gold today.

Silver was going to be the topic of choice.

After all, it’s made an incredible ‘power move’ in the last two weeks.

The angle was how undervalued it is to gold.

Perhaps I was even going to delve into what silver’s incredible moves meant in a historical context (which by the way, the folks over at ABC Bullion did a good recap of this last week).

Then there was the bet with an old mate from high school on where the silver price is going.

Pro tip though: When it comes to making bets with friends on where the price of a precious metal is going, clarify the currency you are talking about. The price I threw out in the conversation was in US dollars. The price my mate tossed down was in Aussie dollars…

Neither of us cleared up which currency we were referring to.

The short version is, I now I owe a bloke a bourbon when the pubs in Melbourne open back up…

My point is, I was all fired up ready to talk about the ‘other’ precious metal.

So, what gives? Why am I not delving into all things silver and why not analyse this metal in detail?

After pulling an all-nighter last night, writing my latest stock recommendation for Strategic Intelligence Australia — coming out Monday evening — I woke up bleary eyed to see gold was still in the press.

Now I’m not normally one for chasing headlines, but I think it’s time we cleared something up…

Discover why Shae Russell is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

This ratio says gold stocks are cheap

There’s a long list of well-worn myths in the gold space which mainstream analysis normally hang onto as truths.

One I mentioned last week is last is the inflation myth. There seems to be this persistent idea that gold only shines during inflationary periods. Yet as I pointed out, gold staged the most incredible price run over two decades in periods of low inflation.

But another idea I’m keen to counter, is that now that gold has hit US$2,000 an ounce, perhaps it’s too expensive.

And that even means that gold stocks have probably had their day.

Does this mean you’ve missed out on the rally in both?

Not even close.

Let’s start with the gold price first.

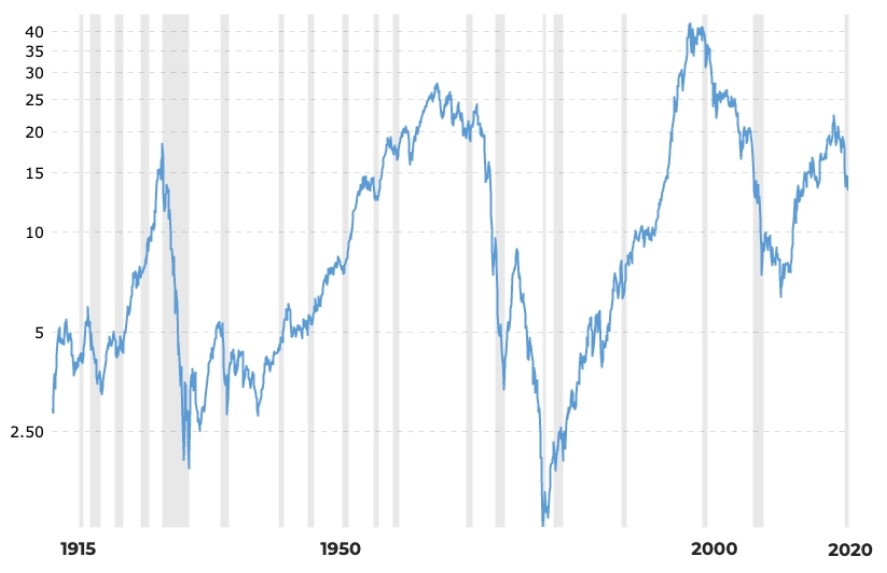

The Dow-Gold Ratio is a crude tool used to show you if gold is cheap or expensive in relation to the Dow.

In other words, how many ounces of gold would it take to ‘buy’ the Dow.

Here’s the thing.

Even though the Dow-Gold Ratio has dropped from 14.5 in October 2016 (when gold averaged US$1,265 an ounce for that month) as of Friday last week, with gold trading well above US$2,000 per ounce, it still takes a little over 14 ounces to buy the equivalent value in the Dow Jones Index.

Dow-Gold Ratio

|

|

|

Source: Mining.com |

This gives an indication that even though gold has enjoyed a 30%-plus rally this year, gold is still cheap.

In fact, the founder of my parent company has a firm rule when it comes to the Dow-Gold Ratio.

For years Bill Bonner has told subscribers all over the world that when the Dow-Gold Ratio goes below five, he buys the equal number of shares in the Dow. When the Dow-Gold Ratio is above 15, he sells the Dow and buys gold.

With the Dow-Gold Ratio sitting at 14, this tells us gold is still cheap compared to stocks…

But what if you wanted both gold and stocks?

That’s where I come in…

[conversion type=”in_post”]

Hang onto your hats

Take the top 10 Aussie gold mining stocks, lay them out on the floor.

Cover your eyes, spin around, and drop a pin. Whatever it lands on, buy that one.

Sounds crazy right? Where’s the analysis, the methodology, the number crunching?

I say that not to annoy our compliance department (though I might be lucky enough to get a private sit-down chat with our compliance manager now), but to emphasise the quality of our incredible mid-tier stocks listed on the Australian Securities Exchange (ASX). Of course, I’m not really suggesting you should take the ‘drop a pin’ approach, but you get my point.

A decade ago, I absolutely could not have said that to you.

However, our mid-tier Aussie gold miners have learnt some hard lessons.

Rotating doors of management, financial engineering, using cash costs that didn’t really reflect the all-in costs of mining. Forward selling gold that they lost money on when they actually produced it…

There were a bunch of sucky outcomes for our gold miners last time around.

But today Aussie investors are better off because of it.

What almost wiped out some during the mid-2000s has led to an incredibly resilient, well-managed, cashed-up sector that has ditched short-term profit thinking for long-term success.

The average all in sustaining cost (AISC) for the top 10 producers is under AU$1,400 an ounce and most are selling it for a thousand bucks more (on average).

They have so much cash on the books it’s frankly embarrassing.

The top 10 have relatively low hedging across the books. Meaning that only a small portion of their profits are being crimped by forward selling gold.

In fact, some companies like Kirkland Lake Gold Ltd [ASX:KLA], AngloGold Ashanti Ltd [ASX:AGG], and Alacer Gold Corporation [ASX:AQG] have no hedging in place. Leaving every ounce sold from these guys is free to ride this gold bull market.

My point is this:

Gold in US dollar terms may have cracked two gees, but by the Dow-Gold Ratio — a hundred-year-old yardstick by the way — it’s still cheap.

Not only is this third gold bull market just getting started, it’s going to take many well-run gold stocks with it.

Hang onto your hats people, you ain’t seen nothing yet.

Until next time,

|

Shae Russell,

Editor, The Daily Reckoning Australia