Well, well, well it just got very interesting…

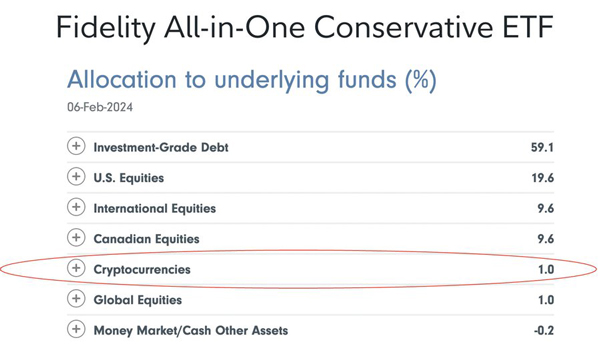

You see, last week, the Canadian arm of huge global money manager, Fidelity – they manage about US$4.3 trillion of investor funds – just announced they’d be adding Bitcoin [BTC] to their ‘All-in-One’ model portfolio.

Various funds they manage will invest between 1%-3% depending on the investor’s appetite for risk.

The Balanced option will have a 2% Bitcoin allocation while the more aggressive Growth option will aim for a 3% weighting.

But get this…

Bitcoin for the risk averse

This is the part that sent shockwaves through the investing industry.

You see, Fidelity Canada announced that even their Conservative option would be adding a 1% Bitcoin allocation.

Check it out:

|

|

|

Source: Fidelity |

Haters in mainstream finance are in disbelief!

I mean, they’ve spent the best part of a decade trying to convince you this asset has no value; that it’s the riskiest thing you could own.

(By the way that’s a decade of missing out on the world best performing asset by far too.)

And yet, now here’s the likes of Fidelity telling the world even Conservative investors should have some exposure to Bitcoin!

Who could’ve seen this coming?

Well, not to blow my own trumpet but it is something I said would happen one day.

Because properly understood, Bitcoin is the anti-fiat — the only viable hedge in a world dominated by never ending money printing and debt.

Which means it’s an essential part of all portfolios…

True back then, still true today

I wrote to my Crypto Capital subscribers a couple of years back that:

‘As a new monetary asset, bitcoin is in a way a hedge — insurance — against the collapse or devaluation of existing money.’

I continued:

‘…in my opinion it would be reasonable for a Conservative investor to allocate 5–10% of your fixed income portfolio to bitcoin.

‘So, 3–6% of your total portfolio.

‘Of course, if the risk of total loss scares you, you could reduce this to 1–2% too.

‘The point is, allocating part of your portfolio — even for the sceptics — makes sense when you take a nuanced and considered position on this stuff…’

This was put out in July 2022, and I remember it well, because I had a bit of a battle with our own compliance team to get it out!

The attitude of Bitcoin as simply a speculative risk — a ‘punt’ — was even more pervasive back then than it is today.

But what happened next?

The price of Bitcoin was around $32,000 and it fell as low as $25,000 in the months after my original report went out.

Today, Bitcoin is at $73,000 as I type:

|

|

|

Source: Coingecko |

But this is the important part to understand…

You see, it’s not just the price move that matters here.

It’s the comparative performance against its nemesis — the bond market.

As predicted, Bitcoin provided a much-needed hedge against a bond (fixed income) market which experienced a crash of ‘epic proportions’ in 2022 and 2023.

It was the ‘safe-haven’ asset people needed, not ‘government bonds’ which had their worst year in 250 years of data!

If this was true in the US and Australia it was even truer in places like Turkey and Argentina which saw their currencies go into freefall.

Now, of course, with Bitcoin up 160% in 2023 you might think you’ve missed the boat.

But that’s not the case at all.

Especially, with the existence of the newly approved Bitcoin spot ETFs (exchange traded funds).

It’s now as simple for the likes of Fidelity to add Bitcoin to their models as it is any other investment.

That’s why I expect to see more and more big-name firms start to add Bitcoin.

Right now it’s only the Canadian arm of Fidelity doing this but other international chapters will follow close behind in my opinion.

But if the entire organisation follows suit, you’re talking about Fidelity alone trying to add US$80 billion worth of Bitcoin (or around 8% of Bitcoin’s market cap).

Of course, such demand would drive up prices dramatically and one back of the envelope calculation I’ve seen gets Bitcoin to US$680k on Fidelity demand alone!

Take such predictions with a grain of salt of course. But at the same time, realise that Bitcoin’s provable scarcity is real.

So if every cat and their dog starts to emulate Fidelity, the upside potential is quite handsome.

Which is why the smarter allocators realise this is a race.

The earlier you add Bitcoin to your portfolio, the larger the potential returns, should Bitcoin continue to rise.

That goes for you too…

However, there are no guarantees and you need to remember that Bitcoin is still a highly volatile asset, and will have price swings…up and down.

Don’t miss the boat

You can wait until your super fund does it for you — likely they’ll be late to the party as the entrenched hatred of Bitcoin still runs deep in many pockets of mainstream finance, especially in Australia.

Or you can simply go out and buy some Bitcoin for yourself today. Maybe even through these ETFs?

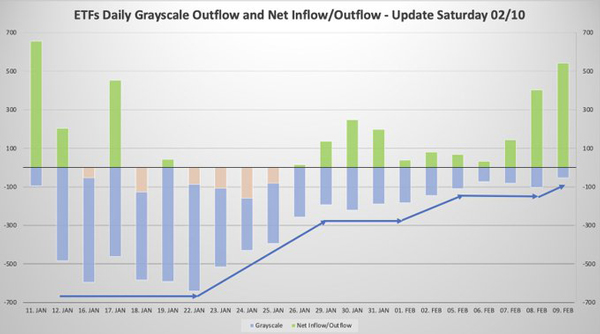

It’s clear that many people are already using these new ETFs to add some Bitcoin exposure.

It’s actually mind blowing how much demand there is right now.

On current metrics ETF buyers are buying 100x as much Bitcoin as is ‘mined’ (new Bitcoin minted) per day!!!

Check out the net flows:

|

|

|

Source: Allesandro Ottaviani |

I’m sure I don’t need to tell you what supply and demand does to the price of an asset.

But I’ll let economist Allesandra Ottaviani lay it out in a nutshell:

‘Last 2 trading days saw a Total Net Inflow, considering The Nine + Grayscale, of $947m —> $474m per day.

‘So far, we have reached $2.6b net inflow. We have 223 trading days left in 2024.

‘In case the net inflow remains at $474m/day —> $105.7b Summing it with the inflow so far: $108b in the year 2024.

‘Maybe too optimistic, but I definitely see $108b being closer to the real number than the $10b/$15b forecasted by many analysts.

‘Once we break $50k, $60k and then ATH, institutional FOMO will take place!’

If this pace of buying keeps up into April’s halving — the point when the supply of new Bitcoin drops from 900 BTC per day to 450 BTC — we’re likely to see a monumental move higher.

The good news?

It’s still not too late to front run this…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader