Kiwi cloud-based accounting software company Xero [ASX:XRO] is today’s stand-out performer on the ASX 200 as investors celebrate the company’s return to profits.

Xero’s shares are up by nearly 10%, trading at $135.73 per share despite the wider ASX 200 falling by -0.5% in trading so far today.

Xero’s path to this moment has been years in the making. In late 2022, it undertook a management change and restructuring in the hopes of returning to profitability.

For FY24, Xero has shown its first major success from those changes, posting a NZ$175 million profit. That’s well up from its (NZ$113 million) loss in 2023.

Early signs of this success were seen before today, with Xero’s shares up by 25% in the past 12 months.

But today’s full-year results cemented the extent of the change from last year, sending its stock racing to the top performer on the ASX 200 today.

So, has today’s share price jump made the company’s valuation too high for new investors, or is it a sign of better days to come?

Let’s take a closer look.

Source: TradingView

Xero hits the rule of 40

Xero has not had an easy run in the past few years. The company’s stock fell by over 50% in 2022 as slowing growth and falling profits troubled the New Zealand-based company.

In late 2022, Sukhinder Singh Cassidy was named CEO and started 2023 with the ambitious goal of reigning in costs while expanding subscribers to its Software-as-a-Service (SaaS) platform.

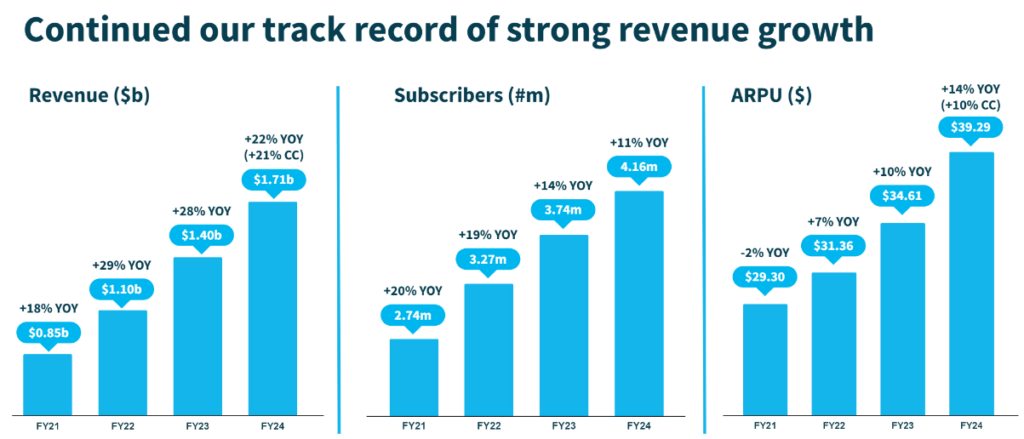

Today, these changes finally bear fruit for the company, as it reported a 22% YoY increase in operative revenue.

Subscribers also grew by 12%, adding 419,000 new customers to a total of 4.16 million.

That number was slightly lower than their 2023 growth of 14% YoY, but the difference was more than covered by the company’s increase in customer value.

Source: Xero Investor Presentation 23/05

The average revenue per user (ARPU) was up 14% to NZ$39.29, while customer churn was under a percent — both healthy signs in this macro environment.

The other way many people judge the health of SaaS companies is known as the ‘Rule of 40’.

This loose indicator says that a SaaS business should have revenue growth (in percentage terms), and free cash flow margins should combine to be 40% or over for a healthy SaaS company.

Xero proudly announced a 41% combined metric, that’s 9.1pp growth year-over-year.

CEO Sukhinder Singh Cassidy was especially proud to hit this milestone, saying today:

‘This result shows we’re doing what we said weʼd do. Weʼve delivered a strong and profitable FY24 result and Rule of 40 outcome, demonstrating our commitment to balancing growth and profitability. We have a clear and focused strategy to win on purpose, and Xero is positioned well as we move into FY25.’

‘This result shows we’re doing what we said weʼd do. Weʼve delivered a strong and profitable FY24 result and Rule of 40 outcome, demonstrating our commitment to balancing growth and profitability. We have a clear and focused strategy to win on purpose, and Xero is positioned well as we move into FY25.’

Beyond the growth, Xero also saw solid progress in its cost-cutting initiatives.

Gross margins were up from 87.3% to 88.2%, as the company said its hosting optimisation and other technology additions reduced the cost of its platform.

So, what can we expect from the share price moving forward, and is this a good time to buy?

Outlook for Xero

There was much to celebrate in today’s reporting, and it was hardly a surprise that investors have jumped on the stock. However, new investors should consider a few things before jumping in.

First, we must acknowledge the great work of the management and Mrs Singh Cassidy, a former Google president.

As the prior CEO left the company, the company had shed over $1billion in market cap and had seen its expansion into the US slow to a crawl.

That growth is starting to move again, but North America still stands at only 15% of total revenues.

What was once heralded as their clear runway of growth in the US and Canada hit fierce regional competition and headwinds.

Their latest earnings mentioned tailwinds for the region’s future but were light on details.

Conversely, the prior leadership’s focus on the UK continues with its success, with Xero’s operation revenue from that region at 24% and seeing stronger growth.

But when it comes to SaaS, the UK market doesn’t have nearly the competitive environment or customer base of the Americas.

If Xero wants to sustain its growth, it must not only continue to increase each customer’s value but find new ways to entice small and medium businesses within the US onto its platform.

The next factor investors should consider is timing.

Today’s positive share price response comes in the shadow of Nvidia’s aftermarket earnings report, which was released this morning.

With positive news from Nvidia, there has been an outsized response from ASX’s technology stocks.

In that light you can see Xeros huge share price move today as a combination of a good report and anticipation of a strong day on the Nasdaq tomorrow.

If investors want to add Xero as a longer-term growth option to their portfolios, then there could be better days to pick up the stock without paying such a premium in the near term.

If investors are looking for investments that focus on higher growth, albeit with more risk, the ASX currently holds other opportunities.

One of which could be in mining with a new theme developing.

The next major mining theme that could define your future

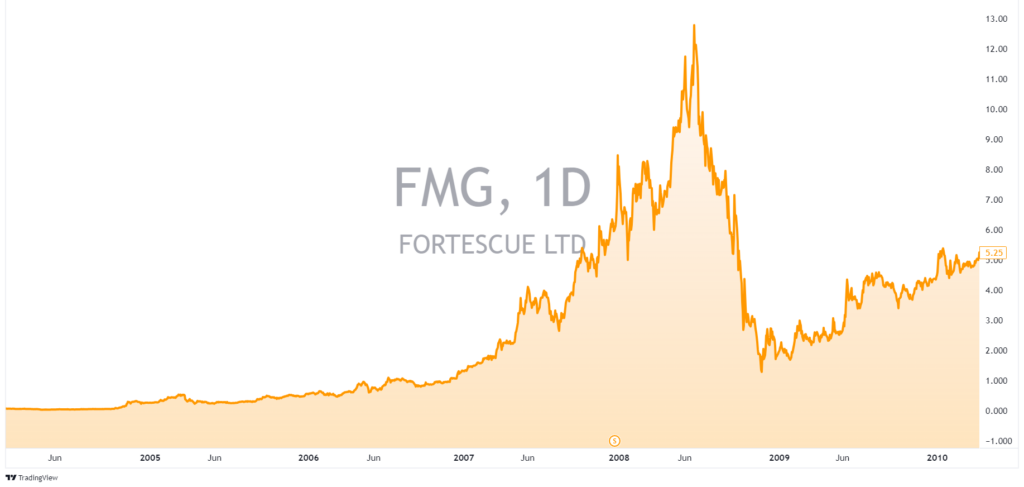

In the last mining boom, a little-known 2-cent share went to $10 in just five years.

That’s an incredible 50,000% return from Fortescue Metals.

Source: TradingView — FMG’s Breakthrough moment

But finding those kinds of winners in such a high risk sector is never easy and Fortescue’s iconic rise is unlikely to be repeated.

Our geologist and resources expert, James Cooper, set out to find the next big disruptors in Australia’s mining sector.

And he has five candidates that could emerge as victors in 2024 and beyond.

A new mega-theme is developing in mining, and we think five companies will be at the forefront of it.

The signs are all there, and you only have to follow the big miners’ actions to see that the smart money is heading this way.

If you want to learn more about what’s in store for Australian mining and our best stocks to play this next trend.

Then click here to learn more about the next potential breakout stocks.

Regards,

Charlie Ormond

For Fat Tail Daily