Xero [ASX:XRO] fell sharply on Thursday after the release of its 1H FY23 results. While operating revenue rose 30% to NZ$658.5 million, net loss after tax widened 172% to NZ$16.1 million.

Xero also announced the upcoming retirement of CEO Steve Vamos, who helmed the business for five years.

Former Google senior executive Sukhinder Singh Cassidy will take charge in February 2023.

XRO shares were down 10% late on Thursday. The accounting software stock is down 55% year to date.

Source: Tradingview.com

Xero revenue rises 30%, but losses mount

Here are the key results from Xero’s 1H23 (measured against 1H22):

- Operating revenue up 30% to NZ$658.5 million

- Net subscriber additions decelerated 17% from 272,000 to 225,000

- Total lifetime value of subscribers up 30% to NZ$13 billion

- Net loss after tax up 172% to NZ$16.1 million

- Total subscribers up 16% to 3.5 million

- Annualised monthly recurring revenue (AMRR) up 31% to NZ$1.5 billion

- EBITDA up 11% to NZ$108.6 million

While revenue growth was strong, expenses remained elevated.

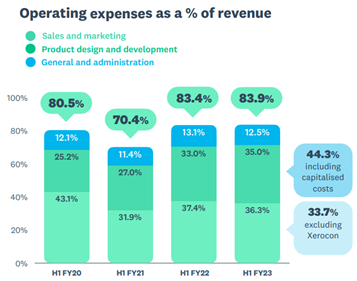

In fact, operating expenses rose slightly as a percentage of operating revenue from 83.4% to 83.9%.

Additionally, product design and development expenses rose to 35% of operating revenue, up from 33%.

Source: Xero

Xero attributed the increase to its investment in ‘global product innovation and platform delivery’.

CEO Steve Vamos commented on Xero’s performance:

‘Our strong revenue growth momentum supports our strategy to invest, with discipline, to take advantage of the significant opportunity ahead as we continue to drive efficiencies in our business. This strong result underlines the quality of our business and the value we’re generating as more customers join us, do more with our open platform and stay with us for longer.’

Expenses continue to weigh Xero down

Due to inflationary impacts and changes within the company, Xero expects product expenses in proportion to operating revenue to be higher in FY23 than FY22.

Nevertheless, the company is seemingly undeterred, working on growing and enhancing its technology platform and investing in opportunities that arise.

‘Xero will continue to focus on growing its global small business platform and maintain a preference for reinvesting cash generated, subject to investment criteria and market conditions, to drive long-term shareholder value,’ XRO management said.

‘Total operating expenses (including acquisition integration costs) as a percentage of operating revenue for FY23 are expected to be towards the lower end of a range of 80-85%.’

Source: Xero

Five bargain ASX stocks

Inflation is hitting many companies quite hard. Xero itself said it is managing inflationary cost pressures right now.

That’s making investors less upbeat about the near term.

However, this can present mispricing opportunities for long-term investors.

At times like these, some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls the ‘best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Kiryll Prakapenka,

For Money Morning