The Mongolian-focused explorer Xanadu Mines Ltd [ASX:XAM] share price has soared today thanks to promising results from its Kharmagtai porphyry copper and gold project.

The XAM share price is up 31.25% at time of writing to trade at 4.2 cents per share.

Source: Tradingview

The company’s share price has struggled since the middle of last year, despite a rapidly rising copper price and historic gold prices.

However, interest in XAM’s 1.9 million tonne copper and 4.3 million ounce gold project could return with today’s impressive results.

Did it cross your mind to invest in gold ahead of further interest rate cuts? Download your free report now.

What’s caused the change?

Back in October 2018, XAM announced major increases to their Kharmagtai Open-Cut Resource.

And as I previously stated, it is now a multimillion-ounce gold project with almost two tonnes of copper.

But if you have a look at the Xanadu Mines share price at the time, there was very little change.

Why?

I suspect that investors already had a decent idea of what kind of mineralisation XAM was sitting on before their resource estimate.

Today, I think investors have been pleasantly surprised, having not seen drilling results for some time.

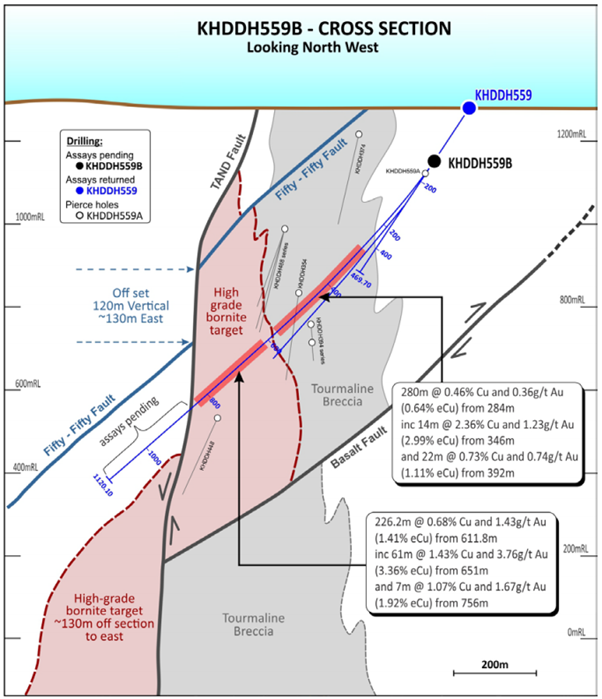

XAM announced the results of a single drill hole today that intersects a broad zone of high-grade bornite mineralisation south of the Stockwork Hill resource.

A hole that XAM says expands the high-grade bornite zone beyond the defined resources.

The assay shows:

- 2m at 0.68% copper and 1.43 grams per tonne (g/t) gold from 611.8m

- Including 175m at 0.84% copper and 1.83g/t gold from 615m

- Including 61m at 1.43% copper and 3.76g/t gold from 651m

Not only are these very broad areas of mineralisation, but the copper grades are above average.

Source: Xanadu Mines

Chief Executive Officer Dr Andrew Stewart commented on the result.

‘This hole provides a snapshot of what the lower zones of mineralisation at Kharmagtai could look like with increasing gold to copper ratios. The tenor of gold within the bornite is impressive, containing two to four grams of gold for every percent copper.

‘This hole materially expands the width of the high-grade bornite zone and will help guide drilling for additional high-grade extensions.’

What does this mean for the Xanadu Mines share price?

Well, it could mean things are heating up for XAM.

The explorer said we could expect a new mineral resource estimate next month.

XAM also said there would be an increase in news flow from Phase 1 drilling results expected through the first quarter of the calendar to support a planned resource update.

An updated mining options study is also on the cards given the new results, although XAM did not say when they planned to release this.

Given the size of the operations and the interest given to today’s announcement, upwards momentum could creep back into the XAM share price this year.

Especially given the rise in the price of copper.

Now with Australia set to surpass China as the world’s gold capital, Aussie gold stocks could be set for some solid gains over the coming years. In her latest report, gold expert Shae Russell breaks down what Australia becoming the new gold ‘epicentre’ means for gold and your Aussie gold stocks. Click here to download the free report.

Kind regards,

Lachlann Tierney

For The Daily Reckoning Australia

Comments