Woodside Energy Group [ASX:WDS], operator of oil and gas assets and hydrogen exploration, has briefed markets with its full-year report for 2022.

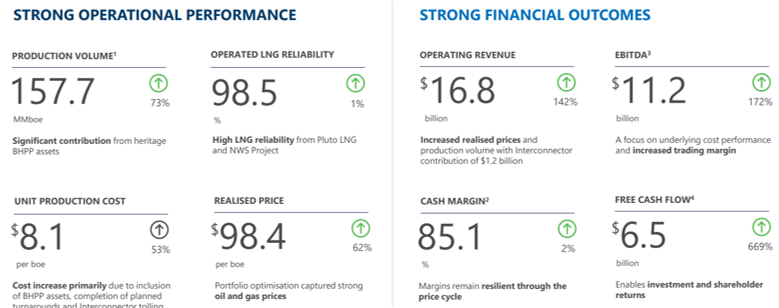

The energy group posted net profit after tax (NPAT) of US$6.49 billion — 228% up on the year before — and said record output was underpinned by ‘outstanding performance’ in LNG, which operated at 98.5% reliability throughout the year.

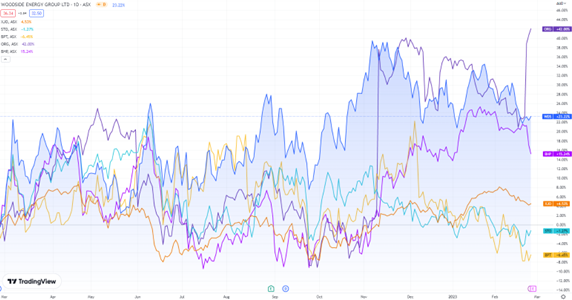

Woodside’s share price was flat on Monday morning, worth $34.60 each.

It has slipped more than 7% in the past month; however, over the last full year, it has gained nearly 24%.

WDS is majorly in line with the rest of its industry, up 18% on the ASX 200:

Source: TradingView

Woodside claims higher profit and record production

The fuel producer reported its full-year earnings and operations for 2022, declaring NPAT of US$6.49 billion.

This was a 228% increase on the previous year and saw underlying NPAT rocket 223%, with US$5.23 billion.

Operating revenue surged a solid 142%, with a total of US$16.82 billion. Annual sales volume was 168.9 MMboe (million barrels of oil equivalent), at a realised price of $98.4 per boe.

The company posted free cash flow of $6.54 billion, and cash on hand by the end of the year totalled $6.19 billion, though WDS still has net debt of $571 million, with a gearing of 1.6%.

Woodside decided on a fully franked final dividend of US$1.44 a share. The dividend was based on underlying NPAT, leading to a full-year shareholder distribution of $4.8 billion.

Woodside’s CEO Meg O’Neill claimed the results were achieved on both strategy and its merger with BHP’s petroleum business back in June.

O’Neill commented:

‘In what was a momentous year for Woodside we achieved the goals we set ourselves ahead of the merger, implementing initiatives to deliver the targeted $400 million in synergies ahead of our original schedule.

‘Our net profit after tax rose on the back of the increased production and sales delivered by the expanded portfolio and higher global prices for our products. In 2022 our realised price rose 63% year-on-year to $98.4 per barrel of oil equivalent.

‘Throughout the year we took steps to maximise our exposure to favourable prices, expanding our global marketing presence and increasing trading activities.’

Looking ahead with WDS

Woodside said that seven of 23 wells have now been completed at Sangomar, while the Singapore facility is to be relocated ahead of first oil late in the year.

The Scarborough and Pluto Train 2 projects in WA are now 25% complete and remain on track for first LNG production in 2026.

O’Neill hopes that 2023 will see progress for Woodside’s pipeline of growth opportunities, including its Trion project in offshore Mexico. She alluded to evaluation of bids for major work scopes, execution plans, and narrowing cost estimates in support of final investment decision (FID) readiness this year.

O’Neill says the group is also preparing for ‘FID readiness’ for the H2OK project in Oklahoma, which would be the first major project to be sanctioned under Woodside’s $5 billion new energy and lower-carbon 2030 investment plan.

Source: WDS

Australia’s next commodity boom

On the topic of fuel and mining, our resources expert thinks the Australian resources sector is set to enter a new era based on the world’s transition to carbon-emission-free energy.

It could be an era that paves the way for commodity corporations to make big gains, just like Fortescue Metals when it struck gold — well, iron — the last time around.

James Cooper, trained geologist turned commodities expert, is convinced ‘the gears are in motion for another multi-year boom in commodities’…and the best part is that Australia and its stocks are in prime position to reap great benefits.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia