While oil markets rallied off of easing Chinese COVID restrictions and depleting US crude stockpiles, Woodside Energy Group [ASX:WDS] hosted an investor briefing, highlighting and updating the company’s direction at this ‘critical time.’

US oil company West Texas Intermediate was sitting at US$80 a barrel yesterday, while the US released reports that its crude inventories dropped 12.6 million barrels in a week.

However, Woodside was more concerned with the ongoing energy crisis linked with the war in Ukraine, which continues to disrupt global markets and is ‘highlighting the importance of energy security and affordability’ and impacting its own production guidance.

Woodside Energy’s share price was volatile earlier this morning. However, year-to-date, it has gone up by 70% and was 73% above the market average.

Source: tradingview.com

Woodside’s investor briefing

Today the energy explorer’s CEO, Meg O’Neill, provided updated insights pertaining to projects, production and spending at the company’s investor briefing.

Off the back of new projects, the energy group will target more than 4% annual growth for its production from next year through to 2027, with Woodside providing full production guidance of 180–190 million barrels of oil equivalent on Tuesday.

O’Neill stated:

‘Our expanded portfolio of long-life assets in Australia, the US, Senegal and the Caribbean offers the scale, diversification and resilience to deliver enduring value to shareholders.

‘We are successfully executing world-class growth projects at Sangomar in Senegal and Scarborough/Pluto Train 2 in Australia, which are on target for first production in 2023 and 2026 respectively. The Mad Dog Phase 2 development in the Gulf of Mexico is also expected online in 2023.

‘At Trion in Mexico, which contains around 500 million barrels of oil, the team is working towards being ready for a final investment decision in 2023.’

The development of the Trion oil project will cost between US$6–8 billion and is expected to reach production by 2028.

The energy supplier also revealed that its operating cash flow remains forecasted between $7–9 billion across the next five years.

WDS continues to hold debt in undrawn facilities of $4.1 billion, which it believes is a strong profile that highlights a solid balance sheet and offers liquidity freedom for capital investments and for its shareholders.

Woodside intends to invest $5 billion in new energy and low carbon services and touched on its recently announced hydrogen refuelling station to be set up near Perth, which already holds an H2OK hydrogen project contract in the US.

The hydrogen station is still pending an investment decision, which is expected next year, with production slated for 2025.

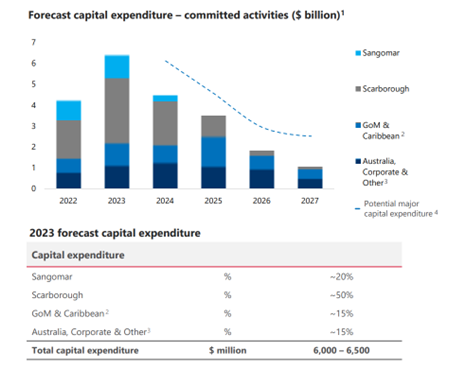

Source: WDS

On Tuesday, Woodside revealed its full-year capital expenditure guidance for 2023, which was revealed as between US$6–6.5 billion, surpassing market predications.

CEO Meg O’Neill stated:

‘At this critical moment in time, with the world now feeling the impact of an energy security and affordability crisis, Woodside is producing and developing the products and services needed for both decarbonisation and to support growing populations and economies.’

O’Neill spoke of Woodside’s LNG market strategies, which cater for changing global shifts, expanding into the Atlantic Basin, and increasing the volume of short-term trading.

The energy company is utilising long-term relationships to diversify its customer base and position itself as favourable for buyers of secure energy supply.

Currently, the company has already delivered $200 million in initiatives for post-merger synergies and expects to reach net synergies of more than $400 million by 2024.

Make way for a commodities boom

Energy resources is a hotly debated topic, and surprisingly, there are plenty of commodities investors are still currently neglecting to tap into.

Our resources expert and trained geologist James Cooper thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning