Get ready – gold stocks could be set for another rally.

The catalyst?

Well, the 2024 December quarter results came out…and they looked great. Some gold companies reported operating margins that exceeded 60%.

Most producers are building cash from their operations.

Clearly, we just saw a bonanza quarter.

It’s possibly the best quarter in the past decade!

Results like these could set them up to break their record prices last October.

We could see bigger dividends and more corporate activity coming up!

You might wonder if these are all too good to be true or fully priced.

Are gold stocks in a bubble? How much upside is there for gold stocks?

After all, those who bought into the euphoria of 2011 and 2020 suffered significant losses in the years that followed when the momentum and buying interest reversed.

Now that may happen. But with the way things are going, I don’t believe that’s the case.

Let’s explore this today.

Market brushes off the Federal Reserve,

gold sets another record

Last week the Federal Open Market Committee (FOMC) met to discuss monetary policy. In its public statement, the committee is worried that tariffs and Trump’s policies will slow down on interest rate cuts, at least for now.

Never mind that the Trump administration has slated to strip down the government of much bureaucracy and waste by removing departments focused on Diversity, Equity and Inclusion (DEI – as Elon Musk puts it – ‘didn’t earn it’). Lower costs and higher productivity HELP remove inflation.

Or the move to encourage the drilling and exploration of fossil fuels and withdraw from The Paris Climate Accord could help bring back cheaper energy would further reduce inflation.

Don’t worry about that. The Federal Reserve just wants to stand in the way as it’s used to calling the shots on the economy.

Fortunately the market is not having any of that.

Normally this message should cause the US dollar to strengthen and gold to retreat.

Well, not this time.

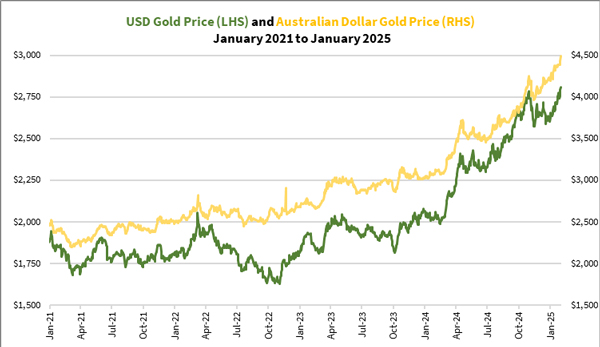

Gold broke yet another all-time high last Friday:

| |

| Source: GoldHub Australia |

This uptrend looks like it’s got more momentum.

Sure gold’s rally in the last five years has been exceptional. Given how far it’s run, a correction seems reasonable.

But the current setup suggests the rally should continue.

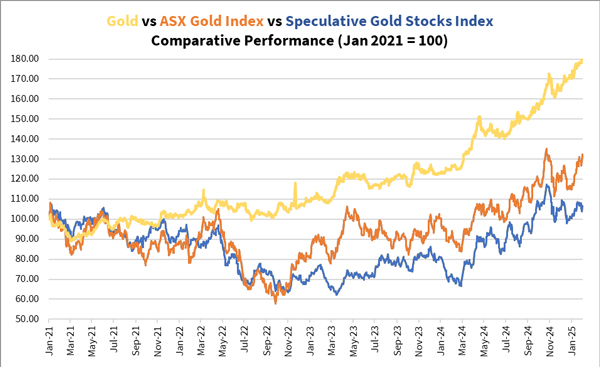

And this should benefit gold stocks, which have lagged gold all this time, as you can see below:

| |

| Source: GoldHub Australia |

Awakening the gold stock rally

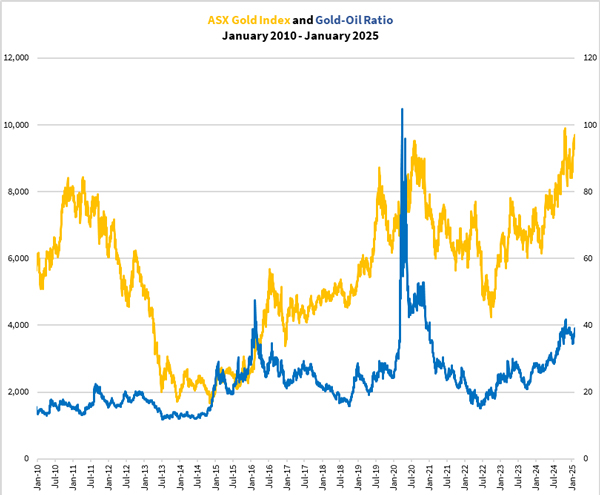

Those who have followed me for a long time know there’s one metric I like to use to gauge the prospects of gold stocks.

It’s the gold-oil ratio.

The ratio measures how many barrels of oil an ounce of gold can buy. Any gold producer’s operating margin is linked to the gold-oil ratio.

Gold producers earn revenue selling gold while they spend a significant amount on fuel to operate their machinery. Moreover, the costs of living and doing business are linked to the price of oil. A higher price of oil can increase expenses, thereby reducing the operating margin, and vice versa.

If you see the gold-oil ratio and the ASX Gold Index [ASX:XGD] performance history below, you’ll see how the gold-oil ratio leads the index performance. The ratio peaks and troughs just before the index:

| |

| Source: GoldHub Australia |

Historically, gold producers flourish when the gold-oil ratio is above 25. Currently, it’s trading at almost 38.

The ratio trading at a historically high level is consistent with the record performance of many gold producers.

What’s important is looking ahead. And for now, the prospects are bright.

The Trump administration’s energy policies include withdrawing from the Paris Climate Accord and supporting the exploration and production of oil and gas domestically. These will likely keep the price of oil lower for longer.

Combine this with the economic policies to bring back manufacturing and boost exports require a weaker US dollar.

All these factors favour gold and gold stocks.

That means many gold stocks still have strong upside potential.

While some have set new records, many pulled back a lot in the bear market in 2022-23. But these companies have quality assets, astute management, and growth plans that could see them deliver outperforming returns in the coming 18 months.

How can you identify these companies from those that won’t deliver actual progress?

Picking winners out of over 150 gold mining companies isn’t an easy task.

You’ve come to the right place for help.

My service The Australian Gold Report offers a comprehensive guide with the aim to help you build a diversified precious metals portfolio.

Learn about where to buy physical bullion and how to invest in commodity ETFs, established gold producers or speculative explorers and developers.

We have a report waiting for you. If you’re interested, click here to learn more.

Join me next week for more insights on ideas to invest across the different stages of the gold price cycle.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments