Small-cap gold miner Red River Resources [ASX:RVR] officially started production at its Hillgrove Gold Operation on 29 December.

Today, the miner announced that further exploration at Hillgrove has turned up additional high-grade gold, pushing its share price to within reach of its 52-week high.

Source: Tradingview

At time of writing, the RVR share price is up 5.36% or 1.5 cents to trade at 29.5 cents per share.

2020 was a solid year for RVR, generating a 12-month return of 100%.

The question is: Can RVR build on the progress it made last year?

RVR begins 2021 with high-grade gold finds

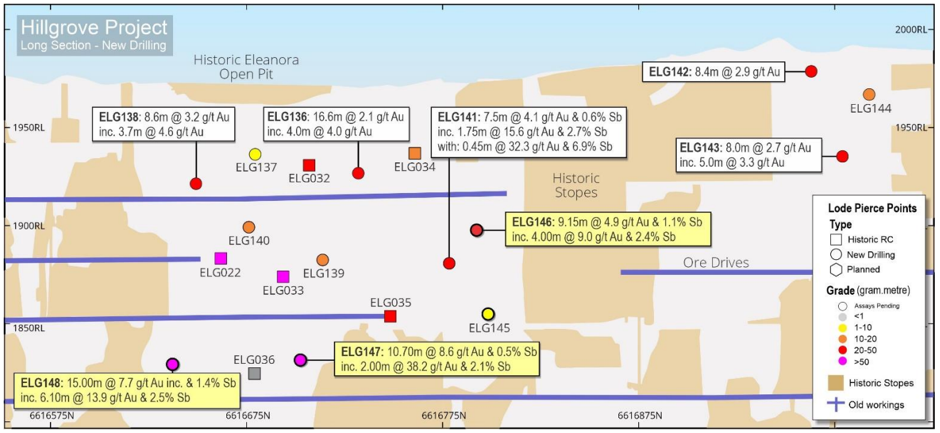

Today, RVR released results from its follow-up Eleanora drill program at Hillgrove, which is almost complete.

Highlights include:

- 00m at 57.2 grams of gold per tonne (g/t) and 1.6% antimony (Sb) from 188.00m

- 70m at 8.6 g/t and 0.5% Sb from 180.6m, including 2.00m at 38.2 g/t and 2.1% Sb from 188.00m

- 15m at 4.9 g/t and 1.1% Sb from 110.45m, including 4.00m at 9.0 g/t and 2.4% Sb from 112.0m

- 00m at 7.7 g/t and 1.4% Sb from 156.0m, including 6.10m at 13.9 g/t and 2.5% Sb from 157.00m, including 1.10m at 30.1g/t and 2.0% Sb from 162.0m

RVR say the results confirm the presence of high-grade gold-antimony mineralisation within the Eleanora vein system.

REVEALED: What’s Next for Aussie Gold Stock Prices? Learn more.

And demonstrate the potential to develop Eleanora as an additional feed source to the Hillgrove Operation.

Source: Red River Resources

The miner is currently producing gold dore, a semi-pure gold alloy, via its Bakers Hill stockpile before moving to underground production in Stage 2 of operations.

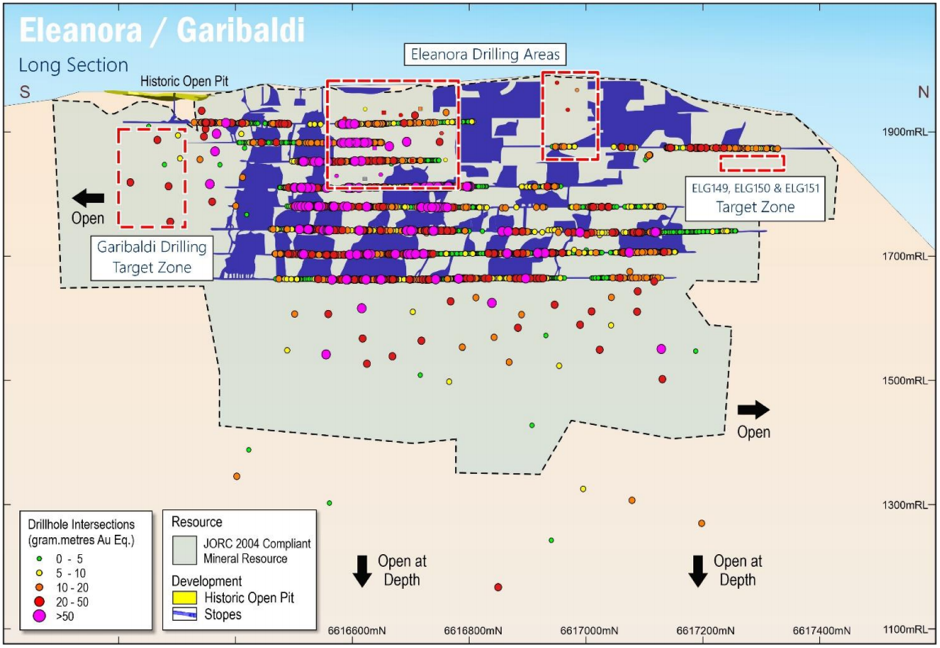

RVR is planning drilling over the next three–four months to support the conversion of the Eleanora-Garibaldi JORC 2004 Mineral Resource to a JORC 2012 Compliant Mineral Resource.

Source: Red River Resources

What can we expect from RVR this year?

With production now underway, we could see something we don’t see from a lot of gold explorers — revenue.

Meaning RVR could be in a position to fund exploration themselves rather than relying on capital raisings.

An attractive prospect for current RVR shareholders.

We have also seen a solid return in the price of gold over the past month or so, which is retracing the losses it made through the middle of 2020.

If the gold price continues to build momentum through the first few months of 2021, we could see some nice gains in the RVR share price.

The recent recovery in the gold price shows there is plenty of upside still remaining, especially with Australia shaping up to be the new gold capital of the world. In her latest report, gold expert Shae Russell breaks down what Australia becoming the new gold ‘epicentre’ means for gold and your Aussie gold stocks. Click here to download the free report.

Kind regards,

Lachlann Tierney

For The Daily Reckoning Australia

Comments