At time of writing, the share price of Wisr Ltd [ASX:WZR] is up more than 7%, trading at 22.5 cents.

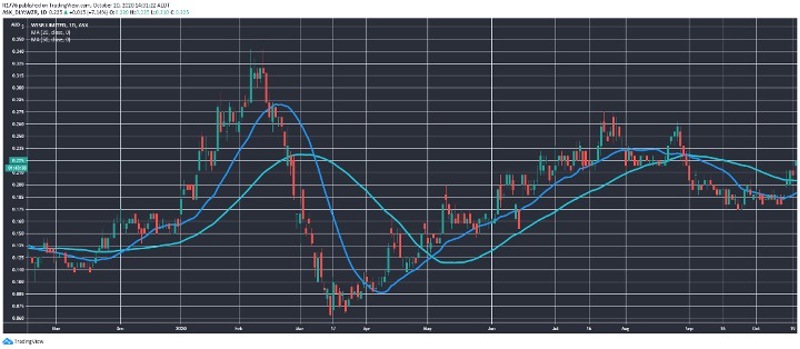

The WZR share price surged from the March market lows, but is yet to reclaim the heights of the pre-lockdown period:

Source: Tradingview.com

There were some interesting bits of info in today’s updates which point to Wisr’s future direction.

We unpack what it means for the WZR share price.

Wisr share price down then up

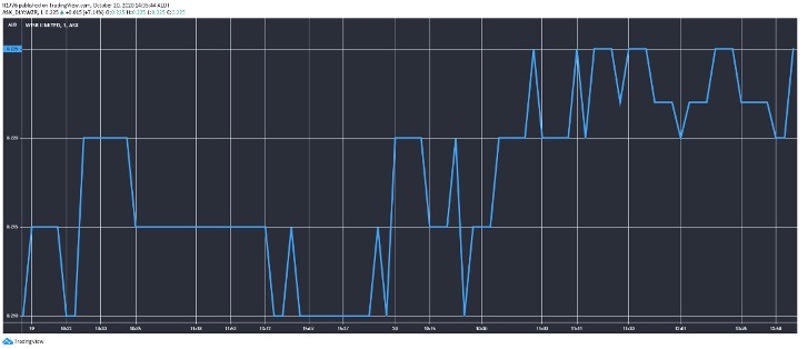

This is what intraday trading of WZR shares looked like:

Source: Tradingview.com

So clearly some positives in there for WZR investors.

Since we last covered Wisr, when the share price was sitting at 23.5 cents, it’s possible it may puncture that mark in the days ahead.

Here are the key metrics as I see it for the neo-lender:

- 358% revenue growth in Q1FY21 versus Q1FY20

- 90-plus day arrears down .43% to 1.01%

- Strong Net Promoter scores

- $32.1 million in cash

So, the takeaways are that they are starting to get revenue traction, the quality of their debt is improving, people like the service, and they have cash to pour into growth.

This doesn’t mean macroeconomic headwinds won’t affect them, but the cash and quality debt could act as a buffer.

Outlook for WZR share price

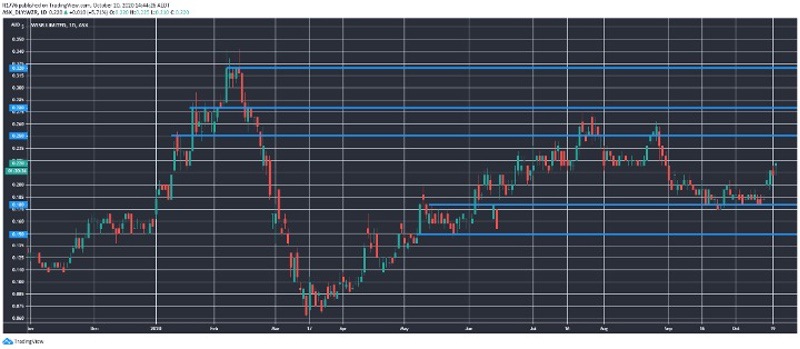

I’ve marked some key levels out on the WZR share price chart below:

Source: Tradingview.com

With the Victorian economy slowly reopening, this is certainly a boost.

If the WZR share price can crack through the first level at 25 cents, this would be a positive.

Then if it pushes further to say 28 cents and manages to beat the selling that might come in at this level, this would be a further boon.

Ultimately though, Wisr’s story is more to do with the unbundling of banking as an institution.

Banking as a service is certainly the future, and if you want the names of three small-cap fintechs that are currently smaller than Wisr, you can get that here.

It’s a quality read and covers some exciting companies.

Highly recommended.

Regards,

Lachlann Tierney,

For Money Morning