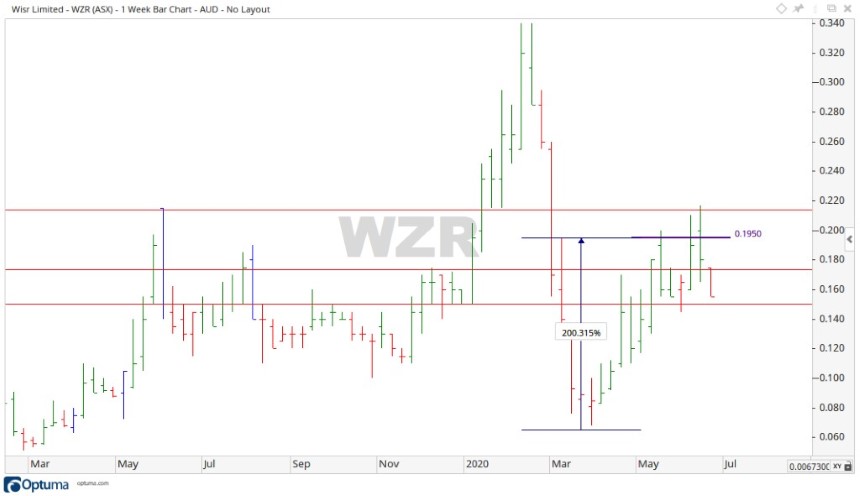

At the time of writing, the Wisr Ltd [ASX:WZR] share price is up dramatically, up over 25% to 19 cents. The fintech lender had seen a large fall in its stock price with the emergence of COVID-19. Losing over 80% of its stock price.

Source: Optuma

Download now: Three ASX fintech stocks taking on the banks (and winning)

What’s been happening with Wisr share price

Like the rest of the market, the Wisr share price experienced a significant decline with the emergence of the novel coronavirus.

Wisr, being a non-traditional lending company, was perhaps able to adjust more quickly to the shutdown that the virus caused.

In March 2020, Wisr staff held a successful test of their work from home abilities, managing to complete a record number of loan originations, without a single staff member in the office.

Wisr CEO Anthony Nantes said:

‘Whilst the Australian economic outlook has changed, Wisr is very strongly capitalised, with a business model able to rapidly adjust to changes in economic outlook. We are writing prime quality credit, which historically performs well through a credit cycle.’

RIP Commonwealth Bank? The Aussie fintech stealing CBA’s credit card profits.

The WZR Share Price Moving Forward

16 June 2020 saw an announcement from the company outlining their rapid response to COVID-19 conditions, and exceptionally low exposure to high-risk COVID-19 sectors.

More remarkably, new loan originations grew 48% in May 2020, compared to April 2020.

Customer support requests have also returned to pre-COVID-19 levels.

It was also noted that the month of May saw a record amount of total weekly settled loans, going over $4 million for the first time ever, all while employees worked from home.

Source: Optuma

Looking at the chart you can see the Wisr share price rocketed over 200% up from the low set in March of six cents, to the current price at the time of writing of 19 cents. Should this continue, the next natural resistance level of 21 cents may come into focus.

Should the Wisr share price turn to the downside, then the levels of 17 and 15 cents may come into play.

Fintech and the companies pushing the big banks to their limits are a frequent topic in our daily e-letter. In it, we also talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Regards,

Carl Wittkopp,

For Money Morning

Comments