At time of writing, the share price of Wisr Ltd [ASX:WZR] is up more than 5%, trading at 20 cents.

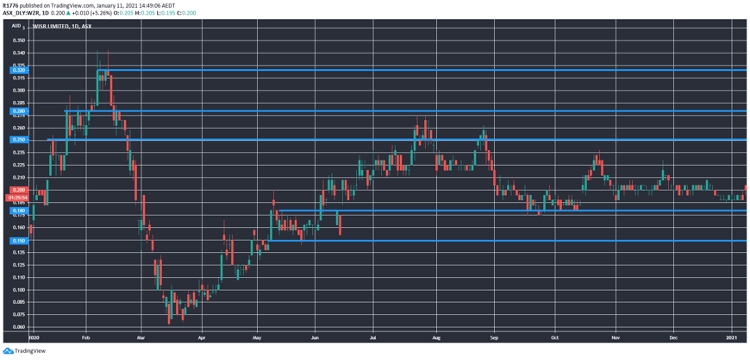

The WZR share price bounced sharply off of the March low, but is now trading sideways in a range:

Source: tradingview.com

We take a quick look at the new numbers and the outlook for the WZR share price.

Strong new numbers from Wisr

Here are the highlights from today’s announcement:

- ‘Record new loan origination growth of $83.8 million1, a 35% increase on Q1FY21 ($61.9 million)

- ‘This represents a 165% increase on Q2FY20 ($31.6 million)

- ‘Total loan originations of $390.5 million as at 31 December 2020

- ‘Improved Q2FY21 average credit score of 757 validates the Company’s risk governance, lending model and continued ability to attract Australia’s prime customers away from the incumbents, whilst driving strong growth’

Initially focusing on the personal loan market, Wisr also highlighted the launch of its secured vehicle loan product.

Outlook for WZR share price

It may be frustrating for investors to see consistent strong growth numbers, but not see the WZR share price take off.

It’s been essentially moving sideways since September 2020.

I think this is largely due to macro concerns about consumer spending and the strength of the Australian economy.

It would be encouraging to see their strong average credit score, meaning they’ve got an eye on mitigating risk.

I also suspect a strong rebound from the Australian economy on a successful vaccine rollout would give Wisr a further boost, should they continue eating into Big Four market share.

There’s no doubt ASX-listed fintech stocks are slowly becoming a more regular part of investors’ portfolios, such is their potential.

Get the names of three other fintechs for the watchlist in our special report on the topic right here.

One’s a niche BNPL stock, the other does data analytics for small businesses and facilitates cross-border transactions.

It’s a great read, and best of all it’s free.

Regards,

Lachlann Tierney

For Money Morning