The personal loan company Wisr Ltd [ASX:WZR] recently announced record growth in Q2 FY21.

This saw the WZR share price move up 7.14% to trade at 22.5 cents at time of writing.

Source: Optuma

The growth of Wisr Ltd

2020 is the year of the fintech companies.

The combination of the COVID-19 pandemic forcing people to stay home and the easy access to new types of credit proved to be incredible for many that operate in the space.

Wisr took an 80.88% drop in the share price in March when the pandemic hit.

They are now recovering on the back of strong growth of the loan book.

Source: newswire.com

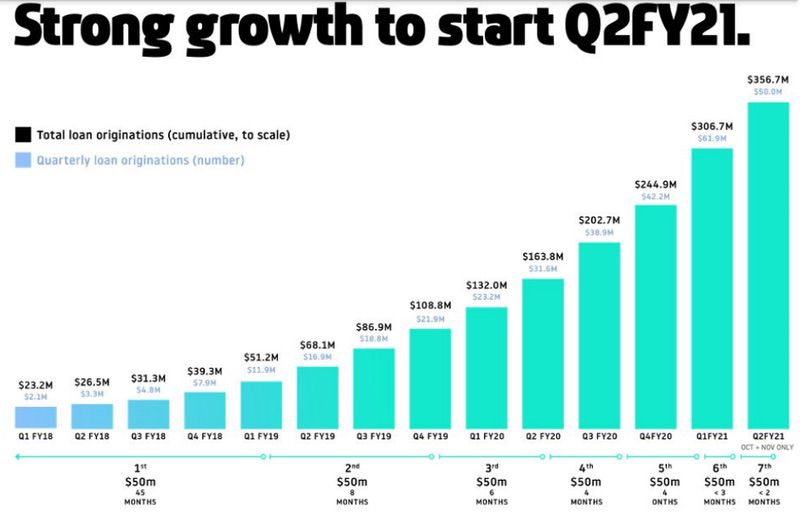

The company listed on the All Ordinaries [XAO] in 2018 and as you can see, quarter on quarter, Wisr have seen an increase loan growth.

With $50 million in new loan originations within the first two months of Q2 FY21 alone.

Mr Anthony Nantes, Chief Executive Officer, Wisr said:

‘It’s been a fantastic start to this period, as we look to continue our unblemished record of delivering quarter-on-quarter growth.’

Continuing:

‘Wisr’s clearly differentiated strategy and business model in this sector, unique consumer proposition and technology platforms are driving record growth and has positioned Wisr strongly to continue disrupting the consumer lending sector’

The Wisr share price and the future

WZR took a huge hit to the share price at the start of the year.

But the loans kept growing throughout the year helping the share price bounce back.

Source: Optuma

From the high in July the WZR share price fell back to the 17-cent level, above the 50% retracement level of the previous run up.

Moving up from here is a sign of strength.

Should the price continue the move up then the levels of 24 cents and 27 cents may come into play.

Breaking the 27-cent level would be a strong bullish sign.

Should it retrace then the level of 17 cents may be enough to halt the fall.

Wisr is showing continued growth with no sign of the pandemic slowing it down. Falling to the 50% level and moving up again tends to be a good sign for the future.

If you are looking for more exciting fintechs, check out our free report on the topic.

It profiles three companies to keep an eye out for in the space in the months and years to come.

They are all small-caps that are carving out unique niches in finance.

Regards

Carl Wittkopp

For Money Morning