At time of writing, the share price of WiseTech Global Ltd [ASX:WTC] is up a whopping 28.3%, trading at $26.70.

WiseTech announced earnings today and the numbers were clearly better than expected.

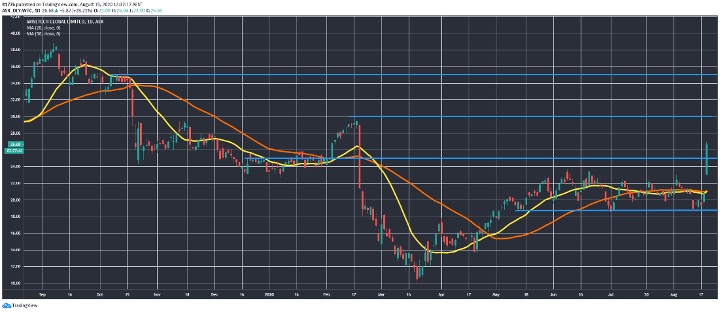

Here are some key levels, as well as the 50- and 20-day moving averages for the WTC share price:

Source: tradingview.com

You can see momentum waned over the past two months, but the WTC share price has punched through resistance at $25. We can look at the WTC earnings and its move to slow down acquisitions.

WTC share price perhaps unfairly maligned

As evidenced by the downtrend dating back almost a year through to the March market lows, some were sceptical about WTC’s prospects.

This included short-seller research from J Capital, which suggested its aggressive acquisition policy wasn’t yielding the desired results.

WTC’s share price growth from the March market lows was muted in comparison to other WAAX stocks, including Altium Ltd [ASX:ALU], Xero Ltd [ASX:XRO] and Afterpay Ltd [ASX:APT].

WTC is now trading at a lower P/E ratio than all three other companies, at 72.

XRO’s multiple is north of 4,000, while ALU’s sits at 103. APT doesn’t even have one yet, because it’s yet to return a profit.

Anyway, here are the headline numbers from WTC’s earnings:

Source: WiseTech Global Ltd

These are strong numbers given the impact of the pandemic on the global logistics industry.

A slightly smaller total dividend would normally be a negative, but it’s doubtful many people are attracted to WTC shares for this reason.

In quotes carried in The Australian Financial Review, WiseTech chief executive Richard White said: ‘Having completed over 40 acquisitions in recent years, we have now assembled significant resources and development capability to fuel our CargoWise technology pipeline and therefore intend to slow our acquisition activity in the near term.’

Which means in FY20, the company will be spending more on R&D.

Outlook for WTC share price

It will be interesting to see if the upwards momentum in the WTC share price can continue and it can punch through the two levels marked out above.

In the short term, it may retest the $30 mark as the market generally moves sideways.

The pivot to growth over value was discussed recently, and I suspect this will continue.

The fact that WTC was able to grow its EBITDA in challenging market conditions is impressive, to say the least.

If you missed the WTC boat in its early days, we have a great report on four well-positioned small-caps that could follow a similar trajectory. You can get that report right here.

Regards,

Lachlann Tierney,

For Money Morning

Comments