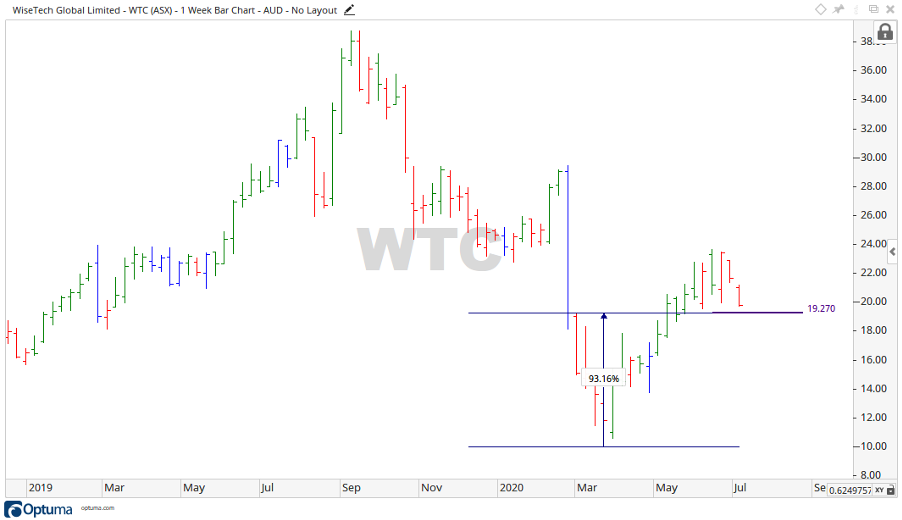

After hitting a low in March, shares of WiseTech Global Ltd [ASX:WTC] — the provider of cloud-based software solution for the logistics industry — are clawing their way back up.

At time of writing, the WTC share price is down 1.62%, trading at $19.47.

This is up more than 90% from the March 2020 low.

WTC shares took a hammering with the onset of the novel COVID-19 virus, and today we talk about what’s moved it back up and where it may go.

Source: Optuma

What’s happened at WiseTech…

In a recent article we discussed the fall in share price WiseTech suffered with the onset of COVID-19.

Taking a fall of 64.48% from the high in February 2020 to the low in March 2020.

At the end of April, the company released a business update and FY20 guidance was reaffirmed.

This outlined a growth in revenue from 21% to 29% for FY20 and a strong balance sheet, with a net cash position of $230 million on 31 March.

At the end of May the company made more announcements, outlining renegotiated earnout arrangements. According to the company, the new arrangements will allow WiseTech to reduce, and in some cases remove, certain cash liabilities.

WiseTech Global Founder and CEO, Richard White, said:

‘The current environment provided us with the opportunity to restructure previously agreed acquisition earnouts, ensuring we can better drive those resources, accelerate their contribution to CargoWise development, and further improve our commercial efficiency.’

Perhaps the biggest news today though, was that founder and CEO Richard White is selling $46 million worth of his WTC shares.

Big insider sales sometimes rattle investors and today may be a similar story.

Where to from here for WiseTech

The news of cuts to the company’s liabilities may be playing a role in the rise up the charts.

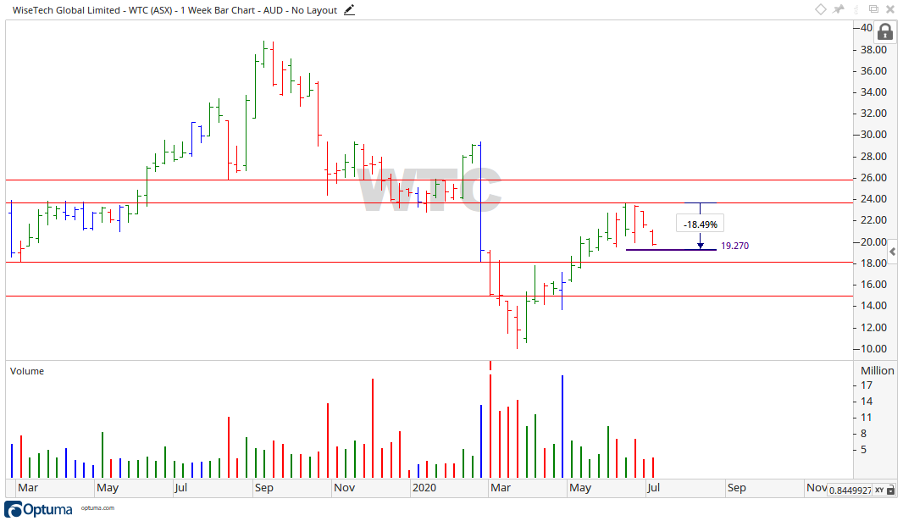

Let’s take a look at the weekly:

Source: Optuma

From the low in March 2020, the price rose strongly to meet the resistance level of $23.71 before falling away 18.49%, to where it sits at the time of writing of $19.27.

If the price were to continue to the downside, levels of $18.12 and $14.94 may provide future support — worth noting is that the move down is taking place on decreasing volume indicating the sellers may not be in full control of the move.

Should the price return to the upside, then levels of $23.70 and 25.84 may become the focus.

If you are looking to stay ahead of the curve in finance, our publication Money Morning is a fantastic place to pick up investment stories before they hit the mainstream press. It will come to your inbox seven days a week, and I strongly encourage anyone trying to become a better investor to subscribe. It’s free and you won’t regret it.

Regards,

Carl Wittkopp,

For Money Morning