Check it out. The ASX is at a three month high.

Now that’s a change from late October. Back then, sentiment and price action were terrible.

What’s changed?

We keep getting good news on inflation! This is taking the fear away about rising interest rates.

This is great news for investors. The stock market is rumbling for all the reasons I’ve been telling you in recent months.

Inflation is falling…oil is tumbling…rate bets are cooling off…iron ore is flying high.

Beauty!

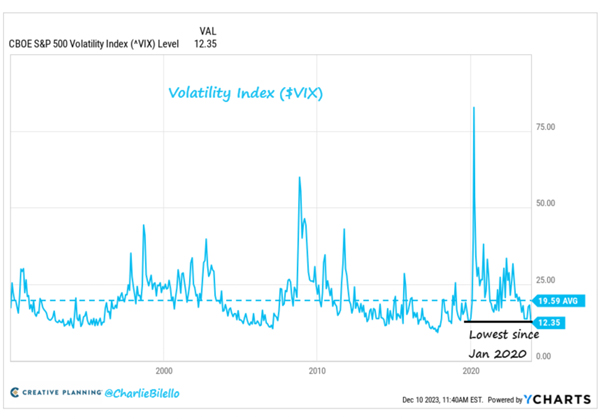

It’s also showing up in a falling VIX index.

The VIX is a way to measure expected volatility. It’s now at its lowest reading since January 2020.

|

|

| Source: Charlie Bilello |

High volatility causes investors and traders to become more cautious and defensive. That keeps a lid on share prices.

Here’s some things we can say about the change happening here, and why you should care:

1) A falling VIX sets the stage of an ongoing share market rally. We are seeing that now.

2) Another point is that a falling VIX invites back the momentum traders.

Momentum as a strategy struggles with high volatility. There’s less definitive trend to ride. I expect to see this style make a comeback in 2024.

3) Small caps can flourish again!

Let’s expand on point 3

Small caps, as a sector, have underperformed for two years now. Smaller shares flourish best in a ‘risk on’ market.

We’re not quite at the giddy days of early 2021 on this front. I don’t expect we will be for a while.

We do have a stabilising share market and a more benign outlook. This means investors are highly likely to start chasing small caps again.

It’s down here that you can get the kind of juicy returns that are very difficult to achieve in the big stocks.

One of my recommendations this year, Tuas [ASX:TUA], is now up 120% in under 12 months. It’s been one of the few to achieve this rollicking price growth in 2023.

Whatever you think about the world, your BHP, Telstra and bank stocks aren’t going to double like this.

That’s the reason investors chase small caps. They offer higher growth and more potential for big capital gains.

I’m not saying it’s without risk. It comes with more risk and they’re highly volatile!

Your BHP, Telstra and bank stocks aren’t going to swing around like a 1950s sock hop either. Or run the risk of failing as a business anytime soon.

However, you don’t have to do crazy speculating here, either. There are small caps across the full business spectrum.

Some are pre-revenue. Some have cashflow but no profits. And others are profitable and pay dividends.

You can scale your risk attitude up and down to suit yourself.

Why should you?

There is so much potential benefit here!

Don’t you see?

Small caps have been hammered since 2021. That means they have incredible upside if you can look out 1–3 years. Markets are cyclical…I’m sure you know that.

A small-cap revival is not guaranteed…but nothing in the market ever is!

Here’s a prediction too. It won’t be long before other investors start to get FOMO.

Fear and greed are the dominant emotions when it comes to the market. It’s a cliché, but true.

How easy it is to stay defensive and in cash when the market is in the dumps and nobody is boasting about the easy buck they made at your weekend BBQ.

That’s pretty much been the story for the last two years.

The vibe is likely to shift here. That’s the way markets work. They suck in more people as they go up.

It’s early days yet. But eventually, money talks.

US stocks are up 18% this year. Indian stocks are at all-time highs. Bitcoin is up over 150%. Iron ore is nearing US$140 a tonne.

What more evidence do you need? Global asset markets are telling you the bear market is behind us.

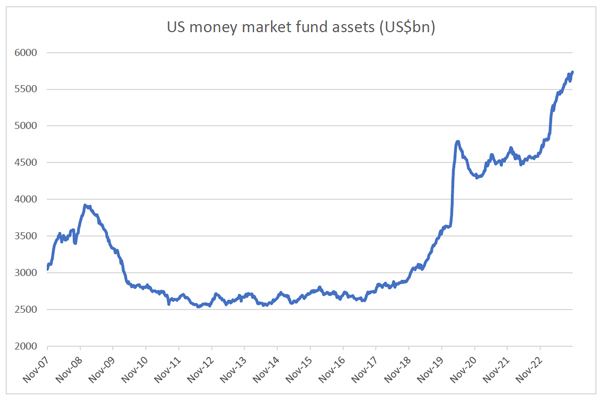

Here’s another point via Quay Global Investors…

‘The rate of US household savings is growing again — adding a buffer to US household balance sheets. If there is any slow down or recession in the US, it seems unlikely to come from the household sector.

|

|

| Source: Bloomberg, Quay Global |

‘Where are these aforementioned savings accumulating? Not just in the banks, but more than ever, in money market funds (which in turn invest in high grade T-bills and bonds).

‘In a world of +5% interest rates, this makes sense. But it also places the recent US equity market rally into impressive context – that there is a lot of investing firepower across a range of risk assets if or when interest rates begin to fall and cash begins to be re-invested again, as it did in 2009-2010.’

Bang on in my book.

Aussie stocks have been a laggard in 2023. We’re flat for the year.

However, I believe Aussie stocks will attack all-time highs next year. I also believe the best way to attack this is via the small-cap sector.

This is not something I’ve been saying since yesterday.

Back in August I put out this presentation, including five stock recommendations to consider.

I mentioned the stock Tuas above.

I also mentioned Tuas in that presentation I just linked to.

Tuas was under $2 per share back then. It’s $2.75 now.

See what I am saying? Opportunities in the market are abundant. Don’t let fear hold you back.

Best wishes,

|

Callum Newman,

Editor, Australian Small-Cap Investigator and Small-Cap Systems