In 2010, Ric Battellino, former Deputy Governor of the Reserve Bank of Australia, gave attendees a history lesson on commodity super cycles.

For many investors, the early 2000s commodity boom was viewed as an unparalleled event, something we’d never see in our lifetimes again.

Yet, as Battellino outlined, commodity-wide booms are nothing unusual… they have been a recurring theme throughout modern history.

Driven by inflationary pressures, including war, rising energy costs, migration, and trade tariffs.

Battellino highlighted the immense metal and energy price inflation occurring in the late 1960s to early 1970s as a prime example.

Adjusted for inflation, copper reached US$15,000 per tonne in 1968.

And in 1973, more than 50 years from today, OPEC enforced the infamous oil embargo against the US.

This was OPEC’s response to America’s support of Israel during the Yom Kippur War. Oil prices quadrupled from $2.90 to $11.65 a barrel.

History shows commodity supercycles are rooted in war, rising migration in the West, emerging market growth, trade breakdowns, tariffs, and energy embargoes.

Today’s economy has a smattering of all these elements.

It was inevitable then that resources would start to emerge from the dust in 2024.But does that really mean we’re embarking on a new super cycle event?

Dr Copper (and Dr Gold) flash green

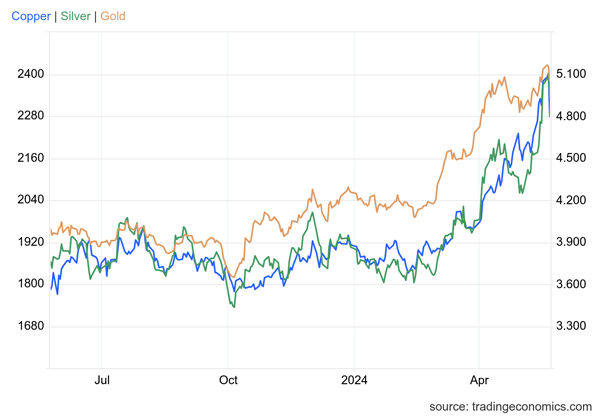

Earlier this year, gold led the commodity pack, surging into new all-time highs. Copper and silver are now hot on gold’s heels testing their own record levels.

|

|

| Source: Trading Economics |

This is important for one key reason… Precious Metals and copper tend to lead in a commodity-wide bull market.

Follow them, and you’ll have a better understanding of the broader landscape forming across the resource market.

This is good news for resource bulls and investors looking to ride ongoing momentum.

But there is another way to view this… If we are embarking on a broad lift in commodity prices, are there sectors lagging and perhaps ready to play catch-up?

The oil and gas sector stands out as a clear opportunity.

Despite disappointing share price performance, these companies have built a track record of delivering strong free cash from established oil fields and offer enticing P/E multiples for investors.

As copper, silver and gold tick higher, oil and gas stocks remain unloved and, I believe, deeply undervalued.

An unlikely alliance

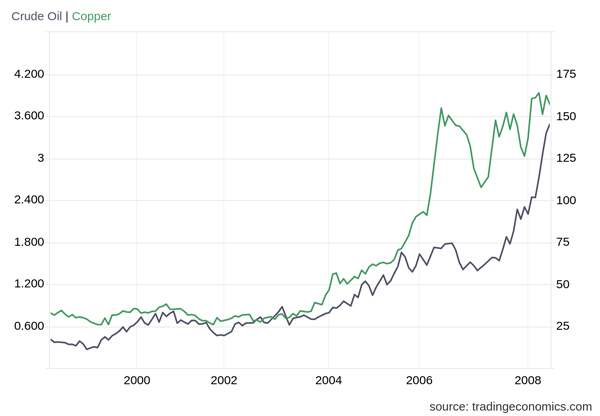

It may seem unwieldy to compare copper with a seemingly unrelated commodity like crude oil.

But, resource super cycles are characterised by a broad lift covering virtually all commodities.

If Dr Copper is correct and we are sitting at the precipice of a commodity-wide supercycle, this could be an ideal time to focus on beaten-down energy stocks.

Take the last commodity boom as an example… As copper climbed to new extremes, oil prices followed closely reaching almost US$150 per barrel by 2008.

|

|

| Source: Trading Economics |

So where does that leave us today?

Over the last 12 months, gold has jumped 22%, while silver has increased 35%.

Copper is up almost 40%, while tin has gained 38%.

Meanwhile, zinc has risen 32% and aluminium is up 22%.

You get the picture. This is what a multi-commodity boom looks like, broad lifts across commodities with vastly different supply and demand fundamentals.

The tide is rapidly shifting in this once-beleaguered market.

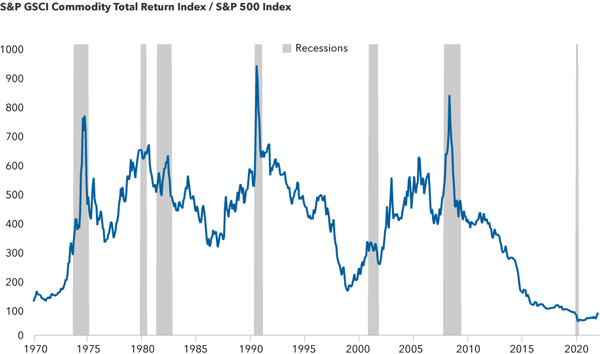

A mega-investment theme is evolving… We remain in the early stages of this tectonic shift BACK to commodities.

Until recently, commodities remained extremely cheap relative to U.S. stocks:

|

|

| Source: Capital Ideas |

While that gap has closed slightly in 2024, there’s still plenty of value in his market.

Right now, the biggest gap looms within the oil and gas sector.

To help you get started, I’ve just finished putting together a free report that will help kick-start your investment journey into the relatively unknown oil and gas sector.

You can access my latest report by clicking here.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments